Allo Budget request for 2025: Building The Capital Allocation Network For the Tokenized Internet

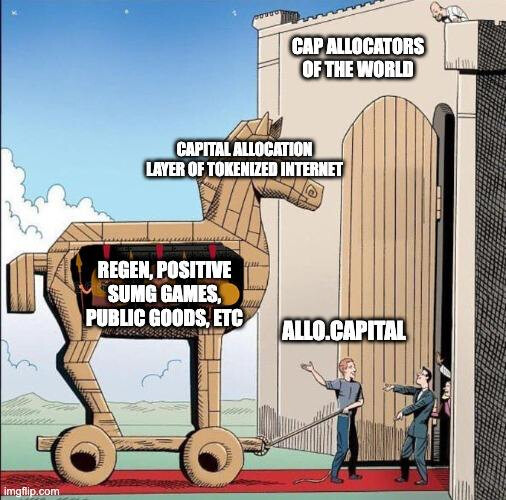

We are excited to present our final operational budget to the DAO for the graduation of Allo to Allo.Capital. For some time, the team has recognized that while Gitcoin continues to focus on grants and enterprise initiatives, the Allo team has been dedicated to reimagining capital allocation for the tokenized internet. Traditional funding models are inefficient, opaque, and short‑sighted. In contrast, Allo.Capital is designed to catalyze a regenerative flow of value—ensuring that resources circulate like nutrients in a thriving ecosystem. We think there is lots of upside for Gitcoin in exploring this design space.

Graduating Allo.Capital marks an important milestone: We have matured into a dedicated entity focused on capital allocation innovation. Importantly, this evolution does not mean we are parting ways. Allo and Gitcoin will continue to operate as a binary star system—each shining in its domain while supporting one another. This arrangement allows us to pursue bold, transformative initiatives without diluting the focus of Gitcoin’s broader grants work. Today, more than ever, we must invest in initiatives that build lasting value and resilience for our ecosystem.

This budget request seeks funding to enable the graduation of Allo.Capital and support the new business unit for its initial operational period (12 mos). In return for bootstrapping this critical initiative, we will work with the Gitcoin Foundation to ensure that Gitcoin retains a strategic stake in Allo.Capital—via potential equity ownership, and token allocation (should we launch a token).

TL;DR

- What?

- Graduation of Allo.Capital as an independent entity dedicated to building the capital allocation layer of the tokenized internet.

- Why?

- Traditional funding models are broken. Allo.Capital will reengineer capital flows—making them transparent, efficient, and regenerative—while allowing Gitcoin to stay focused on grants.

- Funding Request:

- We are asking for $2.0M in operational funding for the venture - costs broken down below.

- What’s in it for Gitcoin?

- In exchange for bootstrapping Allo.Capital, Gitcoin will retain strategic involvement through potential equity and a token allocation (if/when launched). We are actively working to formalize these arrangements.

- Beyond Core Team Costs:

- This $2.0M isn’t solely for minimal contributor compensation—it also funds our treasury initiatives and supports community-led builds to drive ecosystem-wide innovation.

Why Launch Allo.Capital?

Capital allocation directs resources to where they can create lasting, regenerative impact—much like the mycorrhizal networks that support an entire forest. Traditional finance channels funnel capital into short‑term speculation; meanwhile, our approach seeks to reimagine economies as living systems that foster continuous reciprocity and shared stewardship.

Graduating Allo.Capital allows us to build a dedicated team focused solely on:

- Developing Composable Tools & Education: Offering best‑in‑class developer tools, clear documentation, and rapid prototyping frameworks.

- Innovating Funding Mechanisms: Experimenting with models—from grants and Quadratic Funding to streaming and AI‑driven approaches—that drive regenerative capital flows.

- Building a Self‑Sustaining Treasury: Growing the DAO treasury through token swaps, protocol fees, and Revnet‑based revenue flows without relying on inflationary practices.

- This evolution ensures that Allo’s innovative approach to capital allocation receives the full attention it requires—free from the competing priorities inherent in Gitcoin’s broader grants focus.

What Is Allo?

Allo.Capital isn’t simply a protocol update—it’s a full‑spectrum ecosystem built around three core product philosophies:

- Intelligence

- Research & Thought Leadership:

- We’ll produce original research, publish educational content, and develop AI‑augmented tools to push the frontier of capital allocation - check out the work already done on https://allo.capital/.

- Research & Thought Leadership:

- Software

- Developer Tools & Rapid Prototyping:

- Our suite will consist of highly forkable, composable modules (e.g. quickstart guides, integrated SDKs) building on the suite of tools we’ve already created (AlloKit, Protocol 2.0) that reduce friction and accelerate deployment.

- Developer Tools & Rapid Prototyping:

- Fund (Treasury‑Driven):

- Direct Funding & Ecosystem Support:

- We’re focusing on building a self‑sustaining DAO treasury through token swaps, protocol fees, and Revnet‑based revenue flows.

- Direct Funding & Ecosystem Support:

What Does Allo.Capital Do?

We are an ecosystem that empowers our community to innovate in capital allocation. Our work includes:

Engaging the Community

We actively collaborate with builders, researchers, and community members to design and test new on‑chain funding mechanisms that move beyond traditional grants.

Experimentation & Iteration

Our initiatives include prototyping novel mechanisms—such as deepfunding and AI‑driven allocation—that ensure capital flows are transparent, efficient, and regenerative.

Building a Sustainable Ecosystem

Through strategic token swaps, protocol fees, and Revnet-based revenue models, we aim to create a self‑sustaining treasury that funds continuous innovation.

Business Model & Organizational Structure

Hybrid DAO + VC Studio Model:

- Allo.Capital’s design combines the best of decentralized governance with a venture studio approach:

- DAO Treasury:

- Manages early‑stage funding, research, builds and contributor rewards.

- (Future Consideration) Professional Investment Arm:

- While we’re not raising an external LP fund at this time, our long‑term structure contemplates a professional arm to manage growth‑stage investments.

- Revenue Generation:

- Our treasury will grow through a mix of token swaps from incubated projects, protocol fees, and Revnet fee capture—ensuring a self‑sustaining funding model that aligns incentives across the ecosystem.

- DAO Treasury:

Budget Request & Financial Roadmap

Total Funding Request for Operational Execution: $2.0M

Budget Breakdown

| Category | Description | Approximate Allocation |

| Contributor Rewards | Compensation for full‑time and part‑time team members (engineering, product, community engagement, operations) | ~$1.0M |

| Contracting | Fees for expert contractors (DevOps, DevRel, design, marketing) to support rapid development and outreach and community builds | ~$400K |

| Operational Expenses (OpEx) | Costs for software subscriptions, gas fees, audits, travel, and professional development | ~$100K |

| Research and Development | Investment in original research, AI tools, and innovative R&D initiatives that push the boundaries of capital allocation technology | ~$200K |

| Marketing and Community Outreach | Initiatives to expand the Allo brand, drive community engagement, sponsor hackathons, and forge strategic partnerships | ~$100K |

| Treasury & Community Builds Funding | Dedicated funds to seed the DAO treasury and support community-led experiments and pilot projects in capital allocation innovation | ~$200K |

| Total | $2.0M (subject to final adjustments based on market conditions and community feedback) | $2.0M |

** Note: The GTC amount requested and reserves will be updated based on market conditions when this proposal moves to Tally, using the lower of the current price or the 20-day moving average. These figures are subject to adjustment based on community feedback and evolving priorities - and work being completed regarding the DAO Design Competition we’ve launched. *

Roadmap & Key Initiatives for 2025

High‑Level Initiatives:

- Systematic Exploration of Capital Allocation:

- Develop a spectrum of funding mechanisms—from traditional grants to innovative AI‑driven models.

- Product & Ecosystem Expansion:

- Launch composable, developer‑friendly modules (e.g., AlloKit, EasyRetroPGF, Cookie Jar) that enable rapid prototyping and seamless integration.

- Building a Self‑Sustaining Treasury:

- Focus on initiatives that drive token swaps, protocol fee generation, and Revnet‑based revenue flows to organically grow the DAO treasury.

- Enhanced Developer Experience:

- Roll out comprehensive documentation, quickstart guides, and dedicated support channels to nurture a vibrant, innovative community.

Milestones and Deliverables

Below is an example milestone table (final sequencing and numbers are under evaluation)

| Initiative/Project | Outcome | Milestone/Deliverable |

| Mechanism Adoption | Increase community engagement in capital allocation experiments | Grow active proposals from X to Y; onboard Z new community partners |

| Mechanism Growth | Expand the range of deployed allocation mechanisms | Launch at least 3 new on‑chain funding experiments (e.g., deepfunding, streaming) per quarter |

| Sustainability | Build treasury resilience and fund community builds | Increase treasury inflows via token swaps/protocol fees by N%; seed pilot community projects |

Graduating Allo.Capital as an independent entity isn’t merely a structural change—it’s a bold reimagining of how capital is allocated in the tokenized internet. Our integrated approach—anchored in Intelligence, Software, and a Treasury‑Driven Funding model—will create a regenerative ecosystem that rewards builders, drives innovation, and ensures long‑term sustainability. And as a binary star system, Gitcoin and Allo.Capital will continue to support and amplify each other’s success.

\

Learn More

- Allo v2 - B2D Strategy

- TEMP CHECK: Allo + Gitcoin - do they make more sense together or separate?

- 10 year goal - Allo could become the capital allocation layer of the post tokenization internet

- Assembly Theory x Onchain Capital Allocation - A powerful approach to Allo design space exploration

- [ANNOUNCEMENT] Introducing Allo.Capital

- Allo.Expert creates strategic intelligence for Gitcoin’s Multi-Mechanism Future

- $GTC Tokenomics - SubDAOs

- https://allo.capital

- Allo Telegram

Voting Options:

- Yes: Allocate the full $2.0M to Allo.Capital for operational execution.

- No: Do not fund this launch.

- Abstain.