Allo + Gitcoin

Do they make more sense together or separate?

TLDR

- Gitcoin focuses on grants and enterprise-first strategies, while Allo targets on-chain capital allocation with a dev-first approach.

- Combining both under one entity creates conflicting priorities and detracts focus, maybe they may be more effective as separate entities.

- Unbundling Allo could foster innovation, partnerships, and ecosystem growth while maintaining collaboration with Gitcoin.

- I want community input here. Do Allo and Gitcoin make more sense together or seperate?

Introduction

The objective of this post is to compare and contrast the Allo and Gitcoin brands, and to reason about how they work together.

Here is an overview of how I see the brands.

| Gitcoin | Allo | |

|---|---|---|

| Focus | Gitcoin = Grants | Allo = Capital Allocation |

| Brand Strength | Very well known in crypto. Not known outside of crypto. | Not yet known very well |

| Organizing Methodology | Enterprise-First | Network-First Dev-First |

| Strategy | B2B SAAS | Category creation |

| Focus Market | EVM based ecosystems with $$millions in treasury and a grants program | Any EVM based ecosystem |

| Service Addressable Market | EVM Grants($100m/yr++) | EVM Incentives($100m/y++r),EVM Grants($100m/yr++),DAO Cap allocation($100m/yr++) |

| North Star | Gitcoin is a leader in Grants | The capital allocation layer of the tokenized internet |

| History | Founded in 2017 and spend 4 years as a company. Has continually evolved since. | Created as a Gitcoin workstream in 2023 |

Do these things belong together?

First, let us ask.. what value does Allo bring to Gitcoin and visa versa?

At least in theory, Open Source Software and Enterprise Development can complement each other.. This view of the world is expressed below:

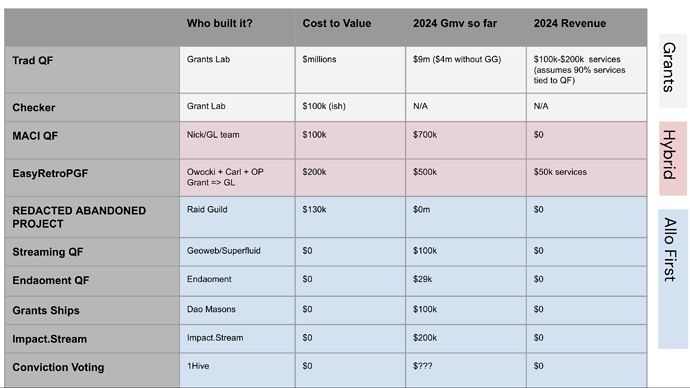

You can see the scorecard for both of these different entities below (numbers are estimates)

Is it working?

I think the answer is no.

Why?

- I have not been able to get prioritized the Allo Application-layer dev work I wanted in time for Devcon, last quarter.

- we’ve not properly supported Gitcoin ecosystem teams (the blue rows above) in creating as much upside as is possible

- I dont think we are moving with sufficient urgency/momentum towards Grants Lab’s north star either towards “Become a leader in grants” and Allo’s north star of “Become the allocation layer of the tokenized internet” . There is SOME traction but it is low relate to resource spend IMO.

- we built the wrong thing with Allo v1 => v2.1

- and we’re not crushing it on enterprise-development either (though that is trending positively the last 2 quarters since @katalunia @gnomadic joined).

- we are still way behind Protocol Guild and Optimism RetroFunding in GMV distributed in 2024.

I think the dysfunction can be summed up as follows: While Allo and Grants are competing priorities within the same business unit, we are not doing either justice. There is a lack of focus that having two north stars can cause. Cobie said it best:

Increasingly I find myself wondering if these two things belong together in the same organizing entity. This has got me thinking about what it would mean to unbundle these two brands from one another, and thereby create more value apart vs seperate. As Jim Barksdale said “You make money by bundling things, and you make money by unbundling them.”

What would it look like to unbundle these two brands?

About a year ago, we spun out Passport.xyz (formerly Gitcoin Passport). Passport has been by far our most successful spinout. What if we were on a similar course with Allo?

I think that Allo and Gitcoin Grants complement each other, at least in theory. But that doesnt mean that these two entities need to be in the same business unit or even the same DAO. They can add value to each other from more distance. They may actually be more valuable unbundled.

This is a phenomenon in math called supermodularity. Supermodularity occurs when the combined value of two elements increases when they are used together in close proximity. The retain more individual value when separate. This synergy enhances their overall benefit, making their combination more valuable than the sum of their standalone contributions. Two other examples of supermodularity are (1) a restaurant and parking lot or (2) a smartphone and app store – each gain more value when placed together, as their proximity enhances utility and demand.

Spinning Allo out from Grants Lab into an Allo Lab, or from Gitcoin into its own DAO, i think could open up the following advantages.

- Practical Pluralism - Enable more of a Practical Pluralism (which we know Vitalik really cares about from his most recent GP episode in Dec 2025) of development teams to build funding infrastructure, by enabling Allo to focus on Network-first, Dev-first, and category creation strategies…

- Create more upside through focus.

- Create more focus by making Allo unencumbered by the roadmap/priorities implications of being in an enterprise-first business unit.

- Enable each entity to do what it does best - Innovation coming from Allo/Open Source wing of community and enterprise reliability from Grants Lab, as described here.

- “The Capital Allocation Layer of the Tokenized Internet” is a big category. Especially if you believe that “We’re going to tokenize everything” in the world as JPDiamond claims. We should probably properly resource the vehicle that is heading to that north star.

- Systematically explore design space by partnering with other dev teams, perhaps even going partnership-first..

- Put everyone on same footing with Gitcoin Grants Lab.

- Systematically explore the design space by distributing governance tokens according to who is generating the most GMV (and GItcoin/Grants Lab has to compete for it in an open market like everyone else)

- partnership = give Allo/Gitcoin governance tokens or a % of your revenue, in exchagen we give you tech tools, funding, and distribution through GG/Gitcoin.

- Launching a fund becomes an option - I think there is an opportunity to launch a fund that invests in strategic complements to Gitcoin (what pgDAO was meant to be to Gitcoin in the 2022 cycle)

- This would allow Allo/Gitcoin to partner more closely with founders/tools not built on Allo.

- It would also reduce pressure on the dev teams to solve for EVERY capital allocation tooling category, by allowing us make a build vs buy decision in each category.

- This could be packaged in an interesting way. MSCI has their Emerging Market Latin America fund where trad investors get the benefit of a diversified basket of assets in an up and coming category. What if we could create a basket of 20 up and coming funding infrastructure projects and mark it as the ̶M̶S̶C̶I̶ ̶E̶m̶e̶r̶g̶i̶n̶g̶ ̶M̶a̶r̶k̶e̶t̶ ̶L̶a̶t̶i̶n̶ ̶A̶m̶e̶r̶i̶c̶a̶ ̶f̶u̶n̶d̶ Gitcoin Capital Allocation Infrastructure Index (GCAII).

- Allo/gitcoin has tremendous dealflow of builders/founders building funding infrastructure, which is a tremendous advantage. They could likely curate a very strong portfolio of these teams.

- The Fund is a fundamentally different operating model than Gitcoin has executed to date.

- Retain alignment - We could still maintain a close working relationship between the two entities as long as social, economic, and technological alignment is preserved.. In this hypothetical arrangement, teams should be stewards in each others ecosystems.

I’d love to hear the community’s voice on this topic.. My prompts:

- In what ways is this situation similar or different than Passport.xyz spinout?

- Did I get the above thinking right or wrong?

- What am I missing?

- What would it mean for Gitcoin and Allo to be a binary star system where both brands exude economic gravity? as opposed to a single star system where only Gitcoin does.

Please comment below.