TLDR - Allo could become the capital allocation layer of the post tokenization internet.

What is our Path to Success?

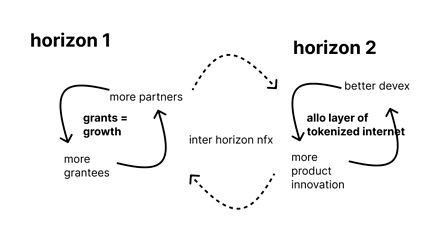

One way to think about Gitcoin’s path to market success (and eventual breakeven) can be described two horizons:

- Horizon 1 - 18 months, focused on winning in grants market

- Horizon 2 - next 5-10 years after that.

In more detail…

Horizon 1

next 18 months, focused on winning in grants market, goal is to hit breakeven by EOY 2025

Horizon 2

next 5-10 years after that.

Allo protocol could become the capital allocation layer of the new internet. This is a trillion $$$ opportunity.

We see the following trends as waves we can ride:

- EVM wins the blockchain VM race. [5-10 years]

- Tokenization of the world’s assets. [5-10 years]

We could be well positioned for this..

- By making Allo the best DevEx to build funding infrastructure, which will trojan horse Allo into the fabric of this era of the internet. What Stripe did for accepting credit cards, Allo could do for capital allocation.

- By surviving until this plan is realized.

- Plan A: Make Horizon 1, Grants = Growth, work relatively close to current course & speed.

Horizon 2  Horizon 1

Horizon 1

Horizon 1 (h1) is our near term priority in 2024/2025, but there may be places in which we sprinkle in Horizon 2 thinking here & there when it supports Horizon 1 goals!

There is a flywheel between h1 and h2.

Zoom In on Horizon 2

The objective of the rest of this post is to reason about Horizon 2 (h2).

I’ve already written extensively about h2 in the Allo Book and in the Rainbowpaper… If you want to understand h2 in high resolution, you should read both of those! The TLDR is that Capital Allocation will be a fundamental part of the post tokenization, and we are uniquely enabled to plant many flags there because of Gitcoin Grants!

I think the main place where h1/h2 intersect is in building allo 2.1, which will be released at Devcon. The hope is that these tools increase the efficiency/efficacy of new grant-focused allo builds!

Why do I have conviction in h2?

- Short term, the answer is product innovation supporting Grants = Growth.

- Medium term, because Gitcoin is Lindy. It’s already survived 7 years. It can definitely survive another 7.

- Long term, its because the TAM is super high.

Large TAM

Capital Allocation = Trillion $$$ Opportunity

- Funding for DAO Ecosystem development via web3 Grants = $100m+ in Ethereum in 2023

- Funding for Scientific Research, $900bn+ globally in 2023

- Funding for Environmental & Social Impact , $1trn globally in 2023

- Funding for Philanthropic Initiatives, $600bn globally in philanthropy in 2023

- Funding for City, County, and State Development projects, $2.5 trillion globally in 2023.

- Funding for Capital Formation and Economic Growth, $25 trillion

And these are only the market segments we are aware of! When the internet was first taking off, we could not have imagined twitter or tiktok. As web3 begins to eat the world, we cannot predict the next funding infrastructure or predict how they will shatter our existing expectations.

We are uniquely positioned here!

We have established product innovation formulas, and we a track record of seizing opportunities when we have the right leadership!

- Formula: Follow Vitalik: QF => RetroPGF => futarchy

- Formula: Follow whats hot in the industry: Protocol Guild, RetroPGF

- We have a $20m matching pool to dogfood.

- We eat our own dogfood by using these tools ourselves via Citizens

We’ve already validated we can get high quality builds on Allo

| Who built it? | Cost to us | 2024 Gmv so far (projected) | GMV/$$$ | ||

|---|---|---|---|---|---|

| Trad QF | Grants Lab | $millions | $3.6m ($6m) | $0.92 | |

| EasyRetroPGF | Owocki + Carl + OP Grant | $200k | $2m ($6m) | $25 | |

| REDACTED | Raid Guild | $130k | $0m ($100m) | $1000 | |

| Streaming QF | Geoweb/Superfluid | $0 | $100k ($100k) | ∞ | |

| MACI QF | Nick/MACI team | $100k | $0m ($2m) | $10 | |

| Endaoment QF | Endaoment | $0 | $29k | ∞ | |

| Grants Ships | Dao Masons | $0 | $100k | ∞ | |

| Conviction Voting | 1Hive | $0 | $??? | ∞?? | |

| Impact.Stream | Impact.Stream | $0 | $90k | ∞?? |

The Cost-To-Value of our first builds was very low. We have validated that the CTV can be higher by engaging ecosystem players.

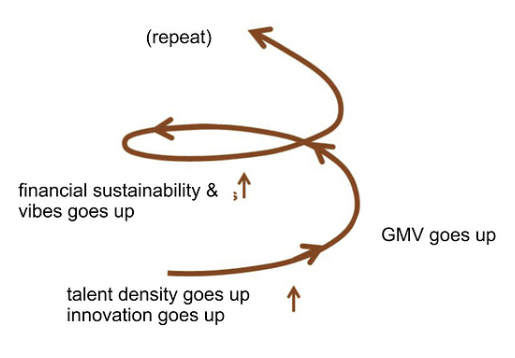

We can build compounding momentum!

The Allo architecture is built for extensibility but also for specificity. Allo takes data/tokens in and spits out an allocation + distribution via a strategy. Each configuration of allo is deeply powerful, and together the allo ecosystem is stronger together because of its breadth.

Because Allo is very modular, we will build compounding value over time as the permutations of complementary modules begin to grow value exponentially and produce revolutionary funding infrastructure.

We will build side apps (reportcards, checker) that will make the Gitcoin ecosystem more powerful and create more stickiness.

Together, these apps could push the frontier of funding innovation in web3. Over time, we will become known as the frontier. In a crowded grants marketplace, we can land + expand w diff apps at our customers.

We can showcase them with Gitcoin Grants. This will create an upward spiral as Gitcoin builds Gitcoin with Gitcoin tech.

Whats next for h2?

At Devcon this year, we will release Allo 2.1 to the world. Keep an eye out for this launch!