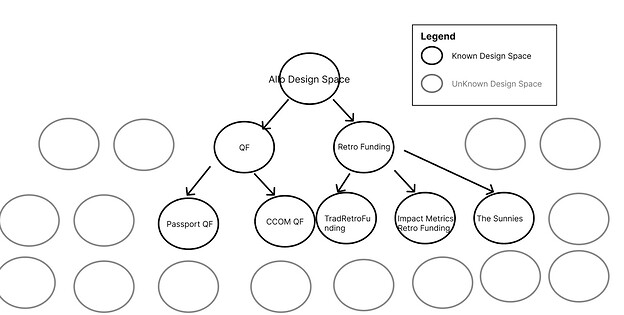

How should we be exploring the capital allocation design space?

TLDR

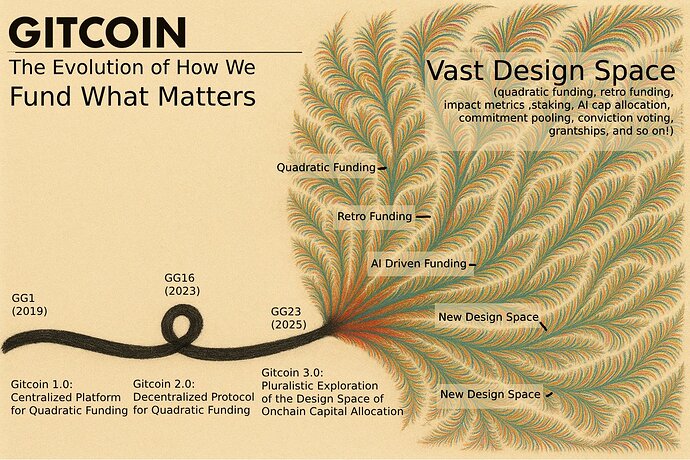

- One of Gitcoin’s challenges is balancing depth vs. breadth in exploring capital allocation designs like Quadratic Funding (QF) vs Retro Funding vs other designs.

- Gitcoin fell behind projects such as Protocol Guild and Optimism, but still holds significant influence and resources in Web3.

- Future exploration could focus on building interconnected networks, partnerships, and fostering a pluralistic ecosystem, potentially rethinking Gitcoin’s approach to embrace more experimentation and collaboration and enabling of other projects.

Over the last cycle, Gitcoin has fallen into a business of selling grant programs to those who want ecosystem growth. Our customers are the top web3 ecosystems out there. We have achieved $64.1M funding distributed via 5m unique donations via 250 funding rounds [via impact.gitcoin.co]

Also over the last cycle, Gitcoin has also suffered from a handful of false starts: PGN, Shell, BlueDAO. And it has seen the emergence of competing* capital allocation tools that have eaten its lunch, Protocol Guild [$100m+], Retro Funding [$100m+], Futarchy [Inchoate], Q/acc [Inchoate]. All while its burn is higher than all of these competitors combined.

(We don’t have to compete to make the world better bc if these tools win => we all win. But in the sense of building a world class impact network, we all do engage in a healthy coopetition for the honor of being the innovators who are unearthing the frontier (and the spoils that come with it: funding, the dopamine ruish of solving problems, the glory, the privilege of stewarding the movement)).

In this post, I will examine our exploration of the design space so far. And I will propose next steps to enhance our exploration of the design space.

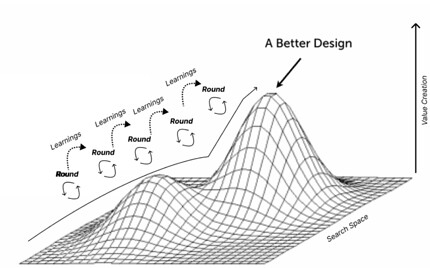

Exploring the design space in the past

The journey for Gitcoin since our first QF campaign in 2019 has been an optimization of the Allo search space. We’ve been trying to maximize value creation for our partners each round. Since that first round, we’ve been retrospecting after each round, channeling our learnings from one round into the next, ideally iterating towards more value creation in round n+1.

Sometimes, we have to take 2 steps backwards before we can take our next step forward - like when Gitcoin decided to deprecate cGrants and move forwards a protocol first in the future. Or when we had to fundraise and that distracted us from protocol for almost a year. Or our partnership with Shell. There were numerous setbacks, but thats how it always is when you try to do something big . While these setbacks were occurring, they were all valuable learning experiences. The pivot from company => DAO was the right one. The protocol rewrite was the right move in a market where public goods funding needed modularity + credible neutrality - something onchain protocols could provide but monoliths could not.

The world moved on without us while we were figuring ourselves out.

As 2022 turned to 2023, we saw competitive projects spring up that looked foreign to us.

![]()

![]() Protocol Guild is not a grants giving platform, it is a self-curated registry.

Protocol Guild is not a grants giving platform, it is a self-curated registry.

![]()

![]() When we first heard of Retro Funding, we did not realize it was a completely different paradigm from Quadratic Funding.

When we first heard of Retro Funding, we did not realize it was a completely different paradigm from Quadratic Funding.

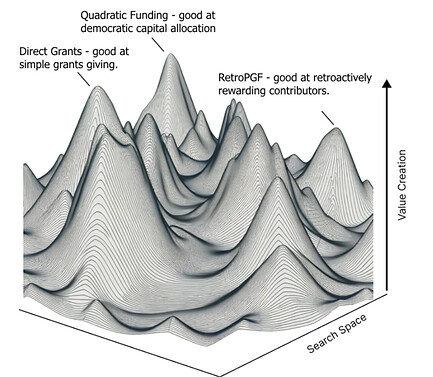

We learned that this is a pluralistic design space, with many local maxima.

2023 was the year that Gitcoin fell to 3rd place in the ETH grants space. Measured by volume, Gitcoin’s distribution ($7m) was surpassed by Protocol Guild ($10m) and Optimism ($100m).

Exploring the design space in the future

In 2024, we began to rebuild and recognize that the future is going to be plural. A plurality of cap allo mechanisms are going to dominate. We stumbled upon a powerful one early (QF), but it was not going to remain the only game in town.

Practical Pluralism values diverse perspectives, methods, and ideologies.

The market is going to be plural. This is good news and bad news for Gitcoin.

On one hand, even if we are third place by GMV, we do have a sizable lead over most teams that are trying to build in the Allo/Grants space - a formidable brand, a relationship with Vitalik, $20m in a matching pool, $20m in our DAO treasury. Gitcoin is prototopian, it gets better every quarter it exists. It is still early days, and we have formidable strength to create and define the Capital Allocation category.

On the other hand, we do have weaknesses. We have not yet found the secret sauce of reliably writing great software. We can only focus on 1 or 2 things at once, and we are often finding ourselves left behind in market as smaller competitors pass us by.

If we can only do 1 or 2 things at once, how do we explore the design space?

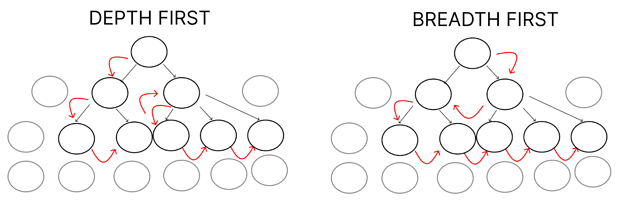

Should we pursue a depth first search - say, going deep on a mechanism we know, like QF? Or should we go breadth first, playing on multiple fronts at once, but not having resources to dominate any of them?

Perhaps there is a dynamic tension here between doing one thing and doing it well, and incubating a pluralism of experiments at once.

One great outcome for us could be if we ever figure out a network-first exploration of the design space. Where all of the top innovations come to us instead of us having to find them.

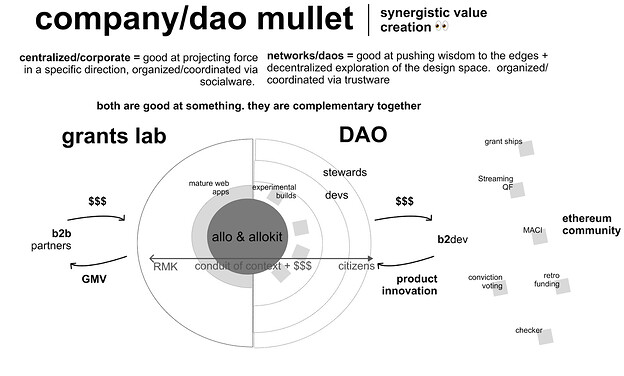

I think that Grants Lab has shown its able to do 1, maybe 2 things at once (a depth first search). The current setup at Grants Lab seems very focused on focus, and operating like a SAAS company. There is wisdom here, the formula for running a SAAS company is well known. This legibility creates security for everyone involved. Over time, our SAAS company may even evolve a great software organization and ship Grants Stack 2.0 or another world renowned SAAS product.

But even this path still leaves a lot on the table (all of the other opportunities outside of the 1 or 2 that GL can take on)… By thinking like an organization, we are able to identify a niche and pursue it via a depth first strategy. We leave all of the other things in the allo space on the table.

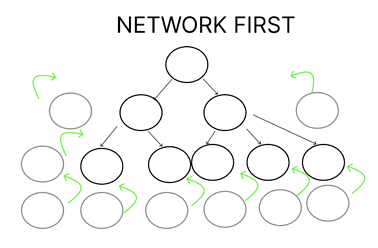

Should Gitcoin be more of a hierarchy - able to project force in 1 or 2 directions? Or a network - able to explore the design space multidimensionally?

I think Gitcoin’s final form resembles a network more than it resembles an organization, because a network is more fit for purpose to explore this design space than an organization is. Networks harness edge based wisdom, and so are really great for exploring frontiers. They beat out centralized, top-down authority, any day of the week.

OIr maybe Gitcoin’s final form is more of a hybrid. Our current organization resembles a combination org/network (although it is missing core elements and the network component is underfunded relative to its corporate counterpart, which I cover below).

Networks are good at exploring frontiers, and It just so happens that the Allo design space is a frontier.

So how do we explore it?

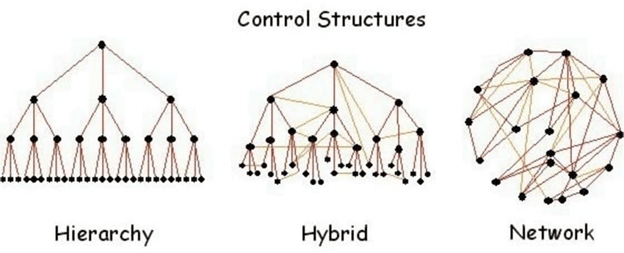

We continue building a network. This is separate and apart from Grants Lab - which is a hierarchical company.

How do we build a network?

We can leverage wisdom from Impact networks- the strength of the relationships and the collaboration between network participants are the number one indicators of whether you’ll solve the problem or not.

To embrace a network mindset as a leader means:

- Scaling impact, not growing their organization or function.

- Being part of an interconnected system, not the center of it.

- Sharing leadership with peers, not hoarding power or trying to be a hero.

- Building trust based relationships, not systems of control.

To me a key lesson here is that we want to be part of an interconnected system, not the center of it.

How does this apply to us? We cannot invent every cap Allo tool out there. It was an unattainable expectation that Retro Funding, Protocol Guild, or Futtarchy could have been invented or scaled at Gitcoin! With anything less than perfect foresight, Gitcoin was going to be mispositioned for these innovations.

But we can stil greatly improve Gitcoin’s exploration of the design space.

I think the way we do that is we embrace that we are part of an interconnected system. The ethereum ecosystem. The regen ecosystem. We embrace our role in the ecosystem and build our connectedness to it.

This needs to be more than just vibes. It needs to be true value creation.

How do we build interconnectedness?

The basic mechanism of an interconnected Gitcoin is partnership with other projects. Partnership is the (3,3) between us.

There are 3 layers to a DAO to DAO partnership. They go in order from more casual to more serious (from less commitment to more commitment).

- Social interoperability

- Product/Technology interoperability

- Governance Rights interoperability

How does this apply to us?

- Social interoperability

- Lets hold more schelling points for weaving.

- Product/Technology interoperability

- Lets get them building on Allo

- Economic interoperability

- Lets share fees and tokens with them.

How might we succeed?

There are a couple problems with our current setup vis a vis this direction.

- Proving out that we are building great software - Grants lab is not yet proven at building great software. Allo is second fiddle to Gitcoin partner needs. This means the value prop for Allo is not great (yet).

- Reduce the Zero Sum Economic game - Any token that goes to a team that builds on Allo will not go to Grants Lab. This means there might not be much willingness for token swaps, or funding non-Grants Lab entities.

How might we fundamentally rethink or our org?

What if we fundamentally rethought our organizational structure in recognition of these strategic needs? To do that, we need to think about the basic business lines that Gitcoin maintains.

I believe there are 3 places that revenue will accumulate to Gitcoin.

| What | Description |

|---|---|

| Services Revenue | Revenue provided via Services. |

| Protocol Fees & Token Locks | Fees paid to Allo protocol via the fee switch, or token locks cratead by protocol usage. |

| Token Swaps | Recognize the fundamental truth that the next capital allocation tools will not be built at Grants Lab, and instead enable other Allo builds to be accelerated through a combination of (1) being built on Allo (2) being funded by Gitcoin (3) being accelerated by Gitcoin. Provide easy access to these projects by creating a basket of Allo projects that functions as an “Allo Frontier Index Fund” |

In thinking about these differing value flows, we should consider whether they would have more value bundled together or unbundled apart. ( @DisruptionJoe 's recent post explores this as well). We should also consider Gitcoin’s runway, people, market success, and other variables.

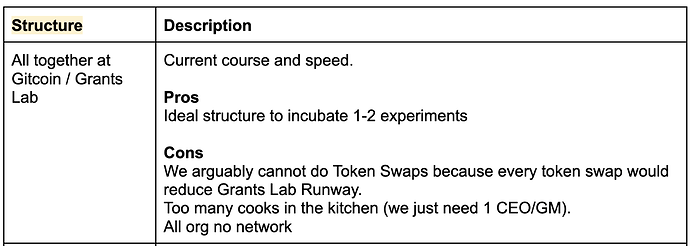

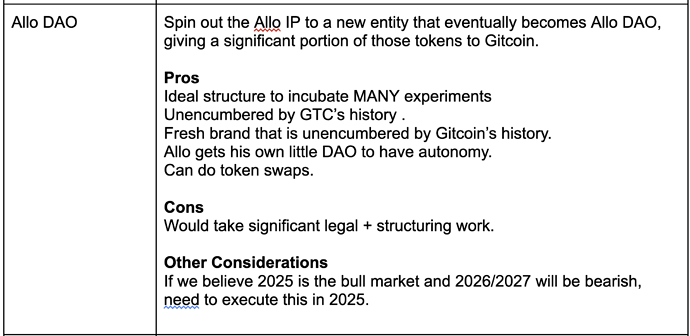

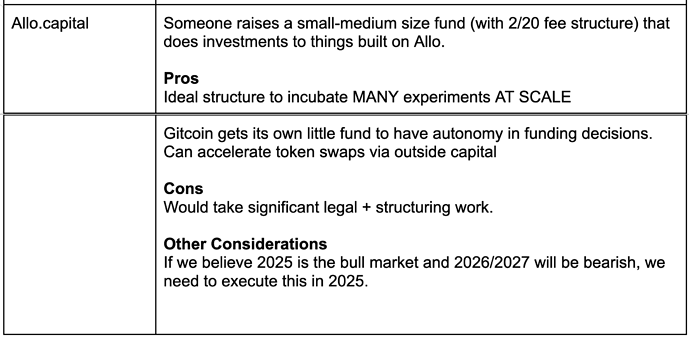

These are the structures I think these could take in H2 2025 and into 2026.

Conclusion

In summary,

- One of Gitcoin’s challenges is balancing depth vs. breadth in exploring capital allocation designs like Quadratic Funding (QF) vs Retro Funding vs other designs.

- Gitcoin fell behind projects such as Protocol Guild and Optimism, but still holds significant influence and resources in Web3.

- Future exploration could focus on building interconnected networks, partnerships, and fostering a pluralistic ecosystem, potentially rethinking Gitcoin’s approach to embrace more experimentation and collaboration and enabling of other projects. One example of this is having a more fundamentally network-first exploration of the design space is where all of the top innovations come to us instead of us having to find them.