This post combines ideas from RPP, Grants+, Allo B2c Strategy, Gitcoin Rainbowpaper, and Repeatable Path to New Market Share. You might get the gist even if you skip them, but consider reading those posts for full comprehension!

TLDR

- I propose that we create an Allocation Strategy Exchange.

- A capital allocation strategy exchange (CASE) is a place where capital allocation strategies (CAS) are exchanged.

- This CASE would position Gitcoin at the strategic center of the emerging onchain capital allocation ecosystem and position Gitcoin for exponential growth.

The CASE - Capital Allocation Strategy Exchange

2023 was the year that Gitcoin fell to 3rd place in the ETH public goods funding space. Measured by volume, Gitcoin’s distribution ($7m) was surpassed by Protocol Guild ($10m) and Optimism ($100m)

| Network | Mechanism | GMV (2023) |

|---|---|---|

| Optimism | RetroPGF | $100m |

| Protocol Guild | Self Curated Registry | $10m |

| Gitcoin | QF (mostly) | $7m |

(To be clear, we <3 Protocol Guild and Optimism. Not only for their impact, but for their leadership in designing allocation strategies. They are our friends. This post is not about competing with them in a zero sum way, but learning from them and developing positive sum relationships with them.)

(and about Making Gitcoin Lead Again ![]() )

)

In this post, I propose a path towards catching up (and making sure we are uniquely positioned in a strategic way to deal with future competition).

I propose that Gitcoin 2.0 facilitates a Capital Allocation Strategy Exchange.

An exchange is a marketplace, where goods and services are exchanged or sold.

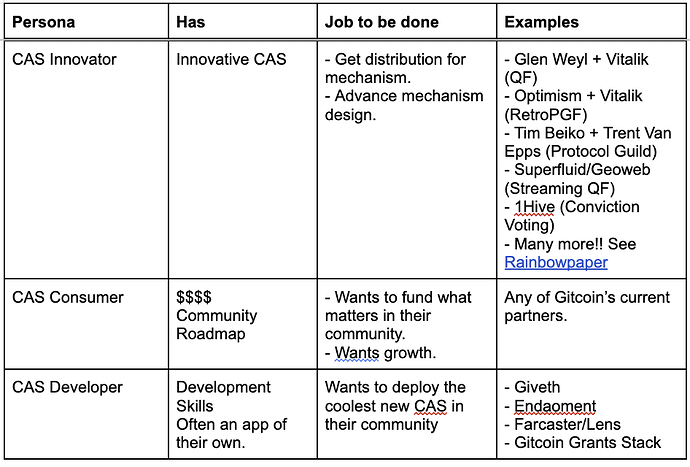

A capital allocation strategy exchange (CASE) is a place where capital allocation strategies (CAS) are exchanged. It has 3 primary personas it attracts with distinct jobs to be done.

I think that Gitcoin can add value to all three of these personas by giving each of them what they want.

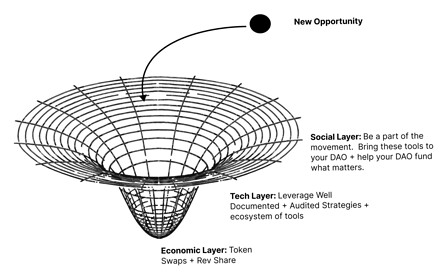

To understand this opportunity, you can view Gitcoin as an attractor - or gravity well, that attracts new opportunities into it.

The attractor operates on 3 levels:

- Social layer

- Technology layer

- Economic layer

The weight of Gitcoin’s intermingled social, technology, and economic layer provide a schelling point for CAS Innovators, CAS Devs, and CAS Consumers to rally around.

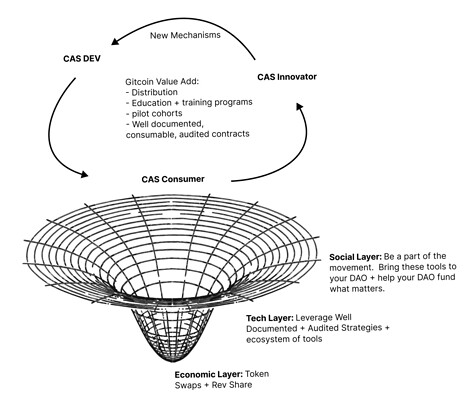

Around this schelling point, each actor gets what they want.

- CAS Innovators get distribution of their mechanisms. And data about how their mechanisms operate in the wild. If all goes well, maybe even a rev share.

- CAS Devs - get access to well documented, audited contracts, that do capital allocation well out of the box.

- CAS Consumers - get access to the latest capital allocation mechanisms, education training programs, and pilot cohorts about how they work.

To juice the wheels, Gitcoin could/should provide value add services, including

- marketing/distribution for new mechanisms

- education + training programs

- Pilot cohort operations

- Well-documented, consumable, audited contracts, integrated into Allo Protocol

Here’s what it looks like visually:

Example 1

We are already doing this! This is just the Repeatable Path to New Market Share at scale!

An example of this in practice is EasyRetroPGF. Here’s how EasyRetroPGF went.

- We identify a CAS Innovator + begin building a relationship with them (Optimism)

- We fork their software + create a well documented, audited, tool for other people to use it.

- We run educational + training programs + invite CAS Consumers to it.

- CAS Devs (like the MACI team) build on top of it.

- We get $$$millions in Allo GMV (forecasted, lets see how the pilot goes).

The pod for this CASE looked like:

- Kevin/Carl to dev the business line + build the code.

- Sejal handed off the educational course to her educational consultant.

- (TBD) to manage the customers of the pilot cohort.

More Examples

Other examples:

- Another example is Endaoment. They took our QF strategy off the shelf and built it into their app.

- Another example is Impact Stream. They took Allo off the shelf and built it into their app and then ran a pilot.

- Another example is GeoWeb/Superfluid Streaming Quadratic Funding.

Examples in the works right now::

- Another example is 1Hive/Conviction Voting (currently being built on Allo).

- Another example I’ve got coming up is EasyGuild.xyz - not yet built.

Why do this?

- Relieve the burden of exploring the CAS design space alone. Enable our network of citizens to do it with us.

- Repent for the past loss of market share, and to create a path to making up that ground.

- Make GItcoin antifragile wrt the next innovators.

- Create exponential network utility.

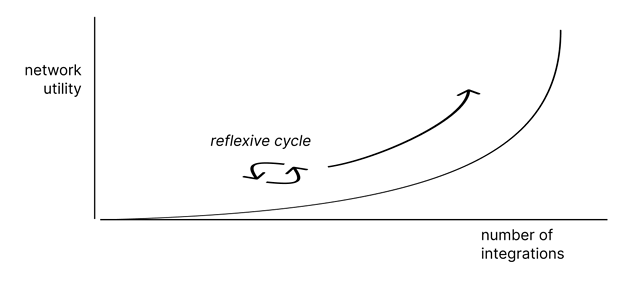

As more and more people build on Allo via the CASE, more network value accrues, in the form of

- Documented + audited strategies on the Allo Awesome List.

- Social Momentum of Gitcoin Innovating

- Allo GMV

… Which reflectively creates more demand for CAS in the CASE.

The coolest thing about this strategy is that it is reflective. Momentum begets momentum - and metcalfe’s law kicks in. Reflexive growth cycles like this can create exponential growth in network utility due to Metcalfe’s law:

As these CAS mature, we will fold them into Grants Stack.. Powering Grants Stack to be the premier capital allocation swiss army knife in the industry.

What would it take to do this?

To successfully pursue this strategy at a larger scale (more than one CASE pod at once), we would need to

- Continue funding the RPP.

(we’re already doing this)

(we’re already doing this)

- Prioritize the hottest mechanisms in the space

(we’ve already got QF/RetroPGF which is a great start)

(we’ve already got QF/RetroPGF which is a great start)

- Pursue a unix philosophy style software development methodology.

(we’re already doing this in RPP)

(we’re already doing this in RPP)

- Allocate $3k per training program we run, and run 2-3 training programs per quarter.

- See Sejals budget

(we’re sort of doing this right now but lack the staff to repeatedly do it or focus on it)

(we’re sort of doing this right now but lack the staff to repeatedly do it or focus on it)

- Citizens Rounds

- We will need to leverage these to fund CAS Devs + CAS Innovators.

It’s already happening, kinda.

It’s already happening, kinda. If a mechanism is really gaining heat, we may need to increase funding to it or do a token swap.

If a mechanism is really gaining heat, we may need to increase funding to it or do a token swap.

- Properly Fund & Execute the Allo B2C Strategy.

We are not presently doing this.

We are not presently doing this.

- Harden Allo Product + Developer Experience [Allo Protocol Working Group].

We are not presently doing this.

We are not presently doing this.

Full Operational Plan

TBD - but only if we think this is a worthwhile/high upside thing to do.

Key Stakeholders

who are the key stakeholders that need to buy into this/provide feedback?

- workstream leads

- dao stewards… since theyd be funding it

- rpp team - carl + whomever is chief of staff

- allo developers

- Citizens - especially CAS Innovators, CAS Devs, CAS Consumers - are all welcome to comment

Feedback welcome, commente blow.