After the articulation of CASE, we are starting to see Gitcoin become a capital allocation strategy exchange.

Some examples of CAS (Capital Allocation Strategies) that the Gitcoin network is working on:

- Quadratic Funding - A CAS pioneered by Gitcoin/Vitalik (now being grown by Grants Lab - doing $1m-$10m/qtr)

- EasyRetroPGF - A CAS pioneered by Optimism/Vitalik (now being grown by RPP - doing $1m-$10m/qtr)

- Streaming QF - A CAS pioneered by Geoweb/Superfluid (doing $1k-$100k/qtr)

- Conviction Voting - A CAS pioneered by 1Hive (not yet live)

In addition to the above, we have leads for a handful of other capital allocation strategies that could be built in the ecosystem.

As we venture towards $1billion GMV on Allo, we need to start thinking about how we prioritize these builds. There are likely to be builds that will not going anywhere, and builds worth $millions. The DAO should build the muscle to prioritize the latter, not the former.

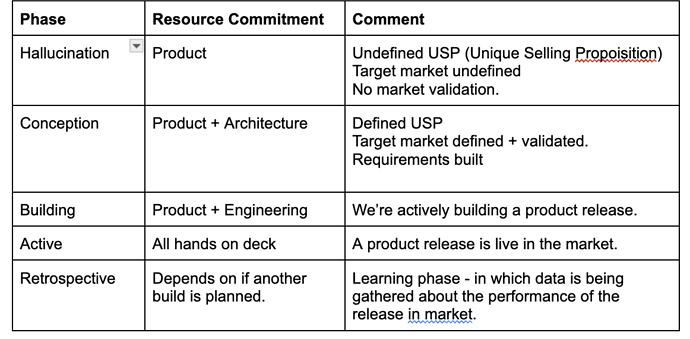

Build Maturity Matrix

For CAS that are not yet live, I propose the following as a build maturity matrix.

Maturity Matrix

Once a CAS is live, these are maturity phases I recommend:

| Phase | Comment |

|---|---|

| Pre-PMF | a high user churn rate, difficulty in acquiring and retaining users without substantial marketing efforts, and widespread user feedback suggests the app does not effectively address a strong market need or user problem. |

| PMF | consistent user growth, high engagement or retention rates, and positive feedback or demand that indicates users find significant value in the app, leading to organic referrals and reduced marketing spend for user acquisition. |

| Network Effects | each new user adds value to the existing user base, leading to exponential growth in user engagement and retention. This growth often results in a self-sustaining ecosystem where users attract more users, and the app becomes more valuable and indispensable as the user base expands. |

| Financial Sustainability | consistently generates revenue exceeding its operating costs (or token staking exceeding treasury outflows), allowing for reinvestment in growth and innovation. app can adapt to market changes without compromising its financial health, indicating a resilient business model. |

Origination Options Gitcoin Orbit

Builds can originate in the following places.

| Phase | Comment |

|---|---|

| Inner Orbit | A build built by Grants Lab or RPP |

| Outer Orbit | A build built as a joint venture between Gitcoin funded teams and an outside team (Nifty Apes) |

| Not in Gitcoin’s orbit | A build built outside of the Gitcoin ecosystem (RetroPGF, Conviction Voting) |

Builders who are not in Gitcoin’s orbit have the following incentives to work with Gitcoin:

- Distribution

- via Gitcoin’s marketing channels

- to Gitcoin’s partners

- via Allo protocol github

- via Owocki’s network + Greenpill network

- Economics

- Fee Share

- Token Swap

Applying these matrices

I recommend DAO should prioritize builds that we think will be reaching the PMF or network effects phase.

As early as the hallucination phase, we should be asking hard questions about whether this will reach product market fit + how big the TAM is for it.

Feedback welcome.