Authors: @schlabach, @HelloShreyas from Llama

Gitcoin’s Current Liquidity Situation

Gitcoin’s current volume is around $5m/day, mostly on off-chain CEXs (most notably Binance) [1]. At the time of writing, there is $680k (GTC @ $2.64) worth of TVL in the Uniswap v3 pool. Gitcoin does not pay liquidity mining rewards.

Overview of Tokemak

Tokemak is a novel protocol designed to generate deep, sustainable liquidity for DeFi and future tokenized applications that will arise throughout the growth and evolution of web3.

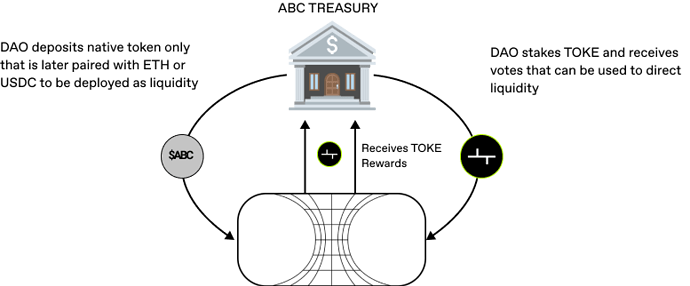

An example of how Gitcoin can use a Tokemak reactor:

- Gitcoin creates a Tokemak reactor.

- Gitcoin deposits GTC in the reactor in exchange for tGTC.

- This tGTC can only be withdrawn at the end of the cycle [2]. However, smaller depositors in the pool will be able to swap tGTC for regular GTC at any time on a normal DEX (assuming a liquidity pool is created).

- Gitcoin will earn TOKE, which it can stake and then use to 1) direct TOKE rewards to the pool and 2) direct GTC liquidity to different exchanges.

- Other TOKE holders (Liquidity Directors) are incentivized to direct GTC liquidity to the appropriate exchanges.

@Willy and @kyle had a discussion in March exploring setting up a Tokemak reactor. We would like to take this discussion to the next stage of execution.

Benefits of Gitcoin using Tokemak:

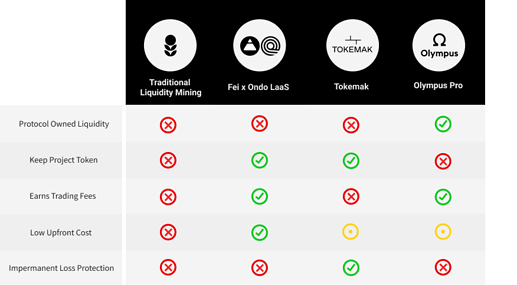

- Provide liquidity for GTC

- Gitcoin can ensure that GTC has plenty of liquidity without relying on any costly liquidity mining incentives.

- No need to provide USDC or ETH (as those come from Tokemak).

- Allow GTC holders to become LPs without having to manage a complex LP position or take on risk of impermanent loss. [3]

- Sustainable, deep liquidity (avoid mercenary capital).

- Platform/DEX agnostic; Tokemak sits above the exchange layer and can seamlessly route liquidity wherever it’s needed.

- Earn revenue for the DAO

- Gitcoin DAO will earn TOKE rewards, which they can either sell or use to direct liquidity on Tokemak. As the Tokemak protocol becomes more widely used, it will have a large treasury of Protocol Controlled Assets, making it strategically valuable to hold TOKE.

- Allows Gitcoin to take advantage of its un-utilized GTC

- Allow the Gitcoin team & community to focus on their core competencies instead of managing GTC liquidity on DEXs

- Philosophically, it would be best for Gitcoin (with its focus on driving public goods) to have liquidity for its token available on-chain as opposed to on CEXs.

Process of setting up a token reactor

Gitcoin will need to enter and win a token reactor through Tokemak’s Collateralization of Reactors Event (C.o.R.E). In a C.o.R.E., different DeFi projects compete with one another to secure one of five token reactors. The projects with the most TOKE votes are rewarded with a reactor for their token.

In C.o.R.E. 2, there were 45 candidates and 5 were selected, so the process is competitive. C.o.R.E. 3 saw 5/52 candidates selected for reactors. Even well-recognized names like Aave and Curve did not win reactors in the last two C.o.R.E.s.

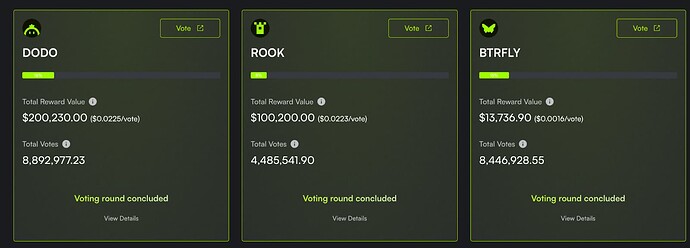

In the last C.o.R.E., Gitcoin would have needed 6,717,153.36 votes to win (if the original LUNA vote is counted). Voting power is different depending on which token is used:

- 1 liquid staked TOKE = 6 votes

- 1 staked LP token = 69 votes

- 1 locked (vesting) TOKE = 1 vote

Tokemak’s introduction of the vote-locked token model might make it more difficult to win a reactor, as token holders may lock their tokens in exchange for boosted voting power.

We can also improve Gitcoin’s odds by bribing voters on Hidden Hand, though it can be quite expensive to purchase votes, and there’s no guarantee that we’d win.

C.o.R.E.s last 1 week. The next C.o.R.E., C.o.R.E. 4 will begin in the next ~1.5 months.

While it will be challenging to secure a reactor through C.o.R.E., winning a reactor would be hugely beneficial to Gitcoin and the liquidity of GTC.

Llama will work to secure a reactor by advocating on behalf of Gitcoin, securing votes for the GTC reactor, managing any technical requirements needed to enter C.o.R.E. or spin up a reactor, and evaluating any terms of using Tokemak (e.g. a mutual grant for TOKE).

Ongoing Maintenance

Once Gitcoin has won a reactor, Gitcoin will need to deposit GTC into the reactor. There won’t be ongoing maintenance (other than directing liquidity with TOKE, which Llama can handle, or selling earned TOKE).

About Llama

Llama is building economic infrastructure for DAOs. We have worked with some of the leading DAOs, including Aave, Uniswap, dYdX, Gitcoin, Radicle, PoolTogether, FWB, Harvest Finance, and Fei Protocol, among others. Llama has implemented on-chain proposals, constructed treasury strategies, designed liquidity incentive programs and on-chain indices, and built analytics dashboards and financial reports. Llama’s 45 contributors are among the most active in the DeFi and DAO ecosystem and include engineers, DeFi strategists, data analysts, quants, and accountants.

[1] - Source: CoinGecko

[2] - Cycles now last 7 days, ending every Wednesday.

[3] - Read more on Tokemak’s approach to impermanent loss here.