The goal of this thread is to introduce the concept of Tokemak’s token reactors and to discuss the merit of campaigning for a GTC Reactor in the next election, dubbed C.o.R.E.3 (Collateralization of Reactors).

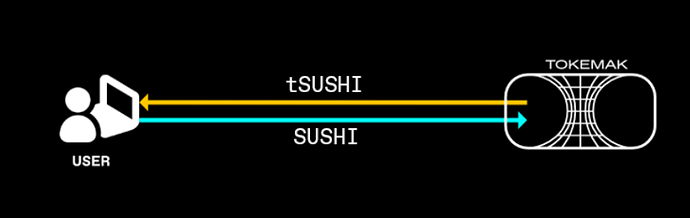

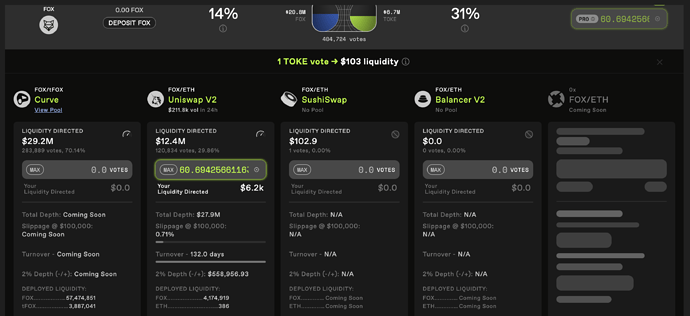

If you’re not familiar with Tokemak, I encourage you to read this Introduction. The tl;dr is that Tokemak is a novel protocol designed to generate deep, sustainable liquidity for tokens. Token holders deposit Tokens in exchange for tTokens and earn TOKE. TOKE holders can then stake their TOKE to direct staked liquidity, both by voting on which reactors to allocate TOKE rewards to as well as which DEXs to LP the tokens staked in reactors.

This provides 2 major benefits to tokens:

- deeper liquidity on DEXs without liquidity mining

- yield for token stakers

Furthermore, the DAO can stake tokens from its own treasury to earn TOKE rewards. ShapeShift DAO (where I spend most of my time) was fortunate enough to secure a FOX Token Reactor in C.o.R.E.2, and subsequently staked 50M FOX from its treasury. We’re so happy with our reactor, we’re now working on a new contract, FOXy, which evolves traditional staking contracts that share DAO or protocol revenues with token stakers (ie. xSUSHI) by depositing FOX staked in the FOXy contract into the tokemak reactor to both boost yield while also enabling otherwise idle tokens to be put to work to deepen liquidity. If Gitcoin secures a reactor and is interested, we’d be happy to help you deploy your own GTCy.

Token Reactors are pretty cool, and as a result the demand for them is strong. In CoRE2, 45 projects entered, but only the top 5 projects with the most TOKE votes left with token reactors. The details of CoRE3 haven’t been announced yet, but if anything I expect it to be even more competitive now that more projects caught wind. In a world of lengthy governance cycles and juggling priorities, being prepared is a huge advantage.

Things to consider:

Does Gitcoin DAO want to secure a token reactor?

If no, we can end the convo here ![]()

If yes…

Should we give everyone who votes for GTC a sweet poap? (this one is a no-brainer)

Should Gitcoin DAO allocate GTC from the treasury as a bribe using votemak.com?

Should @owocki write a letter to the Tokemak community like Erik Voorhees did?

What other creative ideas can we come up with to secure the bag?

Excited to hear your thoughts

Details on the last CoRE:

CoRE2

CoRE2 Conclusion