I’d also ask the following question: “How can we hone the product/market fit of the engagement with Llama? What financial forecasting needs does the DAO have + how can they been more deeply met by reporting?”

Llama’s best work has been on-chain, financially sophisticated actions that it doesn’t make sense for a DAO to work on internally. For example, we are working on securing a Tokemak reactor for Gitcoin. The nature of the financial, technical, and governance work needed to secure and manage that process makes Llama better equipped to work on this versus the average Gitcoin contributor.

We’ve implemented on-chain proposals, constructed treasury strategies, designed liquidity incentive programs and on-chain indices, and built analytics dashboards and financial reports.

Examples of what we’ve worked on for Gitcoin:

- Improve GTC liquidity with Tokemak

- Proposal to liquidate AKITA partly via sale and Sablier stream

- Financial statements

Examples of what we’ve worked on for other DAOs:

- Consolidate reserve factors and enable DPI borrowing on Aave

- Strategic partnership between Aave and Balancer

- Uniswap liquidity program v0.1

- PoolTogether proposal on tokenomics and alternative capital structures

- FWB liquidity improvement plan & escrow contract

- Fei analytics dashboard

- CVX asset listing

- Forge template for Aave proposal payloads

- Harvest analytics dashboard

On how best to use Llama to serve Gitcoin:

While we could work on one-off proposals for Gitcoin, I think entering into a longer-term 6-month contract could help accomplish more with a longer term, dedicated focus. A Llama team of engineers and DeFi strategists could be focused on few core areas for the DAO:

- Increasing revenue to Gitcoin’s treasury

- Improving liquidity for GTC token

- Growing Gitcoin’s treasury and making it productive / earning yield

- Hedging the treasury against extreme downside risk

- Accruing metagovernance power in other protocols

- Building analytics dashboards and financial statements to inform the DAO

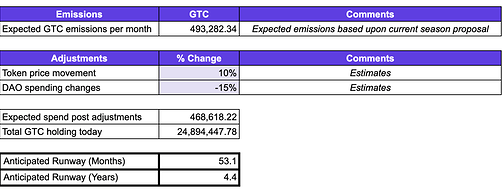

- Building a runway analysis report based on budget proposals (example from last month below)

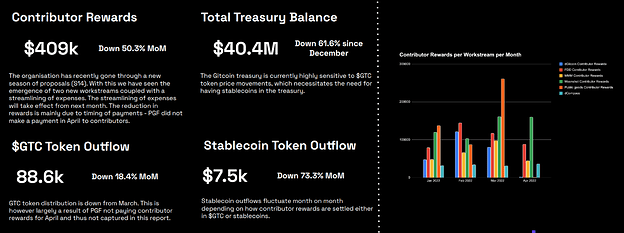

On our monthly report:

I’ve heard from Gitcoin members that our monthly report is useful. However, so far, it has not gotten enough attention and visibility to the rest of the DAO. For example, I think the chart below should be shown in monthly steward calls and help inform voter decisions on approving quarterly budgets.

TLDR

We think we can best serve Gitcoin’s treasury with some type of longer-term arrangement that can align Llama and Gitcoin.