Authored by @HelloShreyas, @ajbeal, and @AcceleratedCapital from Llama, which provides treasury management as a service to DAOs.

Summary

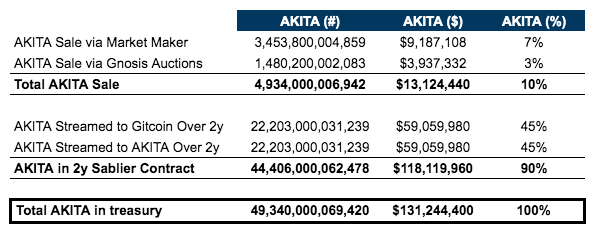

We propose that Gitcoin sell 10% of its AKITA balance and place 90% of its AKITA balance in a Sablier contract unlocked over 2 years.

-

Sell 10% of AKITA balance

- Sell 7% of AKITA balance via a market maker. This is 3.5 trillion AKITA worth $9m.

- Sell 3% of AKITA balance via Gnosis Auctions. This is 1.5 trillion AKITA worth $4m.

-

Allocate 90% of AKITA balance to Sablier contract unlocked over 2 years

- 45% of AKITA balance will be unlocked to Gitcoin’s treasury over 2 years to fund quadratic rounds. This is 22.2 trillion AKITA worth $59m.

- 45% of AKITA balance will be unlocked to AKITA’s treasury over 2 years fund AKITA development or public goods. This is 22.2 trillion AKITA worth $59m.

This proposal is inspired by Vitalik’s recommendation. We want this donation to fund important public goods and support the development of both Gitcoin and AKITA.

Note that dollar amounts stated are as of May 26, 2021.

Abstract

Gitcoin’s treasury currently has about $131m worth AKITA or 49 trillion AKITA tokens. This is about half of AKITA’s total circulating supply. This proposal provides practical next steps for how Gitcoin should deal with the AKITA donation.

AKITA’s total liquidity on Uniswap is $2.5m. AKITA is not listed on many exchanges, which makes a liquidation difficult. We have had conversations with teams from Wintermute (market maker) and Gnosis Auctions to evaluate a realistic amount we can sell. Despite this, given current market conditions, we might be able to sell less than what we plan or take longer to execute it.

The AKITA donation is substantial. We cannot decide everything now so have decided to take a piecemeal approach. We want to maximize the value of the donation to further Gitcoin’s goal of funding public goods. We also want to avoid causing significant harm to AKITA’s project. Based on these goals, we recommend placing 90% of the AKITA donation in a 2-year Sablier contract that helps fund critical development that the Gitcoin and AKITA communities independently deem valuable.

I. a) Sell 7% of AKITA Balance via Market Maker

We recommend selling 7% of the AKITA balance via a market maker. The market maker will sell AKITA via exchanges and attempt to get the best execution for Gitcoin. They will also try to sell tokens via OTC but OTC buyers are unlikely.

We recommend using Wintermute as the market maker. Wintermute has been effective with the sale of SHIB tokens donated by Vitalik to the CryptoRelief fund. They have sold $140m worth SHIB so far. Unlike SHIB, AKITA is not listed on many exchanges and is far more illiquid so we cannot expect similar outcomes.

Benefits

- Quick execution with an effective market maker

- Tried and tested method

Drawbacks

- Not trustless: we will have to transfer AKITA to market maker to execute the trade

- Market maker will charge a fee, whereas Gnosis Auctions is free

Implementation

- KYC for Gitcoin multisig wallet signers

- Enter into agreement with Wintermute to execute sale over 1 week

- Transfer AKITA to Wintermute

- Wintermute will sell AKITA via exchanges (and, possibly, OTC)

- Wintermute will transfer ETH/USDC/DAI/USDT from sale to Gitcoin treasury

I. b) Sell 3% of AKITA Balance via Gnosis Auctions

Gnosis batch auctions let you execute trades on-chain and trustlessly. Batch auctions enable matching of limit orders of buyers and sellers with the same clearing price for all participants. They are designed to reduce the risk of frontrunning, gas bidding wars, and lower the amount of extracted value from auctioneers and bidders. The largest auction executed so far is by Boson Protocol, which had >$50m of bids and ended up settling ~$26m.

Benefits:

- Fully on-chain and trustless

- Batch auctions help prevent getting front run or sandwiched

- Good precedent for the Gitcoin treasury; auctions are transparent and don’t privilege any particular players

- Gnosis does not charge a fee for batch auctions

Drawbacks:

- Can be a slower process than selling via market maker

- Execution could be worse than market maker

Implementation

- Set up Gnosis Auctions via Gnosis safe app by following these steps

- Enter parameters including but not limited to:

- Token address we plan to auction

- Token address we accept for bidding

- Amount of tokens we plan to auction

- Limit price we are willing to accept for tokens

- Finalize bid and receive ETH or stablecoins

Note that we have the option of KYC’ing bidders. However, this will make the process longer and reduce demand.

II. Place 90% of AKITA Balance in a 2-year Sablier Contract

We recommend placing 90% of the AKITA balance in a Sablier contract unlocked over 2 years. 45% of the total AKITA balance will accrue to the Gitcoin treasury over 2 years to fund quadratic rounds. 45% of the total AKITA balance will accrue to the AKITA treasury over 2 years to fund AKITA development. The Gitcoin and AKITA community will independently control how funds streamed to them are spent.

Why place this amount in a 2-year Sablier contract instead of selling it?

- Liquidity is thin and attempting to sell this balance will be difficult in current market conditions

- A sale does not maximize the amount of public goods that can be funded with this substantial donation

- A 2-year contract gives confidence to AKITA that the token won’t be sold at once

Why place this amount in a 2-year Sablier contract instead of burning it?

- 90% of the AKITA balance is a substantial amount that could be used to fund public goods; burning all of this could mean important projects miss out on funding

- Placing this amount in a 2-year Sablier contract helps Gitcoin and AKITA take more time to decide the best course of action and get the most value out of this donation

- 2 years is a long enough time horizon to help both Gitcoin and AKITA to think longer-term about funding development that matters

Drawbacks

- A substantial portion of AKITA’s token supply will be held in the Sablier contract

- There could be immediate benefits from a sale that Gitcoin isn’t realizing

- Although minimal, this might necessitate some coordination between Gitcoin and AKITA that both communities may or may not want

Conclusion

We recommend selling 10% of the AKITA balance and placing 90% of the AKITA balance in a 2-year Sablier contract. There is no perfect way to deal with the AKITA donation. However, given the goals of Gitcoin (funding public goods), the risks involved (reputational and headline risks), and current market conditions (low liquidity for the token), we believe this proposal is the best out of the possible options.

We would love to hear any feedback and questions! We plan to set up a Snapshot vote on this proposal later this week.

_

_