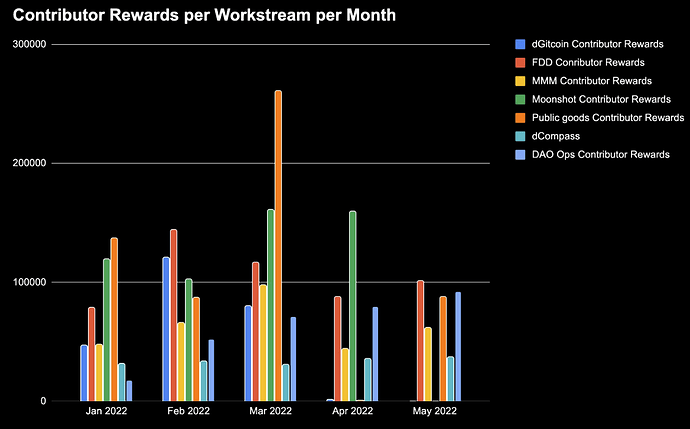

Very small suggestion. I wonder if it would be possible to show these charts relative to the budget seasons. Round 12, Round 13, Round 14, etc. You can kind of see the seasons in the colors, but it might make what’s happening easier to see. Just a thought.

@ivanmolto have finished up the visual for GTC outflow per month, check it out here.

It’s also been added to the Dashboard mentioned above.

(Click the workstreams in the legend to hide/show)

We’re working on creating Workstream-cards on https://www.daostewards.xyz/ where these type of metrics will be aggregated.

Just for my future voting information, what workgroup is this being done under?

Hi @Fred thanks for your comment. Sure, we use the following address’ when tracking the transactional data for Gitcoin DAO.

| Workstream | Descripton of account | Address |

|---|---|---|

| FDD | Main multisig FDD | 0xD4567069C5a1c1fc8261d8Ff5C0B1d98f069Cf47 |

| FDD | Ops Account | 0xbc4C3D4c6cCA25d5704b6d6841BA75882b8F061B |

| MMM | MMM ops account | 0xC23DA3Ca9300571B9CF43298228353cbb3E1b4c0 |

| Moonshot | Moonshot ops account | 0x230Fc981F7CaE90cFC4ed4c18F7C178B239e5F9F |

| Public goods | Public goods ops account | 0xa7aC9f7087d7197e0047DB9A90562a1364bf897D |

| Decentralize GitCoin | Ops account | 0x931896A8A9313F622a2AFCA76d1471B97955e551 |

| Decentralize GitCoin | Hot wallet | 0x6BF1EBa9740441D0A8822EDa4E116a74f850d81B |

| Vester Account | GitCoin the company | Not tracked since this is the vester account and not Gitcoin DAO funds |

| GitCoin DAO timelock | GitCoin DAO main treasury account | 0x57a8865cfB1eCEf7253c27da6B4BC3dAEE5Be518 |

| DAO ops | Gitcoin DAO ops | 0x5dd4721bb322499616d827be45c93f55d9181bc3 |

| dCompass | dCompass | 0x756239E5B7D2aa6F3DA0594B296952121Fb71606 |

| FDD | FDD Payments | 0xb24e82384Ff49CB58DEE244C72f15A71C02b74c5 |

| DAO ops | Gitcoin DAO ops hot wallet | 0x0625C8506a292846227b87Dfb245a692a7d06293 |

It’s part of the MMM Workstream transparency and accountability initiative. Under the same umbrella as Steward Health Cards etc.

Hi Kyle, you are correct here - there were two payments made in March which caused inflated costs for PGF. We utilize the cash accounting framework to prepare these reports so we will account for the cost when it is incurred. However, for budget vs actual work, we will match payments with the months they correspond to.

If a contributor from DAO ops would like to reach out to perform a review or audit of the work then we would be happy to run through the details with them in order for Gitcoin to fact check these reports.

Thank you!

I would argue that the Vester Account should be included in the GitcoinDAO funds, as funds can only move to the Timelock, which is being tracked.

Either way, 19.8M GTC was transfered to the Timelock 22 days ago so the treasury is quite a bit larger than reported. ![]()

Also I do not think Vester == Gitcoin the Company as outlined in the table?

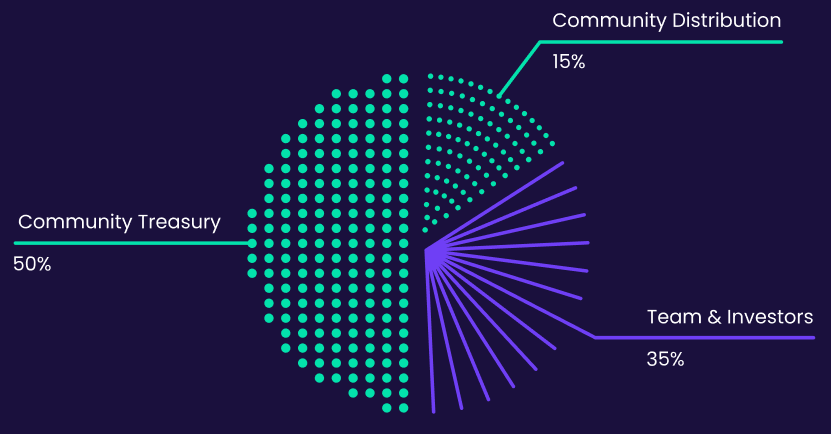

The Vester, and the Timelock, are the “Community Treasury” in this chart:

While the company is part of the “Team & Investors” piece.

That’s correct the treasury balance is larger than reported. This transaction was not captured since it occurred in May, however, you will be able to see the update in the May report which we hope to be able to publish within 5 days of month-end.

I’d also ask the following question: “How can we hone the product/market fit of the engagement with Llama? What financial forecasting needs does the DAO have + how can they been more deeply met by reporting?”

Llama’s best work has been on-chain, financially sophisticated actions that it doesn’t make sense for a DAO to work on internally. For example, we are working on securing a Tokemak reactor for Gitcoin. The nature of the financial, technical, and governance work needed to secure and manage that process makes Llama better equipped to work on this versus the average Gitcoin contributor.

We’ve implemented on-chain proposals, constructed treasury strategies, designed liquidity incentive programs and on-chain indices, and built analytics dashboards and financial reports.

Examples of what we’ve worked on for Gitcoin:

- Improve GTC liquidity with Tokemak

- Proposal to liquidate AKITA partly via sale and Sablier stream

- Financial statements

Examples of what we’ve worked on for other DAOs:

- Consolidate reserve factors and enable DPI borrowing on Aave

- Strategic partnership between Aave and Balancer

- Uniswap liquidity program v0.1

- PoolTogether proposal on tokenomics and alternative capital structures

- FWB liquidity improvement plan & escrow contract

- Fei analytics dashboard

- CVX asset listing

- Forge template for Aave proposal payloads

- Harvest analytics dashboard

On how best to use Llama to serve Gitcoin:

While we could work on one-off proposals for Gitcoin, I think entering into a longer-term 6-month contract could help accomplish more with a longer term, dedicated focus. A Llama team of engineers and DeFi strategists could be focused on few core areas for the DAO:

- Increasing revenue to Gitcoin’s treasury

- Improving liquidity for GTC token

- Growing Gitcoin’s treasury and making it productive / earning yield

- Hedging the treasury against extreme downside risk

- Accruing metagovernance power in other protocols

- Building analytics dashboards and financial statements to inform the DAO

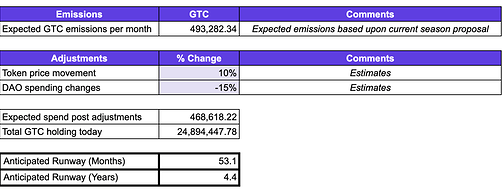

- Building a runway analysis report based on budget proposals (example from last month below)

On our monthly report:

I’ve heard from Gitcoin members that our monthly report is useful. However, so far, it has not gotten enough attention and visibility to the rest of the DAO. For example, I think the chart below should be shown in monthly steward calls and help inform voter decisions on approving quarterly budgets.

TLDR

We think we can best serve Gitcoin’s treasury with some type of longer-term arrangement that can align Llama and Gitcoin.

Hi @schlabach do you know of a model to project slippage? I was thinking of working on one w/ some other interested folks however if there is one that is sharable maybe we could start w/ that. Do you know of one? Or is there a rule of thumb we should use like w/ liquidity X (for eg avg volume) & a swap of volume Y we can expect slippage Z? (I presume we will end up w/ many more determinants). Or is this sort of model probably just owned by the large traders and they are unlikely to share w/ those of us actually building?

Promising! I just recently vented a bit to fellow wildfire folks in the last week about the challenges I think everyone likely feels about getting a sense of the context of a DAO before making suggestions or providing feedback on proposals and discussions. The work you are doing w/ Llama obviously is promising. That said we are still a little ways away from having a broadly adopted “defacto standard” way of looking at DAO health and areas of activity, right? What I’m getting at is do you think we in GitCoin and DAOs more broadly DO have such a fairly well-accepted way of examining DAO health yet or is this an area you feel needs more work - or is the question moot?

Secondarily - I asked below about means to assess treasury sensitivity to diversification. Do you know of a model for predicting slippage? I would guess you and fellow LLamas would be a good group to ask ![]()

Hi @epowell101 - which AMM model are you thinking? A Uniswap v2 model is fairly trivial but a v3 model is much more complex as you’re going to have to make many assumptions about the depth of liquidity at different prices given Uni v3’s concentrated liquidity features.

There is the liquidity provided w/ the help of LPs on Uniswap for eg - and then there is the overall price elasticity of demand for GTC as supply increases. I guess I view the first as fairly dependent on the specifics of the tool whereas the second has to do w/ underlying demand and of course utility. Along those lines, there is quite a thread elsewhere that discusses some work that was done to see about the hold times of contributors which was enlightening if not conclusive: Data Science @ GitcoinDAO - #27 by Fred

Gitcoin - May 2022 Financial Report

Llama is pleased to present the May 2022 Financial Statements.

Please find above the GitcoinDAO treasury report for May 2022. As with previous months, the statements are split into transactions denoted in the governance token GTC and separate transactions in stablecoins. We have also included a consolidated profit/(loss) account that translates the GTC transactions into $USD to allow for comparison in a denomination that is easily relatable to many reading the report.

This month’s iteration has undergone some design changes to improve the readability of the report, coupled with taking onboard some feedback from the community. You will also notice we have included a list of wallet address’ used to prepare the report for auditing purposes.

Highlights

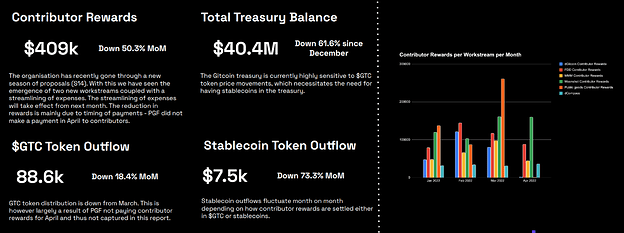

- Total $ value of contributor rewards is down 5.7% MoM. This is a direct result of timing differences in payments made to contributors cross workstreams. This can be seen in the screenshot below with the Moonshot collective making payment to contributors just after month end, hence not included in this report.

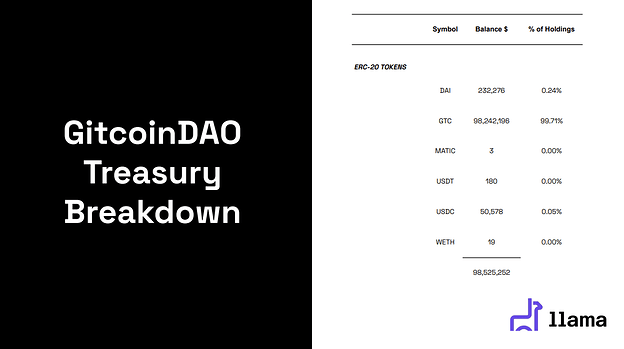

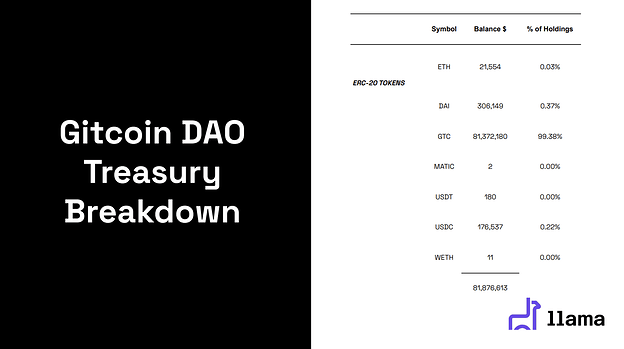

- Total Gitcoin treasury balance has increased by 144% MoM. This is a result of a ~19M GTC claim from the Gitcoin vester account. As can be seen from the screenshot below 99.7% of the treasury value is held in GTC.

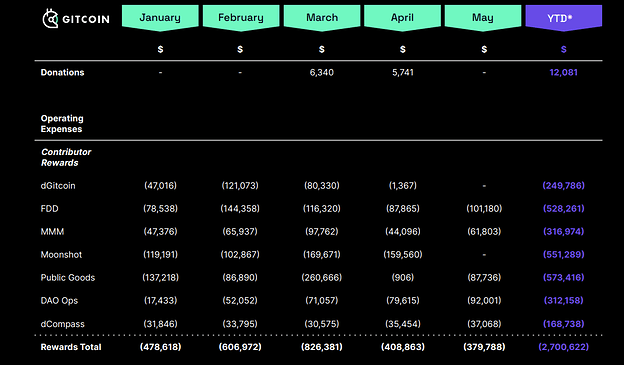

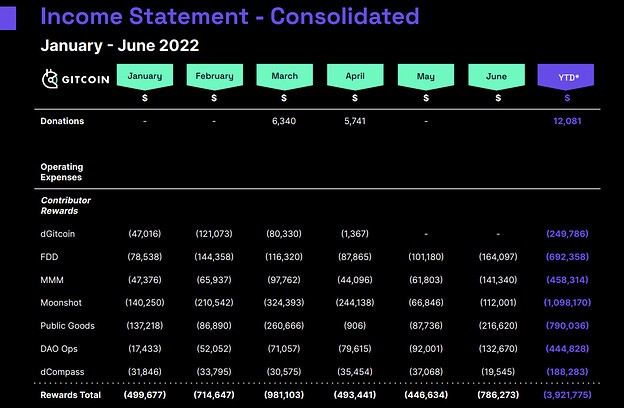

- The consolidated income statement shows total contributor rewards YTD of $2.7m

Please do read, share and add a comment to let us know what you would like to see in our next iteration of this report.

What else is Llama doing to support Gitcoin?

Llama is currently working with the Gitcoin team to prepare a detailed Budget vs Actual view of contributor rewards payments over the last 6 months. We will post this analysis within this Financial reporting thread in due course.

In addition to this we are also preparing a detailed runway analysis of GTC and also the organisations stablecoin needs over the next 2 year period. Watch this space…

Gitcoin June 2022 Financial Report

Llama presents the June 2022 Financial statement for the review of Gitcoin DAO. The intention of this report is to provide the users with a detailed understanding of treasury health, monthly spending and emissions of GTC.

Find above the Gitcoin DAO treasury report for June 2022. As with previous months, the statements are split into transactions denoted in the governance token $GTC and separate transactions in stablecoins. We have included a consolidated profit/(loss) account that translates the GTC transactions into $USD to allow for comparison in a denomination that can easily be relatable to many reading the report.

Highlights

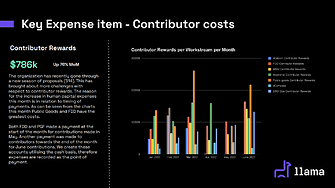

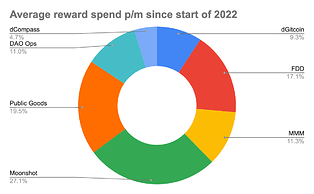

- Total $ value of contributor rewards is up 76% MoM, which is a direct result of timing differences in payment made to contributors from differing workstreams. As can be seen both FDD and PG seem inflated, this is due to multiple payments being made within the month of June. Utilizing an average across the last 6 months we are able to share estimates of committed spend per work stream.

- Total Gitcoin treasury balance has decreased slightly from May, as a result of GTC token price depreciation. Llama has proposed with the core Gitcoin team a Treasury diversification. This intends to raise $3m in stablecoins. This should provide some stability to the treasury balance and ensure a certain runway in stablecoins. We have recently posted the GTC runway analysis which should be reviewed by all members of the DAO.

- The consolidated income statement shows total contributor rewards YTD of $3.9m

We would like to ensure we are staying up to date on what Gitcoin DAO finds most valuable from a Financial reporting and analytics perspective. We have created a google form that DAO members can complete to provide comments and feedback. Please do take the time to complete this, it really helps us identify the issues key to the DAO and how we can assist in providing information to help.

Thanks

My apologies. The Link should now work. Reposting here Financial Reporting and Analytics feedback

Gitcoin July 2022 Financial Report

Llama presents the July 2022 Financial statement for the review of Gitcoin DAO. The intention of this report is to provide the users with a detailed understanding of treasury health, monthly spending and emissions of GTC.

Gitcoin DAO - July 2022 Financial Report

Find above the Gitcoin DAO treasury report for July 2022. As with previous months, the statements are split into transactions denoted in the governance token $GTC and separate transactions in stablecoins. We have included a consolidated profit/(loss) account that translates the GTC transactions into $USD to allow for comparison in a denomination that can easily be relatable to many reading the report.

Please do read review and comment on the contents of the report. We are continually trying to improve the analysis and we want to make sure the Gitcoin team is provided with information they find most valuable. With that said please provide feedback on the below form.