Hey Gitcoiners!

Below is a draft Treasury Management Proposal for the Grants Multi-sig, authored by @HelloShreyas, @ajbeal, and @AcceleratedCapital from Llama, which provides treasury management as a service to DAOs.

Treasury Management Approach

There are a variety of approaches to treasury management based on the goals and demands of the organization. The primary levers available to us are the assets and the allocation.

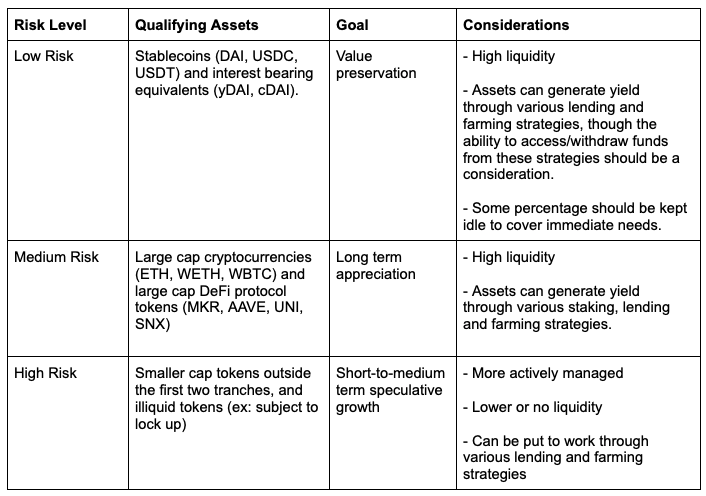

We can distinguish different crypto assets based on market cap, liquidity, months since launch, volatility, return potential, and other factors. For purposes of this exercise, we have divided assets into three tranches:

Because funds in the Grants Matching Pool are needed for quarterly grant distributions, we are inclined to take a slightly more conservative approach. Below is the suggested allocation:

Low Risk (40%) - Allocated to stablecoins and interest bearing equivalents.

- An amount of these assets equal to at least the dollar amount of the last quarter of grants will sit idle in the Grants multi-sig and be available for immediate use.

- The remainder will be put to work across several lending and AMM platforms to earn passive yield. [We estimate 7-12% APY on these assets for the foreseeable future.]

Medium Risk (50%) - Allocated to large cap cryptocurrencies and DeFi tokens.

- This tranche will be held long, and may be put to work across several lending and AMM platforms.

- To the extent the asset can be staked for yield such as in the case of ETH2, we will commit 100% of the asset to staking, taking into consideration any lock up periods. There is a preference for a derivative asset that enjoys the staking yields without being subject to the lock up (ex: stETH on Lido), if available.

- Assets in this tranche may be used in conjunction with assets from the Low Risk tranche for yield generation purposes. Example - contributing an equal amount of WETH and USDC to the WETH/USDC liquidity pool on Uniswap.

High Risk (10%) - Allocated to smaller cap tokens

- This tranche will be held long, and may be put to work across several lending and AMM platforms.

- To the extent the asset can be staked for yield such as in the case of ETH2, we will commit 100% of the asset to staking, taking into consideration any lock up periods. There is a preference for a derivative asset that enjoys the staking yields without being subject to the lock up if available.

- Assets in this tranche may be used in conjunction with assets from the Low Risk tranche for yield generation purposes. Ex: contributing an equal amount of [small cap token] and USDC to the relevant liquidity pool on Uniswap.

Implementation of Treasury Management

Llama will work with Gitcoin on an ideal way to implement the strategic asset allocation that involves the community and allows for effective decision making. We will screen assets based on various criteria including market cap, liquidity, months since launch, volatility, return potential, and other factors. The Gitcoin community will approve broad guardrails: tokens, strategic allocation, and rebalancing frequency. We will help implement rebalancing within those guardrails. This should be done on-chain, transparently, and potentially programmatically via Set Protocol. We will also review the strategic asset allocation periodically and make proposals to the Gitcoin community for feedback.

We would love to hear any feedback and questions!