This report serves as a consolidated financial overview of our DAO for the period covering July, August, and September 2023 and is designed to be a single point of reference for our community. The objective is to have a report that aggregates everything the community needs to know about the DAO on a monthly basis moving forward and our community doesn’t need to hunt down multiple dashboards or combing the forum to stay up to date - we have provided some reference links at the end of this post should you like to dig into the data further.

We welcome feedback, and any other metrics we should be tracking or tools you’d suggest.

The DAO does not currently have a full-time certified accountant. The numbers below are based on actuals reported from the workstreams, the treasury balances and manual updates. This is not meant to be a comprehensive report, but an update for the community to reference. We have external parties working with us on treasury diversification, accounting and asset management. Expect further updates as we move forward on some of these initiatives. Thank you to @JR-OKX for flagging this in our recent Essential Intents update as well.

Aggregated reporting for July, August and September are noted below and will be rolled out mid-month moving forward. - Expect the next one by November 15th for October actuals.

Massive shoutout to my Ops peeps (@Sor03 x @jonas @connor @Sov ) for their work diving into all of this keeping it up to date over the last 3 months.

[Overview]

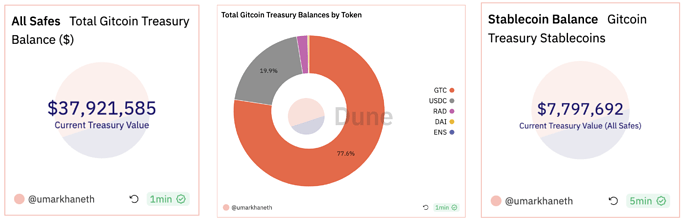

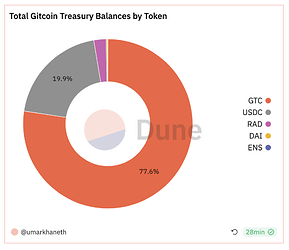

- Current Treasury Holdings: $39,416,953

- This includes both stablecoin and GTC holdings

- Stablecoin Holdings: $7,860,065

Runway

At the end of September the total held in the treasury had a value of $39,416,953 with ~28MM of that in GTC at a price of $0.9210370668 per token (30 day average).

Our current Runway in September (based on USDC holdings and average token price) = 58 Months

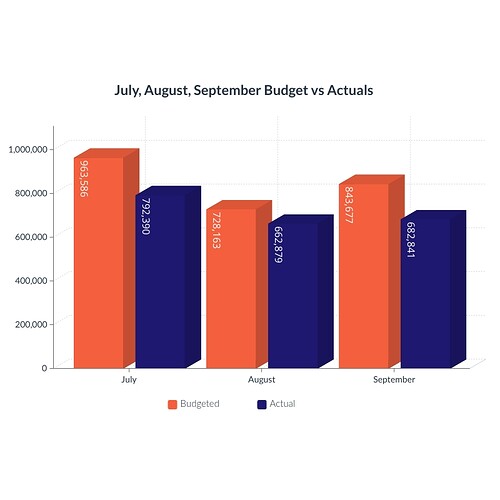

Our 3 month average Expenditure: $812,568.33 which is tracking above our forecasted budget of $700,000. However, we are under budget MOM by appox 9% - 16% across the workstreams with the exception of July, marking the inception of the new budget and adjustments made to wrap up agreements and initiatives that we rolled out over the spring.

Token spend in September

We had a total USD spend of $710,302 in September - with USDC spending at $562,451, GTC spend of 154,375 GTC and nominal amounts in ETH (0.20) and DAI (5,245).

Key Financial Insights (July - September)

Total Contributor Costs

- July 2023: Budgeted at $963,586, actual costs were $792,390, marking an 18% decrease

- August 2023: Budgeted at $661,933, actual costs were $591,886, showing an 11% decrease

- September 2023: Budgeted at $684,433, actual costs were $682,841. We’ve hired another SDR for PGF as well as adding data scientists to the Passport team, resulting in slight changes to the budget contributor costs for August/September and a minimal 0.2% decrease.

Other Operating Expenses

- Audits: Exceeded budget by a significant margin in August, the amazing work the Allo team has been executing resulted in more code review than originally planned. However V2 is wrapping up and ICYMI was one of the most successful audits ever on Sherlock. Loved seeing Gitcoin at the top of the leaderboard!

- Activations: Over budget in July by 542% as per line items, however this is due to the sponsorship money being measured elsewhere. The MMM team effectively made Schelling Point Paris a netzero event for Gitcoin, resulting in little to no expenditure for the event. Check out the retro here.

- Infrastructure: Over budget by 19% in July, this is due to AWS charges for a few launched instances that weren’t monitored in a meaningful way and have since been accounted for moving forward.

July, August, September Numbers

| Budgeted | Actuals | Variance | % Difference | |

| July | $1,034,573 | $918,914 | -$115,659 | -11.18% |

| August | $728,538 | $662,879 | -$67,659 | -9.29% |

| September | $843,954 | $682,841 | -$160,836.08 | -23.59% |

Monthly Breakdown

July

Summary: Software & Subscriptions reflect our yearly Hubspot payment charge of ~$40,000 under the MMM workstream. This will more than likely be the last year we use it.

| Budgeted | Actuals | Variance | % Difference | |

| Contributor Expenses | $931,087 | $776,349 | $-154,738 | -19.93% |

| Travel | $23,500 | $16,041 | $-7,459 | -31.74% |

| Severance | N/A | N/A | N/A | N/A |

| Audits | $0 | $1,605 | $1,605 | 100% |

| Software & Subscriptions | $18,920 | $55,839 | $36,920 | 195.13% |

| Activations & Conferences | $5,000 | $32,145 | $27,145 | 542.9% |

August

Summary: Software & Subscriptions again - AWS charges for July+Aug invoices resulted in higher costs that we were unaware of. This has since be rectified and moving forward will be able to keep these costs maintainable.

| Budgeted | Actuals | Variance | % Difference | |

| Contributor Expenses | 631,912 | 587,368 | $-44,544 | -7.05% |

| Travel | $25,188 | $3,862 | $21,326 | -84.67% |

| Severance | N/A | N/A | N/A | N/A |

| Audits | 1,667 | 15,994 | 14,327 | 859.45% |

| Software & Subscriptions | 21,005 | 47,533 | 26,528 | 126.29% |

| Activations & Conferences | $0 | $2000 | $2000 | 100% |

September

Summary: Came in under once again, software and travel continue to be the biggest fluctuations MOM. This is something to focus on, as both these and Activations/Conferences could be planned out further in advance (in progress right now on the events side) and we can budget accordingly in 2024/2025.

| Budgeted | Actuals | Variance | % Difference | |

| Contributor Expenses | $650,912 | $587,923 | $-62,989 | -9.68% |

| Travel | $28,688 | $18,517 | $-10,171 | -35.45% |

| Severance | N/A | N/A | N/A | N/A |

| Audits | $76,667 | $47,997 | $-28,670 | -37.4% |

| Software & Subscriptions | $20,921 | $7,576 | $-13,068 | -63.79% |

| Activations & Conferences | $0 | $0 | $0 | 0% |

Thank you for taking the time to review, standby for further insights as we shift over from Utopia (shutting down November 6th) and evaluate further tools (and visual creators!) by all means drop any feedback you have in the comments and we’ll take them into consideration for November’s update (some are already in flight but not useful info to share for this month’s update) ![]()