Gitcoin DAO - Financial Status YTD | Jan 23 - July 23

Authors: r3gen Finance (Hammad & Pepperoni Jo3)

Full Financial Report: here

Disclaimer

This report has been prepared for the GitcoinDAO community and has been prepared with no input from Gitcoin’s core team, r3gen has carried out independent research into wallet addresses and traced amounts and payments according to information available in the public domain, predominantly on the Gitcoin forum. Whilst every effort has been made to ensure the accuracy and completeness of this financial report, this is constrained by the level of information available through public channels and there may be instances where balances, transactions or wallets have been omitted due to their existence being unknown. All information provided by r3gen Finance Ltd in this report is not legal, financial, investment or any other advice and should not be used as such, nor should it be relied upon for investment purposes. Whilst we have had no input from the Gitcoin team on the report or the data it holds, we have been encouraged by a Core team member to share this work with the governance forum.

Summary

We are r3gen Finance, a team of specialist web3 financial service operators who have worked for major ecosystem participants including Aave, Index Coop, Squid, Inverse Finance, and Treasure DAO.

Gitcoin is the leader for funding public goods in web3. In our efforts to give back to the space, support value aligned organisation and support ecosystem transparency, we have carried out an accounting review for the DAO. The results are displayed below:

Key takeaways

- Stable Coin runway is relatively low for an organisation of Gitcoin’s size. Whilst GTC reserves are healthy, price movement driven by GTC sales to support stable reserves could risk rapidly undermining Gitcoin Financial sustainability.

- Organisational expenditure is high. Expenditure has grown over recent years and we see examples of Working Unit budgetary overspend. We estimate that total spending in 2023 is expected to be 40% higher than 2022.

- Without robust revenue modelling and forecasting it is challenging to predict a breakeven point for the organisation and thus assess what a sustainable level of organisational spend should be for Gitcoin over the short-medium term.

Key Financial Insights

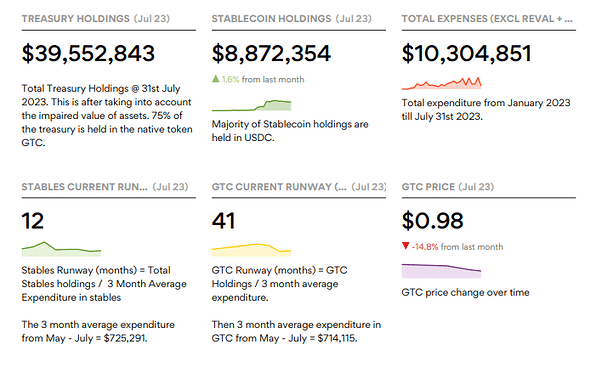

Treasury Holdings

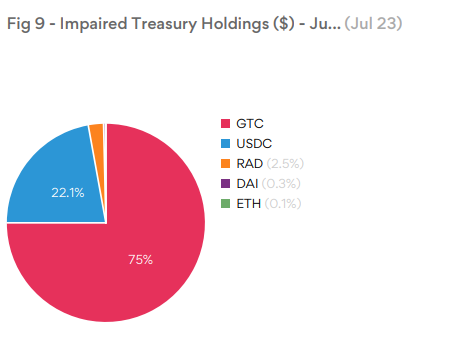

The Gitcoin Treasury is held using the historical cost convention less any impairments to date. This is an interpretation of the IFRS standards applied to the crypto economy. Under the standards the entity should look for any indicators of impairment and revalue the asset accordingly. We have made the assumption that all price impacts should trigger a revaluation. Assets are impaired to their lowest valuation.

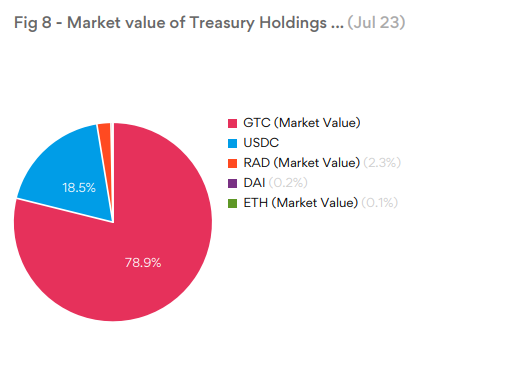

However, since this is not a good indication of the current state of the organisation we have shown two asset holding schedules. One which represents the impaired asset holding (Fig 9), which is shown on the balance sheet. The other represents the market value of the total treasury holdings (Fig 8) currently held across all treasure wallets.

- The EOM Market value of the treasury totalled $47.20M.

- Treasury holdings at the end of July 2023 totalled $39.55M (impaired value), with 75% of the treasury in the native token GTC, the remainder of the treasury is largely held in stablecoins totaling $8.87M.

- Treasury holdings have fluctuated significantly over time, a result of the high proportion of the Treasury held inGTC holdings. This may expose Gitcoin to financial vulnerability in the event of a significant devaluation of GTC. Consideration may be made surrounding how best to diversify the Gitcoin Treasury in a structured manner to prevent the risk of a rushed diversification process if stablecoin runway were to deplete at current assumed rates.

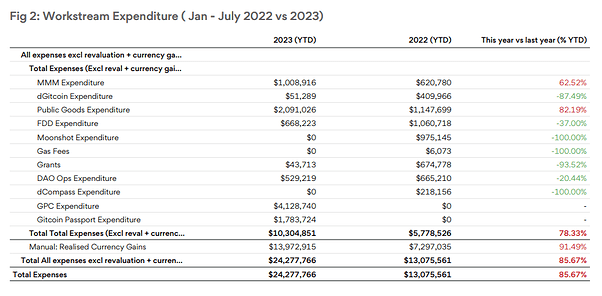

Expenditure (January 2023 - July 2023)

We did not have access to individual workstream spending on a line by line basis and so have grouped outflows into workgroup specific flows to capture spending and trends across the various teams within the organisation. The below figures represent total outflows from workstream owned wallets collected from the data made available to us.

The majority of Gitcoin’s expenditure is related to human capital costs across the various work streams. The analysis in the report aims to review the expenditure incurred in 2022 and provide insights into spending trends observed in 2023 YTD. Expenditure is accounted for at the point of transaction.

- Total expenditure in 2022 amounted to $12.53M.

- The average monthly expenditure in 2022 was $1.04M. 2023 has seen a 41% increase, with average expenditure as at the end of July totalling $1.47m.

- At the current assumed average monthly expenditure, the projected expenditure for 2023 is expected to be approximately $17.64m.

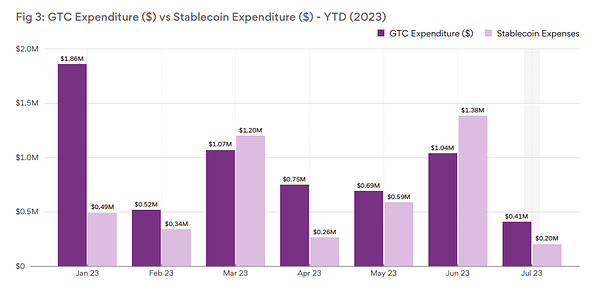

Stablecoin vs GTC Expenditure

- In 2023 GTC expenditure accounted for 59% of the total spend with a current total of $6.34m at the end of July.

- In 2023 stablecoin expenditure accounts for 40% of the spend with a current total of $4.37m at the end of July.

- The other 1% is covered by a minority of payments in ETH.

- Attention should be paid to the proportion of spend made in stables (40%), compared to the treasury holdings in stables (18.5%) and the impact this may have on the organizations financial position.

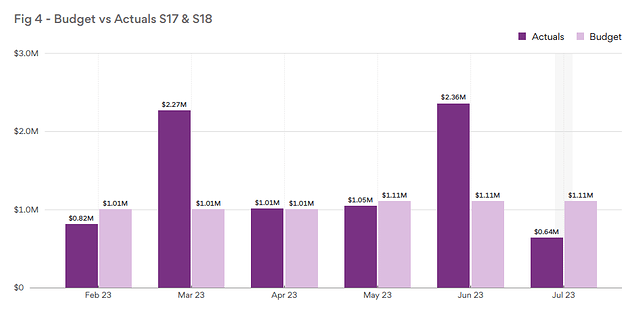

Budget vs actuals - S17 (Feb - April) & S18 (May - July)

The above graph outlines the budget vs actual expenditure for S17 & S18 which cover the periods from February to April 30th 2023 and May till July 31st 2023 respectively. The budget figures have been collated from relevant forum posts shown below.

S17 Budget Forum Posts:

S18 Budget Forum Posts:

S17 Summary

- The total proposed budget for S17 amounted to $3.01m, with the overall expenditure coming in 36% higher with an overspend of $1.08m.

- The largest variance between the budget vs actual expenditure was observed in the Gitcoin passport workstream, with an overspend of $479k.

- Six out of seven workstreams exceeded their respective budgets.

S18 Summary

- The total proposed budget for S18 amounted to $3.36m, with the overall expenditure coming in 20% higher with an overspend of $687k.

- The largest variance between the budget vs actual expenditure was observed in the Public Goods workstream, with expenditure exceeding budget by $410k.

- MMM was the only workstream under budget by $115k.

- Both S17 and S18 evidence expenditure exceeding budgets; a review of budgeting and forecasting mechanics may be beneficial, allowing the organisation to accurately forecast and manage capital and spend moving forward.

Runway

GTC Runway

At the end of July, the total GTC held in the treasury had a value of $29,667,361 at a GTC price of $0.98 per token. Considering this information, three scenarios can be analysed based on the average GTC monthly expenditure across May till July, which was $714,115.

- GTC Current Runway @ 31st July price = 3 years and 5 months until December 2026

- GTC Runway @ 50% price drop = 1 year and 8 month until March 2025

- GTC Runway @ 90% price drop = 4 months until December 2023

Stablecoin Runway

At the end of July, the total Stablecoins held in the treasury had a value of $8,872,354. Considering this information, three scenarios can be analysed based on Gitcoin’s current Stablecoin holdings.

Stablecoin Runway:

- 3 month Average Expenditure

- 12 months till July 2024, with average expenditure being $725,291.

- 50% decrease in 3 month Average Expenditure

- 24 months till July 2025, with average expenditure being $362,645.

- 50% increase in 3 month Average Expenditure

- 8 months till February 2024, with average expenditure being $1,089,936.

Revenue

Currently, Gitcoin operates without generating any significant revenue. A revenue modelling and forecasting exercise may be beneficial to charting a sustainable course for the organisation. This exercise would enable the identification of key metrics, such as the breakeven juncture, where incoming revenue matches expenditure. Insights into key metrics such as this would likely be hugely insightful and support the DAO in its long-term financial planning.

Close

Our hope is the financial insights delivered in this report will drive conversations around: approach to treasury diversification, revenue modelling and long term budget planning. Clarity on these topics will help Gitcoin to ensure long-term financial viability, ensuring they can remain a prominent figure in the Web3 space, whilst setting an example for other similar organisations. Gitcoin is a leader in the space and we would like to see this organisation grow and prosper for decades to come.