tl;dr

- Interop funding is a coordination challenge first: Capital clustered around analytics and visibility, showing the ecosystem needs legibility before committing to execution-heavy infrastructure.

- QF excels at discovery, not deep infra: Quadratic Funding reliably surfaced mid-stage, user-facing tools but underperformed for standards, OIF tooling gaps, and invisible coordination layers.

- Standards attract conviction, not volume: Fewer projects aligned to shared interop standards still drew meaningful funding, signaling high leverage but slower adoption dynamics.

- Intents are emerging, not yet compounding: Interest in intent-based architectures is clear, but funding reflects exploratory pilots rather than production-ready systems.

- A pipeline gap persists: Strong analytics and sensemaking exist, but mechanisms to translate insights into deployable cross-chain coordination infra remain weak.

- Use differentiated funding tracks: Keep QF for discovery, add rolling $5k–$15k microgrants for OIF pilots, and fund long-horizon infra via RFPs or expert-calibrated retro funding.

- Operate the domain continuously: Start funder partnerships earlier, sustain narrative and data between rounds, and align metrics to mechanisms so capital and learning compound across cycles.

Context & Objectives

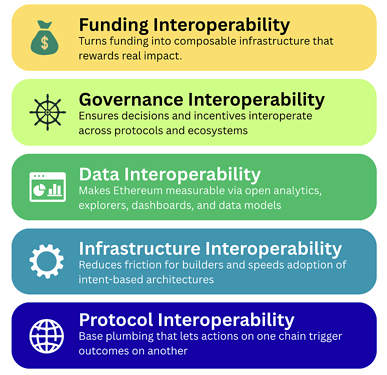

The Interop Standards, Infrastructure & Analytics domain was established to address a growing coordination risk in Ethereum’s multi-chain evolution. As rollups, L2s, and application-specific chains proliferate, interoperability, shared standards, and credible data become essential public goods. This round existed to fund the open infrastructure, analytics, and early pilots needed to make interoperability practical and measurable, with a specific focus on supporting adoption of the Open Intents Framework (OIF) as a foundational standard. Success was defined by surfacing high-alignment builders, generating clear signals on where interoperability gaps exist, and creating an evidence base that could guide larger, follow-on investments beyond a single funding cycle.

Round Design and Mechanism

The Interop Standards, Infrastructure & Analytics round was run as a curated Quadratic Funding (QF) round during GG24 to combine broad community signal with targeted domain stewardship. QF was chosen to surface projects with genuine, distributed demand across the Ethereum ecosystem, rather than concentrating influence among a small set of large donors. This was especially important for interoperability and open data work, where impact is ecosystem-wide but often under-monetized and under-recognized by traditional funding models.

Projects were required to demonstrate proven activity, open-source outputs, and clear alignment with Ethereum interoperability standards, shared data infrastructure, analytics, or adoption of the Open Intents Framework (OIF). Speculative concepts, general-purpose applications, or unrelated tooling were excluded to ensure the round prioritized deployable infrastructure and measurable progress over narratives or future promises.

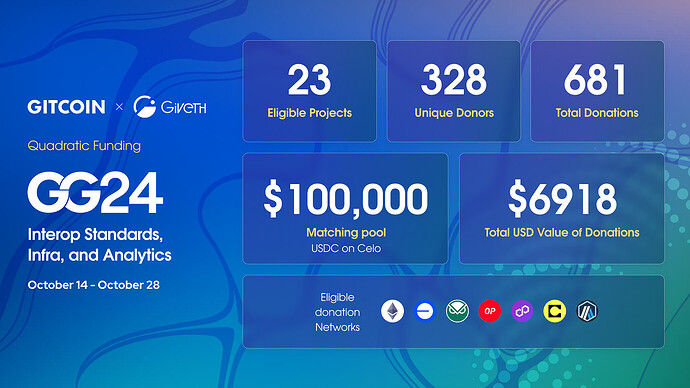

The round was operated in partnership with Giveth, using its QF infrastructure and cluster-based sybil resistance, with Celo supporting the matching pool. This setup balanced accessibility for donors across multiple networks with safeguards to preserve signal quality. The timing of the round reflected a broader ecosystem inflection point: OIF is reaching closer to production readiness, multi-chain complexity is accelerating, and funders need clearer signals on where early interoperability investments could unlock the highest leverage. The design aimed to meet that moment by pairing community discovery with domain-informed curation, making interoperability fundable, visible, and actionable at the right time.

Participation Snapshot

Click here for a deep dive into the five layers of interoperability and the grantees building those layers today. See this post by @karmaticacid for details on the quadratic funding results hosted on the Giveth platform.

Funding Distribution & Thematic Insights

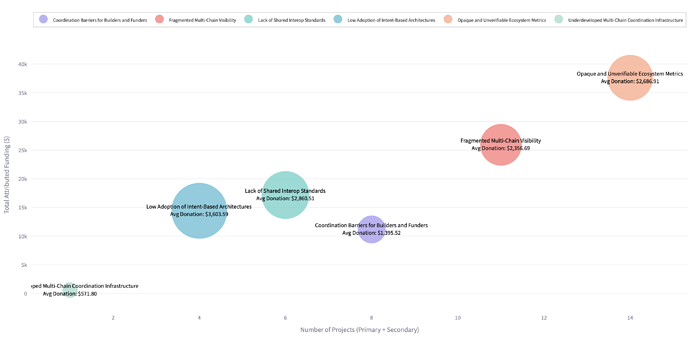

This round was structured around a set of interoperability problems spanning standards, shared infrastructure, and analytics/visibility layers. Each project was mapped to one Primary Problem Alignment, representing the core bottleneck it aims to address, and one Secondary Problem Alignment, capturing meaningful but adjacent contributions. For allocation analysis, primary alignments account for the majority of a project’s attributed funding, while secondary alignments reflect spillover value across the interop stack. This approach allows capital to be read not just at the project level, but as signals across systemic gaps in Ethereum’s multi-chain future.

Each bubble represents a problem area, positioned by the number of primary and secondary aligned projects (horizontal axis) and total attributed funding (vertical axis). The bubble size indicates the average funding per project—larger bubbles mean higher average funding.

What the funding data shows

-

Strong concentration around visibility and analytics layers

Problems related to Fragmented Multi-Chain Visibility and Opaque & Unverifiable Ecosystem Metrics attracted the highest combined funding and broad participation. Projects such as growthepie, Blockscout, and Open Source Observer exemplify this cluster, indicating donor confidence in open analytics and shared measurement as coordination primitives. -

Shared standards drew fewer projects, but high conviction capital

Funding aligned to Lack of Shared Interop Standards flowed to a smaller set of teams, often with deep technical scope. Efforts connected to EAS, Hypercerts, and standards-adjacent tooling received meaningful allocations despite lower project counts, suggesting recognition of standards as high-leverage but slower-moving infrastructure. -

Core coordination infrastructure remains underrepresented

Areas such as Underdeveloped Multi-Chain Coordination Infrastructure showed lower total funding relative to their strategic importance. While projects like Shinobi Cash and intent-aligned pilots appeared, the data suggests fewer mature teams and higher execution risk compared to analytics-focused work. -

Intent-based architectures surfaced as an emerging signal, not a funding peak

Low Adoption of Intent-Based Architectures registered clear interest with projects like Regen Claims Engine from Regen Network and Silvi but comparatively modest overall capital flow. This reflects the ecosystem’s early-stage posture on intents, with exploratory tooling and pilots outpacing production-ready infrastructure.

So what this reveals

-

Donors are prioritizing legibility before optimization

Capital flowed first to tools that make the ecosystem observable, comparable, and analyzable. Before coordinating execution across chains, the crowd signaled a need to clearly see activity, risks, and outcomes. -

Standards are valued, but require complementary mechanisms

While donors recognize the importance of shared interop standards, QF alone may not fully surface or sustain this work. Targeted RFPs, stewarded working groups, or retroactive mechanisms may be better suited to accelerate adoption. -

A pipeline gap exists between analytics and execution infra

The imbalance between well-funded visibility layers and underfunded coordination infrastructure points to a missing middle. Bridging analytics into deployable, cross-chain coordination tools remains a key opportunity. -

Future rounds can be more intentional about sequencing

With observability foundations better funded, subsequent rounds can additionally build capital flows toward execution layers, pilots, and standards adoption, building on the clarity created by this funding cycle.

Impact to Watch Out For

Unified Multi-Chain Visibility & Open Analytics

Projects here are improving how Ethereum’s L1–L2 activity is measured, compared, and explored through open data.

- Growthepie: Expand cross-chain app and wallet metrics, add real-time data and AI-assisted exploration, and publish a new ecosystem-wide research report.

- Blockscout: Roll out a Universal Bridge Indexer, L2 interop views, expanded APIs, and AI-assisted data discovery for cross-chain activity.

- Superchain Eco: Extend the Superchain Index with more OP Stack chains, publish new dashboards, and release research on Open Intents and L2 coordination.

- Open Source Observer: Public, forkable dashboards to support evidence-based governance and funding decisions.

- EAS Pulse: Expand multi-chain coverage and deliver richer filtering and analytics for attestation usage.

Interoperable Impact, ReFi & Funding Data

These efforts focus on making impact and funding data verifiable, composable, and reusable across chains.

- The Regen Atlas: Ship real-time cross-chain ReFi analytics and a public API for standardized green asset and organization data.

- CARBON Copy: Launch Ethereum-focused API endpoints, expand impact datasets, and publish a ReFi ecosystem overview for Ethereum.

- GainForest: Deploy open analytics, expand to Ethereum L2s, and standardize proof-of-impact data using attestations.

- Silvi (Treekipedia): Release ecological schemas, large normalized datasets, a public API, and run an Open Intents pilot for automated funding.

- Regen Claims Engine ↔ Ethereum Intents Bridge: Publish open claim schemas, APIs, and a live intent-to-attestation prototype linking claims, attestations, and impact assets.

Attestations, Credentials & Trust Infrastructure

These milestones strengthen Ethereum’s shared trust layer for credentials and verifiable data.

- Ethereum Attestation Service (EAS): Simplify developer onboarding through a major docs migration, improved explorer UX, and early work toward a developer studio.

- Unlock Protocol (EAS Certification Boost): Ship EAS-enabled contracts, UIs, and tests for creating and verifying onchain certifications.

- EAS Pulse: Deeper analytics and featured real-world attestation use cases.

Protocol, Privacy & Intent-Native Infrastructure

Projects here advance intent-based execution, privacy, and new interoperable primitives.

- Shinobi Cash: Launch an Open Intents–enabled cross-chain privacy pool on Ethereum L2s and publish audited contracts and SDKs.

- Shutter Network: Publish a research paper and reference design for threshold-encrypted intent ordering within an intent-centric Ethereum stack.

- Astral: Deliver open-source location proof libraries, a public testnet, SDKs, and the Location Protocol v1.0 aligned with Open Intents.

Open Web, Governance & Coordination Primitives

These efforts strengthen how Ethereum coordinates standards, content, and proposals.

- WebHash: Upgrade ENS/IPFS gateway infrastructure, publish open dashboards, and run an Open Intents–aligned decentralized web pilot.

- Eth.limo: Continue scaling ENS/IPFS gateways, improve resiliency and verification, and introduce real-time ENS site monitoring.

- DIP.box: Launch a public EIP aggregation platform with open ingestion, wallet authentication, and a foundational EIP state machine.

- DAOstar (OpenGrants): Onboard more funding partners, add project performance metrics, and expand grant analytics and governance research.

Evidence-Led Funding & Program Design

These milestones improve how evidence informs funding and coordination.

- Beacon Labs (MUSE): Integrate impact assets, analytics, and evaluation tooling to turn research into reusable evidence for funding decisions.

- Atlantis: Extend ImpactIntent schemas, upgrade cross-chain contracts, and launch explorers and dashboards for interoperable impact certificates.

Learning & Reflections

What worked well

Quadratic Funding performed as expected in surfacing socially validated, well-understood clusters of work. It reliably highlighted mid-stage, user-facing interoperability efforts such as dashboards, explorers, analytics, and SDKs, where community demand was already visible. Strong alignment between Gitcoin and Giveth on QF mechanics reduced operational friction and allowed the domain to focus on curation, narrative framing, and builder support rather than mechanism troubleshooting.

What didn’t work as well

QF alone was insufficient for reaching deeper, less visible layers of interoperability. Critical needs around OIF tooling gaps, solver infrastructure, measurement systems, and early pilots remained harder to surface because they lack obvious end users or donor familiarity. As a result, some of the highest-leverage work risks being systematically underfunded if the domain relies on QF as the primary allocation mechanism.

Process insights for future operators

If operating the domain again, the single most important change would be to build and secure ecosystem partnerships well before the round. This requires a sustained ongoing effort that clearly articulates the domain’s role, consistently spotlights high-alignment builders, and demonstrates data-driven impact to both developers and funders. Early partner alignment would enable the domain to maintain rolling capital, such as a standing microgrant pool, to accelerate pilots and unblock OIF adoption work outside fixed QF windows.

Mechanism design reflections

Going forward, the domain would benefit from evolving into a multi-pipeline model: a narrow, curated QF pipeline for discovery and demand validation; a pilot acceleration pipeline using $5k–$15k microgrants for real-world OIF experimentation; and a long-horizon infrastructure pipeline using continuous RFPs or expert-calibrated retro funding to address critical but invisible gaps. This mix better matches the layered nature of interoperability work.

Recommendations and Next Steps

- Use QF with targeted focus: Keep Quadratic Funding as a discovery mechanism to surface socially validated, mid-stage interop tools, not as the sole allocation method.

- Add a rolling pilot track: Introduce standing $5k–$15k microgrants for real-world Open Intents pilots to accelerate experimentation outside fixed round windows.

- Fund long-horizon infrastructure separately: Address critical but less visible OIF gaps through continuous RFPs or expert-calibrated allocations rather than QF.

- Start funder engagement earlier: Treat co-funding outreach as a core workstream, beginning months before the round to secure aligned partners and flexible capital.

- Sustain the domain narrative: Maintain ongoing sensemaking that highlights builder progress and data-driven impact between rounds.

- Align metrics with mechanisms: Use adoption and participation signals for QF, and milestone delivery and integration depth for pilots and infrastructure.

- Design for continuity: Operate the domain as an ongoing program so learnings and capital compound across cycles rather than resetting each round.

Acknowledgements

This inaugural Interop Standards, Infrastructure & Analytics round would not have been feasible without strong ecosystem collaboration. The Gitcoin team (@Sov, @LuukDAO, @onworks) played a critical role in exploring funding pathways, supporting round design, and amplifying outreach. Giveth’s partnership (@karmaticacid, @yegor, Ashley) was instrumental in executing the round and enabling community-driven allocation, while Celo’s timely co-funding provided crucial support that helped anchor the matching pool.

Looking ahead, this round marks a starting point rather than a conclusion. There is clear opportunity to build on this foundation by deepening collaboration with funders, ecosystem partners, and Open Intents Framework stakeholders to expand the domain’s reach and sustain interoperability work over time.

Related:

- Sensemaking Documentation:

- Domain Definition:

- Mapping Interop Landscape: