TL;DR

Avantgarde Finance proposes to further support the ongoing efforts to get Gitcoin profitable by activating idle assets in the Gitcoin DAO treasury to earn yield, grow the reserves, and improve overall financial sustainability.

As part of this proposal, Avantgarde in collaboration with MYSO will manage two different strategies on behalf of the Gitcoin DAO and its treasury:

-

USDC Strategy: Deploying $5m USDC to a DeFi Yield Vault to earn above mainnet yield.

-

GTC Strategy: Run an on-chain covered call strategy on GTC to earn yield without selling at depressed market prices, starting with two smaller $250k tranches.

The goal of each strategy is to earn yield, and to earn yield only. There are no intentions to sell/swap any of these tokens, merely to grow the size of the pie.

Details below.

Introduction

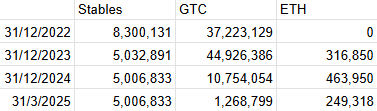

Most so-called “altcoins” have been on a downward trend and struggled to maintain positive price momentum over time, hurting native-heavy treasuries along the way. Despite plenty of organisational achievements, GTC has unfortunately fared no better. The Gitcoin community did well to swap $5m worth of GTC into USDC through proposal SGTM 001 back in May of last year, and following the passing of SGTM 002, Avantgarde and Gitcoin are now building on these efforts together to address the situation further.

SGTM 002 introduced a much-needed diversification and yield-generation strategy for the Matching Pool (MP) that will significantly improve capital efficiency, extend the runway by earning yield on currently idle assets, and diversify into yield-bearing stablecoins to mitigate overall portfolio volatility and impact of trending price declines in the native token. A risk-robust multisig structure has also been agreed on and approved through proposal SGTM 003, providing the necessary flexibility to execute said strategy in a satisfactory manner while providing ample protection for the DAOs assets.

While this has been long overdue, this strategic partnership between Gitcoin and Avantgarde not only signals the community’s readiness to address the issue of financial sustainability wholeheartedly, but also provides the means to do so in line with the community’s risk appetite. Ongoing efforts to get Gitcoin profitable could be further supported by applying the same best practices to the Gitcoin treasury as we’re now doing to the MP to improve financial sustainability.

As noted elsewhere,

Hence, this proposal outlines a path to strategically activate Gitcoin DAO’s idle treasury assets with the following key goals in mind:

- Offset the opportunity cost of not having idle treasury assets generate meaningful yield.

- Earn yield on the idle USDC

- Earn yield on a portion of the idle GTC without selling at current depressed market prices.

This proposal thus contains two strategies, one for each of the following assets: USDC and GTC. Details on each strategy follows in the same order below.

Yield Generation

1. USDC Strategy (managed by Avantgarde)

A by-product of thoughtful diversification of the treasury is the potential for generating revenues for the DAO. In addition to reducing treasury volatility, allocations in stablecoins (but also ETH) can be put to work in DeFi to generate yield that will support DAO sustainability. We consider deploying the treasury’s idle USDC very much a necessary step for the Gitcoin community to help support the DAO’s sustainability and longevity.

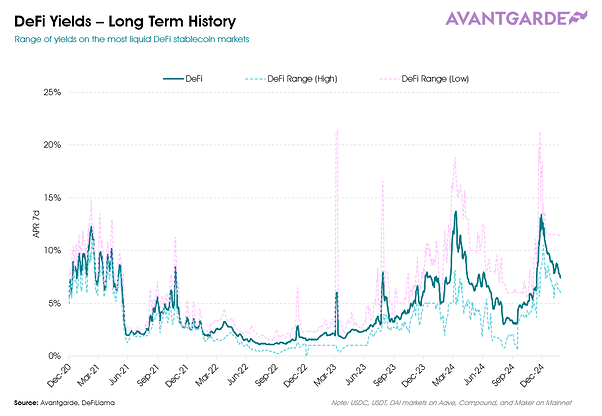

On-chain rates in DeFi vary by collateral, across protocols, and through time (block by block). Rates are currently between 5% and 10% for the most liquid stablecoins markets like AAVE V3 and Compound. As such, they provide a useful baseline to illustrate the potential revenue that can be generated for the DAO.

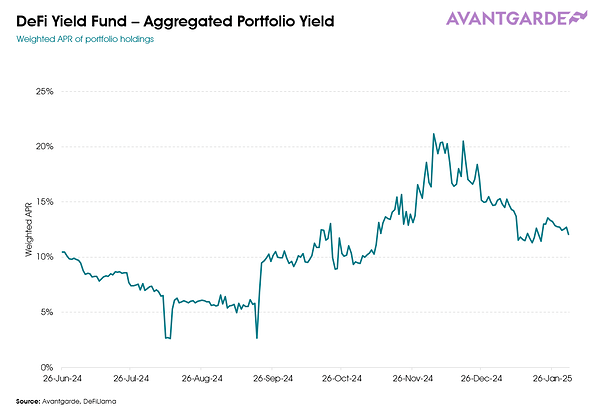

The Avantgarde DeFi Yield Vault provides diversified exposure to on-chain stablecoin yield within DeFi via tokens pegged to USD. The strategy takes an active, conservative approach, focused on diversification and larger battle tested protocols to manage capacity and smart contract risk. The strategy is run fully on-chain via an Enzyme vault. For reference, Avantgarde has been running the strategy in a regulated and permissioned vehicle offered to institutional clients since June 2024, yielding ~10% as of mid-March 2025.

The team has experience managing the strategy through a number of environments, including the low yield environment in second half of 2024, until the volatility of the US election, and the subsequent regime change and run up in on-chain yields. Hence, we are comfortable with this approach and believe it to be in line with the risk capacity of the Gitcoin community. We recognise that change is the only constant within DeFi and are prepared to adapt the strategy as the opportunity set evolves, whilst staying true to the risk-conservative philosophy.

As discussed above, the fully on-chain DeFi Yield Vault will replicate the same conservative stablecoin strategy followed in the regulated vehicle, but in a format tailored for DAOs (fully on-chain and non-custodial). As such, we propose that the Gitcoin DAO deposits its idle $5m USDC into the Avantgarde DeFi Yield Vault on Enzyme to earn yield.

Avantgarde DeFi Yield Vault

An actively managed, non-custodial and permissioned vault for whitelisted DAO treasuries to access on-chain yields within DeFi, focusing on the largest, most battle-tested protocols.

-

Currently yielding around 10% (annualized), realistic average expectations 7-15% APY.

-

Aims to be diversified across stablecoins, protocols, and underlying yield sources while balancing the level of yield with risk and capacity.

-

Competitive fees, 0.5% protocol fee and 7.5% performance fee; calculated and paid out automatically by the vault.

-

Reporting is on-chain provable and auditable 24/7 via the Enzyme UI, and Avantgarde will provide additional formal reporting on the performance of assets on a quarterly basis, and can respond to interim questions as the community deems appropriate.

-

To protect participating DAOs from scrutiny, regulatory or otherwise, ownership of the vault is held by Avantgarde Treasury and controlled via a 3/5 multisig made up of two signers from Avantgarde Treasury, two signers from Avantgarde Finance, and one from Enzyme.

-

Avantgarde Finance acts as the delegated manager with certain smart contract roles & permissions (ensuring that Avantgarde can not misappropriate the funds). However, the vault will remain open to other potential DAOs interested in utilising the vault for its treasury in a similar manner (this would require Avantgarde to whitelist them as a permissioned depositor). Gitcoin would benefit from the economies of scale as gas costs incurred from running the vault would be spread amongst a wider depositor base.

-

The DAO can withdraw from the vault by notifying Avantgarde (the Delegates included as signers on the execution multisig (PGov, Tane and SEEDGov) could technically also withdraw if for whatever reason needed). Please note that the DeFi Yield Vault may hold positions that accrue rewards on third party protocols which ideally should be claimed prior to a withdrawal. Hence, while we could withdraw instantly and receive the deposit in the tokens held in the vault, the optimal way would be for the DAO to communicate its desire to withdraw in advance to facilitate liquidity management within the vault and ensure a seamless withdrawal process.

2. GTC Strategy (managed by MYSO)

Looking at the GTC price chart over the last 2 years, we can see that there’s been plenty of volatility and sideways chopping in between spikes.

(source: Coingecko)

While this is not an ideal picture for token holders, it presents profitable opportunities for the DAO to generate revenue off of this volatility on its idle GTC assets using structured covered call options. We explain how this strategy works in detail further below and provide examples to showcase its potential. The yields achievable through said strategy can be significant and provide a meaningful boost to the Gitcoin treasury, which could be used to offset operational expenses and/or mitigate some of the price decline.

What’s a Covered Call?

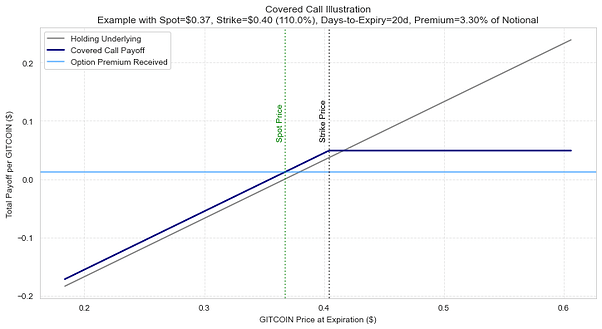

A covered call is an option strategy that uses, as in this case, GTC as collateral to sell call options to institutional trading firms. The call option gives the trading firm the right—but not the obligation—to buy the committed GTC tokens at a pre-agreed strike price. Institutional trading firms are willing to pay for these call options to capitalize on volatility, whereby the seller (i.e., the DAO) receives an upfront, USDC-denominated premium immediately upon execution.

Note, these trading firms are not taking any directional view on the asset but rather their motivation is to carry out so-called “gamma scalping”, which involves hedging the acquired option to “buy low” and “sell high” dynamically, making profits from price swings.

Since the intention is not to sell any GTC;

-

strike prices will be set far out from current GTC price so that the likelihood of reaching it is minimal.

-

The aim is to continuously roll over this strategy to earn yield for the DAO.

Key Benefits of a GTC Covered Call:

- Upfront yield generation – Yield is earned immediately upon match via MYSO v3, with no need to wait until expiry.

- Stablecoin-denominated yield – Yield is paid in stablecoins, allowing for automatic treasury diversification without selling GTC.

- Efficient capital utilization – Large GTC amounts (up to $1 million notional, potentially more) can be deployed, unlike lending or DEX LPing, where only a fraction of capital is utilized.

- No outright selling of GTC – This strategy minimizes market impact and selling pressure compared to direct GTC sales.

- Selective divestment at higher prices – GTC is retained unless the strike price is reached, ensuring that if exercised, it is automatically swapped into stablecoins at favorable prices.

- Lower downside risk vs. holding – Compared to simply holding GTC, a covered call provides downside protection via the premium earned, which is paid upfront regardless of whether the option expires in the money.

Proposed Covered Call Strategy

We propose a bespoke covered call strategy with:

- Notional: $500,000 GTC (2 x $250k tranches)

- Strike prices: Between 120-150% of the current spot price

- Expiry: 14-60 days

- Strike selection: Based on historical conversion probabilities

- Initial target upfront premium: ~$5,000 upfront for first 30 days and $250k tranche

- General target premium: ~2% of notional every 30 days (i.e., 24% in annualised terms)

*Note, effective yields may vary depending on GTC price and volatility.

The strategy aims to minimize conversion probabilities by estimating future returns based on a random forest regressor and set strikes accordingly. The strategy can be continuously rolled over as long as no conversion occurs.

To ensure optimal parameter selection, we conducted some backtesting on GTC’s price history and ran some regressor models to predict future realized returns, which we then used to inform strike prices. See here for more details on the backtesting. We will continue to run these analyses on a rolling basis to make sure parameters are adapted to changing market conditions.

Mechanics of the GTC Yield Strategy

1. Strike and Expiry Selection

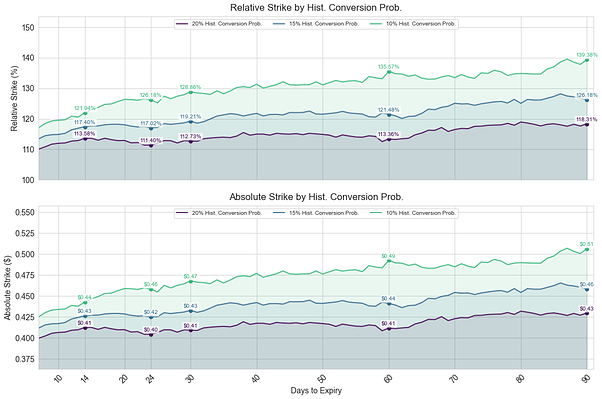

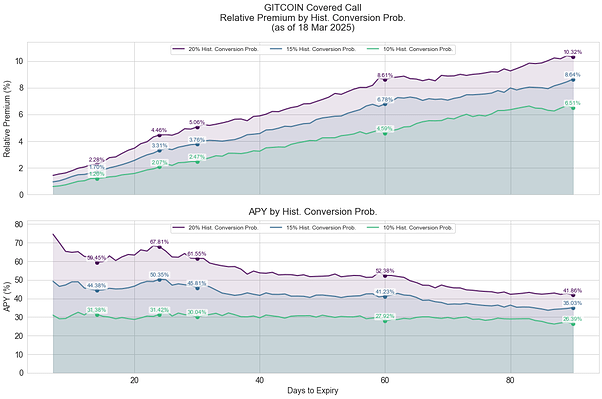

- Strikes will be set based on historical GTC return bounds, ensuring that the probability of conversion remains low (see next section and plot below).

- Call strikes will be positioned where GTC’s price has not exceeded with a 90%, 95%, and 99% probability over historical timeframes.

- This ensures that, in the rare event of option conversion, the strike price remains well above the current market price.

2. Yield Calculation

Covered call strike and days-to-expiry selections are optimized for annualized returns while maintaining a minimal conversion probability. Below, we have plotted how relative premiums change for different timespans (days-to-expiry) and given a target conversion probabilities—for example, 10%. For instance, when writing a covered call with 30 days to expiry and aiming to maintain a maximum 10% conversion probability, the corresponding relative strike price that meets this criterion would be 128%. This means that price appreciation of up to 28% within the next 30 days is maintained, while any returns above that level are capped.

Using these strikes, one can then calculate the indicative relative option premiums for writing calls at those strike levels across varying days-to-expiry combinations (see plot below). For example, a covered call with 30 days to expiry and a 128% strike would yield a ~2.4% relative option premium, meaning that writing a call on $500,000 worth of GTC would generate an upfront premium of $12,000 USDC for the GTC treasury. As expected, relative option premiums tend to be lower for strikes with lower conversion probabilities and higher for those with higher conversion probabilities. Additionally, relative option premiums generally increase as the number of days to expiry extends.

In the Unlikely Event of a Conversion and Additional Risk Management

While this strategy aims to keep the probability of conversion low to avoid selling GTC, it cannot be ruled out entirely if we also want to earn some yield. In the event that we do see a major short-term rally beyond what our ongoing assessments suggest and GTC is converted into stablecoins, we can cycle back into GTC efficiently by writing cash-secured put options using the received stablecoin amounts (this can also be combined with yield bearing stablecoins). This approach is commonly referred to as “option wheel”, where one systematically sells covered calls and, if converted, writes puts to repurchase the underlying asset at a lower price. By utilizing put writing, we could:

- Buy back GTC at a predefined price – Writing a put option on the received USDC amount allows us to repurchase GTC at a strike price we determine, ensuring controlled re-entry.

- Continue generating premium – Similar to covered calls, writing puts generates additional yield, meaning the DAO benefits from stablecoin-denominated income while maintaining flexibility in repurchasing GTC.

- Optimize capital efficiency – Instead of holding stablecoins passively, put-writing ensures the capital remains productive, allowing for continuous cycling between GTC and stablecoins based on market conditions.

For execution, the put-writing strategy can be carried analogously to call writing taking into account the DAO’s liquidity and market exposure preferences, with strike prices and expiries structured accordingly. This allows for an efficient re-entering into GTC if needed.

For additional comments on risk management, see this doc.

Implementation and Execution

While the infrastructure setup and implementation of the proposed treasury management strategy will be fully detailed in a follow up on-chain proposal, we outline the implementation from a high level below.

Typically, Avantgarde has used a combination of Safe multisig roles & permissions (via the Zodiac Roles Modifier) for implementing bespoke treasury management strategies, as was recently approved in proposal SGTM 003 for the Matching Pool.

We propose to follow a similar structure for the DAO treasury, as it provides beneficial flexibility to easily withdraw USDC for upcoming ops cost needs from the Foundation as well as fine-tune execution on the GTC strategy, while still protecting the DAOs assets.

The assets to be managed will be sent into a separate Avatar safe (owned by the Gitcoin Governor contract and controlled by the DAO) with certain set permissions so that the manager can only perform specific pre-agreed actions on selected protocols (Enzyme and MYSO). The Manager multisig will be a 2 out of 5 and have Avantgarde, Myso, PGov, Tane and SEEDGov; allowing Avantgarde and Myso to line up and sign on the time-sensitive options transactions with flexibility while still maintaining two layers of security (Avatar safe with permissions + /5 multisig).

USDC Strategy

As mentioned, the USDC will be deposited in a non-custodial fashion from the Avatar safe into the Avantgarde DeFi Yield Vault on Enzyme.

Enzyme is an on-chain and decentralized asset management protocol that has been on mainnet since 2019, and is as such one of the most battle-tested protocols across Ethereum. Enzyme is an open source code base, and the smart contract code for both the Enzyme vaults and the platform’s core protocol can be found on Github. The contracts are fully tested and independently audited; the most recent release (v4) audited by ChainSecurity and OpenZeppelin amongst others, with a current bug bounty of $400’000. The Enzyme App has also been fully audited.

GTC Strategy

Execution of the covered calls will be done through the MYSO v3 protocol, which eliminates the need for institutional trading firms to take custody of Gitcoin tokens or rely on off-chain legal agreements. The entire process is decentralized, secure, and transparent, ensuring maximum returns while retaining full asset control.

MYSO is a DeFi protocol specializing in on-chain structured products, enabling HNWIs, treasuries, and asset managers to generate upfront stablecoin income by writing bespoke covered calls and cash-secured puts on a wide range of ERC-20 tokens. The protocol sources institutional liquidity by partnering with leading trading firms, ensuring competitive pricing and efficient matchmaking for large-sized trades. By enabling trustless, on-chain settlement, it eliminates counterparty risk, allowing users to write options more efficiently.

The protocol consists of two core smart contracts: the Router and the Escrow Implementation Contract. These contracts are publicly available in the official MYSO V3 repository and have been thoroughly audited (see Omniscia Audit Report). Users only need to interact and approve the core Router contract, which manages all token transfers related to option writing, auction creation, bidding, exercising, borrowing, and fund withdrawals.

Reporting

Avantgarde Finance will provide monthly (written) reporting on the strategies’ performance.

Compensation Structure

USDC Strategy

The DeFi Yield Vault comes with a competitive 0.5% protocol fee and 7.5% performance fee; calculated and paid out automatically by the vault.

GTC Strategy

We will charge 15% of fees on any USDC denominated yield we make out of this. The rest will remain with the DAO and can be diverted to the USDC Strategy to complement and grow the USDC reserves.

About Avantgarde

Avantgarde is a licensed and DeFi-native asset management firm that specializes in non-custodial, on-chain strategies and strategic advisory for a range of DAOs, foundations, and crypto natives. The team has been active in DeFi since 2016 with significant experience in DeFi operations, including as co-founders of the on-chain asset management protocol Enzyme.

Leveraging our extensive investment and operational track records from TradFi firms such as Goldman Sachs, Blackrock, and Credo, we help DAOs and foundations to optimise treasury management strategies, improve financial sustainability, and support long-term growth. Some of our past and current clients include Nexus Mutual, Gitcoin, Near, Uniswap and Arbitrum.

About MYSO

MYSO is a DeFi protocol specializing in on-chain structured products, enabling HNWIs, treasuries, and asset managers to generate upfront stablecoin income by writing bespoke covered calls and cash-secured puts on a wide range of ERC-20 tokens. The protocol sources institutional liquidity by partnering with leading trading firms, ensuring competitive pricing and efficient matchmaking for large-sized trades. By enabling trustless, on-chain settlement, it eliminates counterparty risk, allowing users to write options more efficiently.

MYSO has collaborated with numerous treasuries, including Telos, Evmos, DIA, and Across, as well as several HNWIs. The protocol has undergone security audits by Omniscia, Trail of Bits, Statemind, and ChainSecurity and is backed by leading crypto-native investors, including HashKey, Wintermute, GSR, Nexo, Huobi, and CMT.