1. Summary

This proposal recommends allocating $100,000 from Gitcoin DAO’s treasury to Maple Finance’s institutional lending pools to earn predictable yield while diversifying away from a heavy GTC exposure.

I’m proposing a phased approach:

- Start with a 3-month commitment via Maple’s Drips rewards program to test the strategy while boosting returns.

- If the DAO is satisfied after that period, we can discuss extending to 6 months (for even higher rewards) and/or increasing the allocation.

2. Abstract

Gitcoin’s treasury today is heavily concentrated in GTC, which makes us vulnerable to market swings and limits our options to sustainably fund grants.

By converting $100,000 into stablecoins and deploying it in Maple Finance’s vetted institutional lending pools (USDC or USDT), we can earn ~6.3–6.6% base APY from overcollateralized loans to KYC’d borrowers like trading firms and market makers.

Committing this capital via Maple’s Drips rewards program for an initial 3-month period adds an average ~3.5% APY in additional rewards. That gives us a total target yield of ~9.8–10.1% while keeping risk manageable.

This “test-and-learn” phase lets us evaluate the strategy with minimal commitment before considering scaling it up.

3. Motivation

Treasury Diversification

Right now, most of our treasury sits in GTC (price risk) or idle stables earning little to nothing. That’s not a sustainable setup for a DAO that needs to keep funding grants and operations for years.

We need better diversification. Maple offers exposure to real credit markets in crypto, not DeFi yield farming games.

Why Maple Finance

Maple is trying to be DeFi’s credit layer for institutions. They’re not doing retail degen loans; they’re providing undercollateralized (but carefully underwritten) credit to trading firms and market makers with real KYC/AML processes.

They use Pool Delegates to approve borrowers and manage risk. These pools survived the 2022 meltdown and have gotten stricter in Maple V2. For us, it’s a way to earn stable, predictable yield by supporting real institutional lending activity on-chain.

Maple’s smart contracts are battle-tested, with multiple audits (Spearbit, Halborn) and an active Immunefi bounty program.

Why Syrup / Drips Rewards

Maple launched the Drips program to reward liquidity providers willing to commit capital for longer terms.

Here’s the simple model:

- No commitment = 1x Drips

- 3-month commitment = 1.5x Drips

- 6-month commitment = 3x Drips

By committing for 3 months initially, we get 50% more Drips rewards than passive LPs. Drips rewards are distributed pro-rata and designed to encourage “sticky” liquidity that’s reliable for Maple’s borrowers.

This isn’t just about chasing APY. It’s about:

- Earning more yield by being a committed LP

- Helping DeFi credit markets become more stable and mature

- Aligning our treasury strategy with Maple’s long-term approach to institutional lending

APY Example for USDC Pool:

- Base APY: 6.3%

- Avg Drips rewards: ~3.5%

- Total expected APY: ~9.8%

By starting with 3 months, we keep risk and liquidity lockup manageable. Later, if the DAO is comfortable, we can increase allocation and go to 6 months for 3x Drips rewards.

Why This Matters for Gitcoin

This approach puts our treasury funds to work in a more productive way, earning yield while supporting credit markets that can help grow the broader crypto ecosystem.

It’s a step toward making our treasury work for us while helping the space mature.

4. Specification

Amount Proposed:

- $100,000 worth of GTC or stablecoins

Deployment Steps:

- Treasury multisig converts GTC to USDC or USDT as needed.

- Deposit stablecoins into chosen Maple Finance Pool.

- Commit this position through Maple’s Drips program for 3 months (1.5x Drips rewards).

- Treasury committee monitors and reports quarterly on:

- Base APY earned

- Drips rewards accrued

- Overall treasury diversification impact

Post-Test Plan:

- After 3 months, the community reviews results.

- DAO can vote to:

- Extend to 6 months (3x Drips rewards).

- Increase allocation.

- Withdraw or reallocate if unsatisfactory.

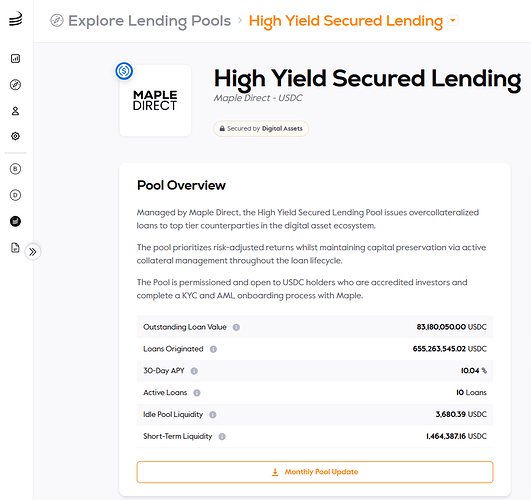

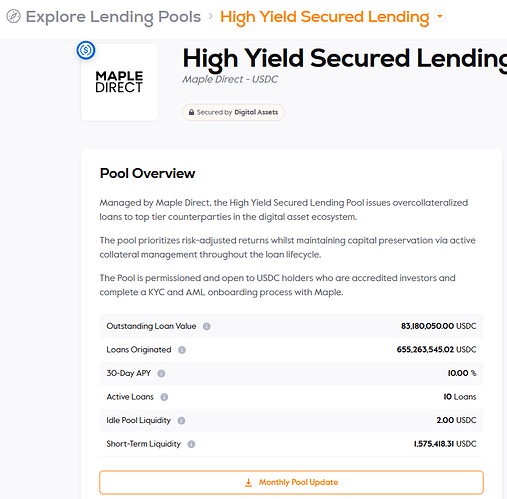

Example Pools:

- USDC Institutional Pool (~6.3% base APY)

- USDT Institutional Pool (~6.6% base APY)

| Pool | Base APY | AVG Drips Rewards APY | Total Expected APY |

|---|---|---|---|

| USDC | 6.3% | ~3.5% | ~9.8% |

| USDT | 6.6% | ~3.5% | ~10.1% |

5. Benefits

- Diversifies away from GTC price volatility

- Predictable yield: ~6.3–6.6% base APY + ~3.5% Drips rewards ≈ ~9.8–10.1% total

- Phased 3-month test reduces lockup risk

- Supports the growth of DeFi’s institutional credit layer

- Aligns with a responsible, sustainable approach to treasury management

- Rewards us for being a reliable LP, not just chasing short-term yield

6. Drawbacks / Risks

- Smart contract risk – mitigated by audits and bounty program

- Counterparty credit risk – borrower defaults possible, but Pool Delegate underwriting and overcollateralization mitigate this

- Liquidity risk – minimum 3-month lock for the test period

- Rewards variability – Drips program terms can change, and rewards depend on pool participation

- Stablecoin risk – limited but present (USDC/USDT exposure)

Security Mitigations

- Maple V2 improvements: better transparency, stricter underwriting

- Multiple formal audits (Spearbit, Halborn)

- Live Immunefi bug bounty

- Pool Delegates can be replaced for poor risk management

7. Voting Options

- Yes – Approve allocating $100,000 in stablecoins from the treasury to Maple Finance lending pools, with an initial 3-month commitment via Maple’s Drips rewards program. After the 3-month period, the DAO will review performance and decide whether to extend to 6 months, increase the allocation, or withdraw.

- No – Do not allocate funds to Maple Finance or participate in the Drips rewards program.

- Abstain – I choose not to vote either way.