Gm Gitcoin community.

After having deployed the SGTM 004 assets in late June, July was the first full month for the deployed strategies outlined above. As a reminder, 5M USDC were deposited into Avantgarde’s DeFi Yield Vault on Enzyme, and another 1.6M GTC were deployed into a covered call strategy on MYSO.

Below we provide the first update and will continue to do so here in this thread on a monthly cadence.

July Update

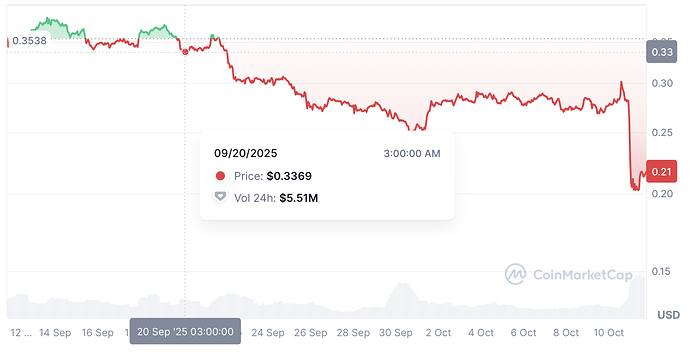

The 1,600,000 GTC deployed into a covered call strategy via MYSO resulted in a premium of 10,072 USDC, which were subsequently deposited into the same DeFi Yield Vault as the 5M USDC. The covered call expires on 21st of September, at which point the strategy can be rolled over, depending on the call’s outcome.

The DeFi Yield Vault saw an increase of 0.47% (or 5.8% annualised) in July. After a muted period for stablecoin yields which saw the supply rates of USDC on Aave struggle below 4%, the environment has shifted in the last week with a significant uptick in risk appetite following positive regulatory news in the US.

The vault has taken the opportunity to reposition into higher yielding opportunities, within the context of its focus on large and battle tested protocols with high capacity. Expected returns have increased, with a portion of the portfolio fixed at 10% until September, and an increased allocation to USDC lending on Morpho, which is currently yielding 9%.