Per impact.gitcoin.co, the Gross Marketplace Value of Gitcoin sits at $50m*

I would like to offer some thoughts on how the DAO might scale that $50m GMV 10x up to $500m GMV.

Before I get into that, I’d like to tell you about a handful of hard fought lessons for me. I’ve gathered these over the last few years and have conveniently summarized for you in less than one page!

-

Because we’ve listened to this recent interview with Vitalik we know that the public goods funding problem can be broken down into (1) funding sources + (2) fund distribution mechanisms. These two sides of the equation need to grow in lockstep together.

-

Because we’ve read @meglister 's many fantastic updates, including Grants Stack Roadmap Updates 2023 and we’ve also read Systematic Exploration of the Coordination Design Space in Jan 23 we know that Gitcoin has a strongly articulated vision on the “fund distribution mechanisms” side of the equation. Quadratic Funding got us started, and we continue to innovate there, but it’s not the end-all-be-all mechanism for all of public goods. We’re building a swiss army knife of fund distribution mechanisms - Quadratic Funding, Direct Grants, + TBD but more details

.

.- Each of these 3 products can be thought of as fund distribution mechanisms.

- Allo is a suite of fund distribution mechanisms targeted at developers.

- Grants Stack is a suite of fund distribution mechanisms targeted at Grants ecosystems.

- Passport is a fund distribution mechanism for the very hard but very valuable problem of sybil resistance.

- Each of these 3 products can be thought of as fund distribution mechanisms.

-

Because we we’ve read Where does the Gitcoin Grants Matching Pool Money Come From? from Nov 21 we know that we’ve raised money from sponsorships, NFT sales, and sometimes donations.

-

Because we’ve read my post Scaling Funding for Blockchain-era Public Goods from Jan 22 and Public Goods funding - The Race to the Bottom from Kyle in the summer of 23 , we know that we should prioritize legitimate, recurring, deep wells of public goods funding. So far we’ve not yet found & tapped something that meets those criteria. Sometimes the wells of funding we have tapped have been deep/legimate, they’ve not often been recurring.

-

Because we’ve been following the ecosystem this summer, we know that Optimism and Protocol Guild are both on a tear lately. The Protocol Guild (a self curated registry of ETH core protocol developers) has regularly been pulling in $1m+ sponsorships (total > $10m in the last 18 months ) and even get a TradFi ETF to donate 10% of their fees to them. Optimism (a Layer 2 that uses Retroactive Public Goods Funding to fund it’s public goods) is using revenue from sequencer fees to fund Retroactive Public Goods to the tune of $20m/quarter. Another interesting entrant is Octant, which is using Golem Foundations massive treasury to stake + return the funds to public goods to the tune of $10m/yr+.

-

Because we practice practical pluralism we celebrate these successes… We love to see public goods get funded! We are proud to be side by side in the ecosystem with these deeply legitimate projects + helping to serve many of the same people they serve, but with different mechanisms. At the same time, these data points prove to us that finding recurring/legitimate/deep wells of funding can be done, even in a bear market and so they give us hope that we will too find a solution! Also, how we add value to these projects by making Allo good enough that it’ll help them?

-

Because we’ve read Vitaliks post on where decentralization matters, we know that decentralization matters for (1) democratic decision making (2) censorship resistance (3) credible neutrality. Because public goods funding requires (1) democratic decision making + (2) credible neutrality, we can take solace that the 24 month odyssey to rewrite the web2 products into decentralized protocols was worth it. And that any project that wants to compete with us will have to make more effective investments in smart contract engineering, protocol design, and dapp design as well.

Ok with those hard fought lessons out of the way… how do we scale 10x from here?

We can (and will) keep doing things that don’t scale. Or only scale sublinearly (worse than linearly). Things like building regen culture, chasing sponsorships, doing NFT drops. I’d go so far as to say that we should be more organized about doing outbound campaigns to partner with other DAOs (in most cases we’d prpose to do a social/tech/token swap + we help fund their public goods as we do it ).

But the bulk of this post is about the promising things that do scale super-linearly (better than linear). Hopefully by having a conversation about where the highest ROI is, we can start making some smart bets.

What follows is what I’m excited about.

Aqueducts - I’m excited about building modular aqueducts for recurring always on funding. Experiments I think are cool here

- Aqueducts being a formal part of Allo v2

- The crowdfunding tool @carlb built while we were at supermodular:

- Taking each of our newly modularized programs and creating separate matching pools for each round we run a la climate.gitcoin.eth, eth_infra.gitcoin.eth, eth_oss.gitcoin.eth, eth_community.gitcoin.eth, etc….

- Integrations with Superfluid and/or Radicle Drips or other similar streaming tools.

- Building mechanisms that consume hypercerts, EAS, or other standardized on-chain impact signals + intelligently distribute rewards to them. Idk any experiments that are doing this yet, except maybe tea.xyz or OSObserver, and I’m mostly just excited about this bc Vitalik is.

Doing Grants/Airdrops for every EVM based Ecosystem - I’m excited about the momentum that we’ve seen in self-serve QF and direct grants since Grants Stack launched. There are many DAOs out there w billions$$$ in capital that doesnt have the proper distribution mechanisms out there, and we could provide that. The meta of Airdrops is totally broken right now, and Grants Stack/Passport offer some interesting new tools to evolve that meta forward. The market for this right now is likely in the tens or hundreds of millions$$$ yearly.

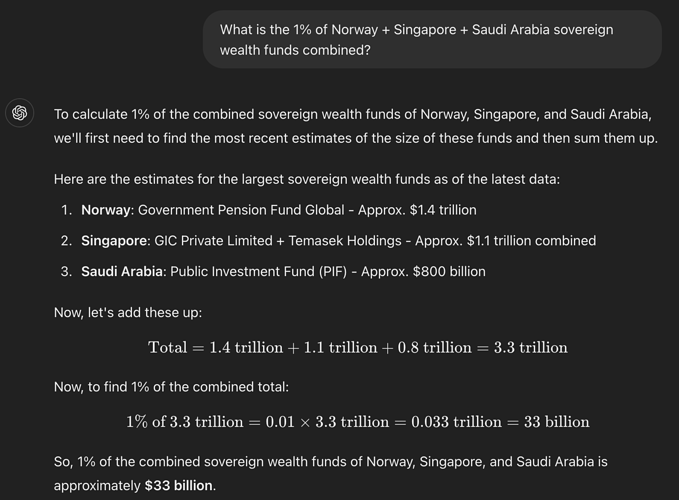

Doing Grants for fiat ecosystems - I think that eventually, having fiat capital on-ramps could be huge for Gitcoin. A recent architectural analysis even showed how this could be done, but I think we’ll have to focus on EVM ecosystems first. When the GTM for EVM ecosystems is maturing, it might be prudent to pursue more fiat ecosystems. The TAM for this is likely in the tens of billions of $$$s/yearly, maybe even more.

Totally new form factors for capital allocation - I am excited to see what Allo v2 will bring, and how a fruitful developer ecosystem can be built around it . Some experiments I’m excite for

- Quadratic Funding Social Networks

- Impact Stream

- Other Allo Integrations like Buildbox, Endaoment, Sablier, or Octant.

- Allo Hackathons

I can’t even estimate how big this market becuase the opportunity is so big. But it is also very complicated GTM wise, because we are bootstrapping a developer ecosystem around our suite of protoocols - and for Allo to be successful, it must make those people successful. Each of them have slightly different GTM considerations.

Always on funding sources - We should always be looking for economically exothermic areas of the ecosystem (meaning they give off funding as a byproduct of normal operations) and then plugging them into our products. Some examples of economically exothermic parts of Ethereum:

- MEV / Sequencer Fees, especially from PublicGoods.network or other L1s/L2s.

- Contract Secured Revenue/EIP-6968 - I’m cooking up something here with Zak Cole.

- Yield from gtcETH, GLOW, etc.

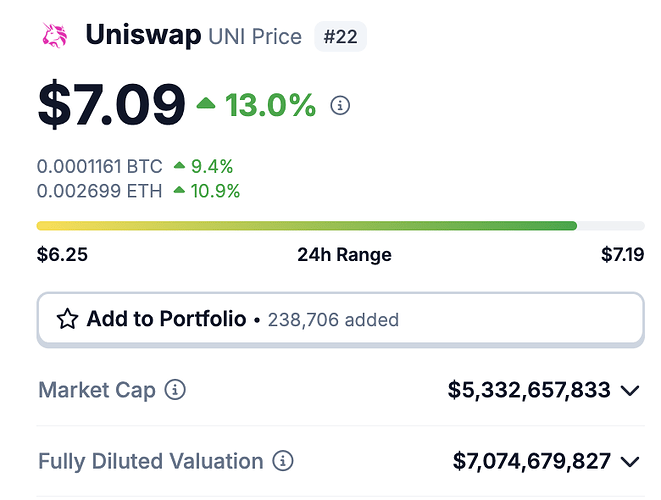

- DAO Treasuries for any DAO that has a sustainable revenue model (like Uniswap, compound, or any DEFI project)

I think these are each 10$$m+ opportunities. But we lack any well-funded special teams that have a mandate dedicate to pursuing them and most of them emerge as underfunded side projects.

Passport - Passport has the opportunity to do for sybil resistance what twilio did for SMS. I wrote a bit about how big of an opportunity I think passport is here last summer. More on their roadmap here. I think there’s likely a billion $$$$ market here. The TAM for human identity tools is literally everyone on earth who has an internet connection.

Internal stuff - OK, this one is different than the above ones. It’s purely an internal-centric one.

> 1. Speaking each others language internally

I think the one important thing we can do is build up inter-workstream and inter-skillset and inter-network shared understanding + empathy. We are building an impact network shouldnt we be following those best practices?

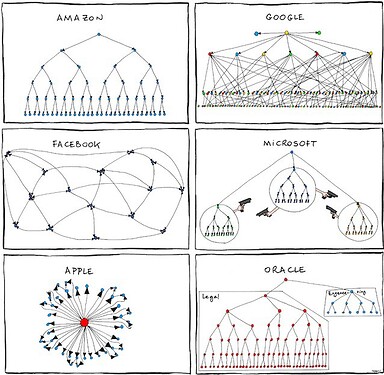

How do we create more common knowledge about our paths to the most important thing. Each pocket of important common knowledge can serve as a shelling point for getting important shit done + delivering more Ws than Ls. This would stretch all of us, because it means that engineers need to speak sales, that BD needs to speak computer science, that we all rally around the product managers for what they need, but it would be high upside if we could.

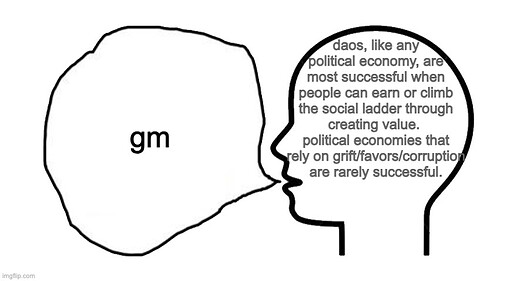

> 2. Create a formal organization-wide value heuristic

I think another intra-workstream thing we could do that would reinforce this is to we need to make value-delivery + the creation external facing W’s the social-political currency + actual economic currency of the DAO . I’d even go so far as to one day formalize this so that everyone is clear on the rubric they are judged against:

A proposed anchor point for the question of “how much is my team generating value?” could be:

w₁ = GTC_utility_produced + revenue_generated_in_usd

In the event that a product is pre-revenue their weight can be determined by

w₂ = size_of_subDAO_economy_in_usd

I have a whole 'nother post about this I can drop if ppl are interested. DM me if you want a preview.

> 3. Decentralization wen?

I expect that the next 12-18 months will be focused on product/protocol adoption and we will start thinking about ossifying Gitcoin’s governance only after reaching product market fit.

I have a whole 'nother post about Gitcoin’s path to ossifyication I can drop if ppl are interested. DM me if you want a preview.

A rising tide lifts all boats - Gitcoin is a bet on EVM ecosystems continuing to grow + proliterate. We are riding Ethereum’s network effects like a tide that is lifting all boats. If Ethereum grows 10x in the next decade, that could lift Gitcoin’s boat as well.

One tangible sign of this happening already is that Gitcoin has started raising funds from Optimism Retro PGF + from Octant. We are extremely blessed to be in a growing ecosystem with a. pluralism of other innovators within the area of public goods funding ![]()

.

Thanks for reading to the end. When I think about the next 10x, the above is what I’m excited about. What are you excited about?

- *impact.gitcoin.co needs an update: the GMV number is actually ~$52m ish after beta rounds/gg18 but for the purposes of this post, lets call it 50m)

- *impact.gitcoin.co also doesnt reflect the total size of the sybil resistent economy on Gitcoin Passport. if you take the sum of all the cost of forgeries on Passport and/or the rewards that have been given because a user has a passport, i estimate that it’s between 3-7.5 million $$$ tho

- Not financial or tax advice. This content is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This post is not tax advice. Talk to your accountant. Do your own research.