Thanks @DisruptionJoe .

This is interesting. Much simpler than the model I put together, and arguably more accurate because it’s based off the data from the Polis survey. All of that makes it more solid foundation to tune assumptions for revenue!

I went ahead and made a copy of the model with some new metrics and also tuned some parameters. You can get my copy here.

Changelog:

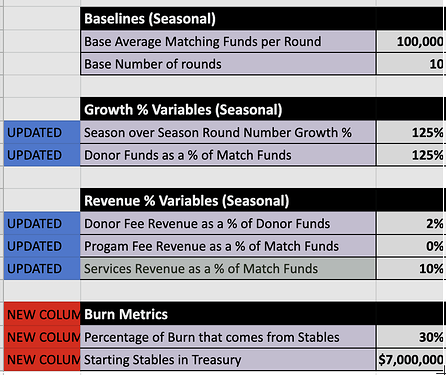

- All of my changes are tracked in red and blue (

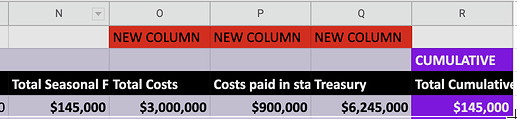

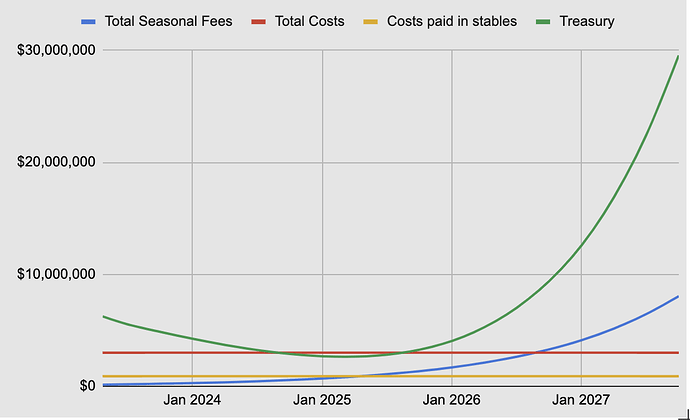

- Added the ability to track spend (GTC and stables spend) and the size of the treasury (I think this is important bc if the treasury hits 0 that is a sign of trouble).

- Updated Growth %s to be more realistic and revenue % to be more realistic.

These are the core KPIs in my forked model.

- Assumes $3million/season in spend, 30% from stables and 70% from GTC.

- Stablecoin Treasury (total revenue - total expenses in stablecoins > $0) reaches all-time-low of $2.6 million in mid-2025 with 60 rounds/season at total $13,411,045 in seasonal GMV.

- Profitable (total revenue - total expenses in all tokens > $0) in mid-2026 with 227 rounds/season at total $51,159,077 in seasonal GMV and $3,296,918 in seasonal revenue.

Future changes to make the model more complete:

- Track Mutual Grants

- Track GTC in treasury, on market, and locked in staking.

- Passport Considerations