One of the reasons why I’ve been spending so much time on Gitcoin is that there is a lot of room for growth here.

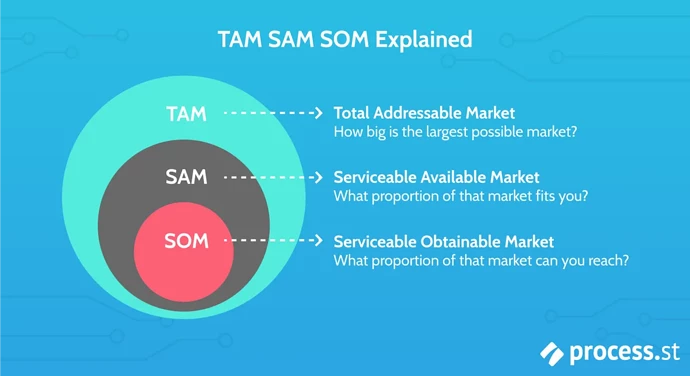

That’s because I think it’s TAM (total addressable market), SAM (serviceable available market), and SAM (serviceable obtainable market) is really really high.

These two slides explain these concepts really well.

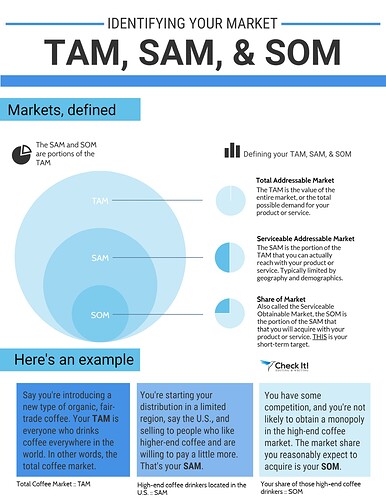

And this second infographic, which is slightly more complicated, explains the concept further.

Gitcoin’s TAM/SOM/SAM

I think that Gitcoin TAM/SOM/SAM look like this:

Gitcoin Passport

How big is the market size for an web3 identity aggregator?

| What | Size | Comment |

|---|---|---|

| TAM | 5 billion | Number of Internet Users per wikipedia |

| SAM | 30 million | Number of MetaMask users per decrypt |

| SOM | 30 million | The SOM is the same as SAM in my opinion. |

| Current Traction | 188 thousand | Number of GItcoin funders per gitcoin.co/results |

| Current Traction | 100 thousand | Number of GItcoin Passports per Gitcoin gov forum |

Grants Stack

How big is the market size for an web3 capital allocation stack?

| What | Size | Comment |

|---|---|---|

| TAM | $25 trillion/year | Amount allocated to public goods per year per giveth |

| SAM₁ | $10.8 billion | Approximate total size of DAO treasuries per deepDAO |

| SAM₂ | $1 trilllion | Total Crypto Market Cap per coinmarketcap |

| SOM | $10.8 billion | The SOM is the same as SAM in my opinion. |

| Current Traction | $72 million | Total amount of public goods funding on Gitcoin so far per gitcoin.co/results |

Token Swaps

As you can see from this post, I am bullish on GTC doing token swaps (what you call Mutual Grants) with up and coming VC projects.

| What | Size | Comment |

|---|---|---|

| TAM₁ | $1 trilllion | Total Crypto Market Cap per coinmarketcap |

| TAM₂ | $800 billion | VC Investments In 2021 per globaldata |

| SAM | $21 billion | VC Investments In Crypto 2021 per coindesk |

| SOM | $21 billion | The SOM is the same as SAM in my opinion. |

| Current Traction | $100k | Estimated Total Gitcoin Mutual Grants so far per this post |

What insights can we derive from this information?

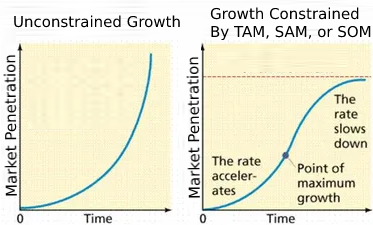

Gitcoin’s Growth will be an S-Curve

Many of the graphs in the GTC Financial Model are quite naive because they show an exponential growth (J curve) growth.

In reality, Gitcoin’s growth will be limited by it’s TAM, SAM, and SOM.

Room to Grow

Gitcoin’s current traction is ~ 1/1000th of it’s SOM in almost all of the market segments that it is in. That makes me really excited about room for growth.

There is massive room for growth in this market! All that remains between current traction + the SOM is execution and network effects!

Rising Tide Lifts All Boats

A rising tide lifts all boats. The nice thing about Gitcoin is that it’s being lifted by the rising tide of Ethereum’s growth. We can expect that Gitcoin’s SAM/SOM will continue to grow as long as the EVM continues to gets adopted.