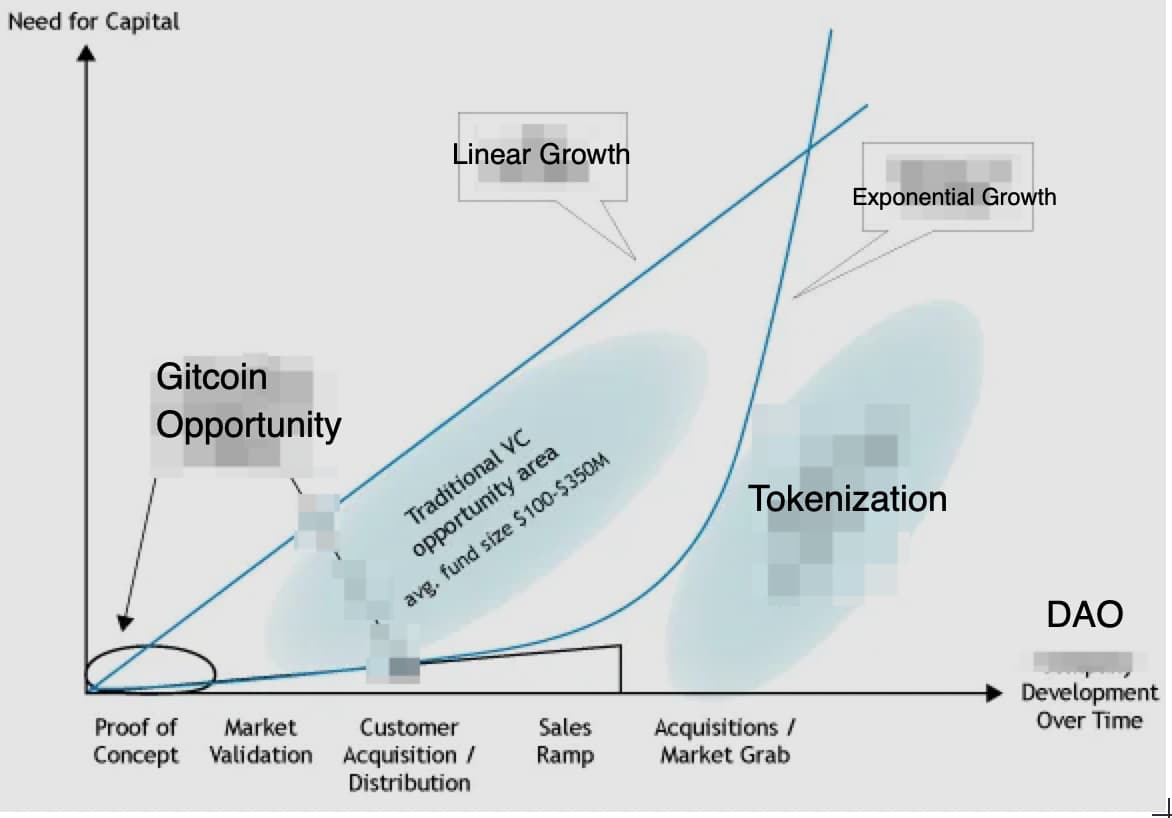

Per the model, the hypothesis behind the Mutual Grants tab is

Currently called “Mutual Grants”. This is the idea that Gitcoin is a source of alpha for the space + would do a token swap with up & coming projects on the platform. The strategy would be to do investments in alumni, put their tokens in treasury, and to catch the next Uniswap that comes into the platform.

The main insight that powers this hypothesis is that Gitcoin is a source of signal for what projects are up and coming in the space. The ETH ecosystem has MEV. The GTC ecosystem has DEV (data extractable value).

To explore the power of this opportunity, let me illustrate a counterfactual history of Gitcoin wherein Gitcoin had taken 1% of Uniswaps token supply back when it was a Gitcoin Grant.

In this counterfactual, UNI is as valuable as it is today - the fully diluted network value of UNI is $6,385,373,549 as of today. In this scenario Gitcoin’s stake of Uniswap is worth $63,853,735.49.

In this scenario, Gitcoin has no worries about it’s cash position or size of it’s burn because it’s got a highly liquid very valuable asset that it got on its “Balance Sheet” early before anyone else saw the value of UNI.

Lets dive deeper into this counterfactual scenario. In this counterfactual scenario, in their infinite wisdom and foresight, Gitcoin’s team also took 1% positions in Yearn, 1Inch Exchange, Rotki, WalletConnect, and others. That counterfactual Gitcoin has $100 million in liquid assets to invest into Grants Stack.

UX

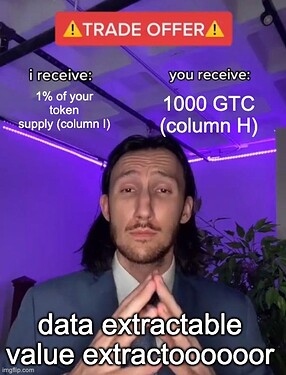

The UX of implementing a feature like this feels pretty simple for me.

- Rounds run as per normal.

- After the round, the Round Manager sends an email to a subset of grants on the platform (curated by the round manager).

- The email looks EXACTLY like this TO THE PIXEL:

- The User submits information about their business plan and takes a short 30 minute call with the round manager.

- The offer amount can be negotiated in a token swapping app. If both sides accept the offer, a token swap is facilitated.

- Repeat until deal is closed (or abandoned).

- Over time Gitcoin gets access to the Data Extractable Value (DEV) in it’s ecosystem.

- If it gets really sophisticated,

- Gitcoin can charge large VCs for the DEV coming out of Gitcoin.

- Gitcoin can share this data with its ecosystem building partners (like Fantom or Uniswap).

Model

OK now to answer your question about the model @kevin.olsen .

As the trope goes “all models are wrong, some are useful”. The model is 99.99% likelihood wrong about the upside of mutual grants. How wrong? IDK. What does the next Uniswap look like? IDK. But I do know that whoever those founders are, it is will likely get $$$ from Gitcoin (bc Gitcoin Grants & QF = a source of data signal about whats hot in the ecosystem).

The model assumes that Gitcoin will offer standard deal teams

- 1k GTC / deal (column H)

- in exchange for 1% of future tokens (column I)

But it could easily support variable deal terms (eg the standard offer is just “double your match payout for 1% tokens”, and Gitcoin puts a blended deal into its financial model in column I/H).

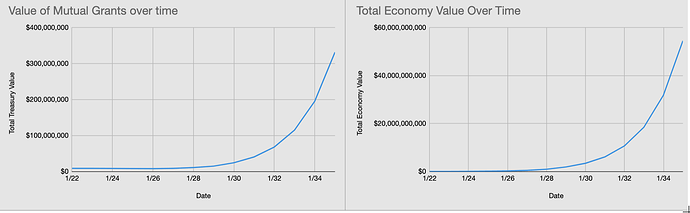

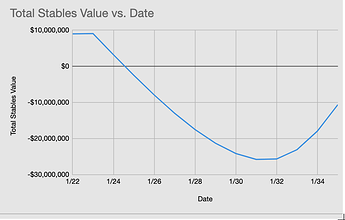

Portfolio Number Go Up

Over time Gitcoin will hold

- Column F Num Grants Invested In Yearly

- Column G Cumulative Grants Invested

- Column K Total GTC Investment Yearly

- Column L Cumulative GTC Investment

So how do you value that portfolio?

If we assume that

- Average Project Value at Investment Time (column L)

- then we have Total Ecosystem Value of Alumni (column N)

- and Total Portfolio Value (column O)

Of course the giant elephant in this room is “How much is this token worth?”

There is NO way to know which token will be the next UNI, YFI, etc… So the solution is to take many bets. If we assume

- 45% Average Project Value Growth YoY (column M)

- place many bets

then we will see Total Portfolio Value (column O) grow by about 45% per year.

Of course most projects will grow 0%, some projects will grow 30%, but maybe 10% will grow 400% and bring the average up for everyone.

Execution

I think the most important thing if Gitcoin does this it

- preserves its capital

- makes many small bets earlier than anyone else can

- over time tries to get better and finding signals that a project is about to ramp it’s network

The key thing that would excite me as a GTC part time fanboy/part time critic is to build a market intelligence engine that can invest in projects BEFORE anyone else knows about them. (Market Intelligence Engine = a combo of tech, product, marketing, data, operations, etc)

Let me know if any questions.