BASE SUMMARY

Gitcoin is DAO that makes Gitcoin Grants - a suite of protocols for distributing capital to any EVM based community. It’s protocols include

- Gitcoin Passport - a protocol for creating sybil resistence

- Gitcoin Grants Registry - a grants storage/retrieval protocol

- Gitcoin Grants Round Manager - a protocol for easy CLR Funding for any DAO

In addition to Gitcoin Grants protocols, Gitcoin also offers a funding programs - basically Gitcoin Grants protocol as a service.

Gitcoin has reinvented itself as a DAO instead of a company. It now has nearly 100% turnover of talent, governance, model, code from its days as a company in 2020.

BULL CASE

Gitcoin Grants

The bull case for GTC is that Gitcoin could be a “back office” tool or protocol for community capital allocation any EVM community out there. That means any L1, L2, DAO, DeFi Protocol, NFT Project, etc could use Gitcoin’s protocols to supercharge their ecosystem development.

According to DeepDAO there is roughly $8 billion in assets in DAO treasuries. According to CoinGecko there is at least $200 billion in market cap for EVM chains. According to coincodex there is $7 billion in market cap for NFTs. According to CMC there is $38 billion in market cap for DEFI.

In total that is $8 + $200 + $7 + $38 = $253 billion. Assume 10x growth over the next 5 years, and thats $2.5 trillion in Total Addressable Market. Assume 0.1% of this market cap is allocated for incentivizing community participation within these markets on a yearly basis, that is roughly $2.5 billion in serviceable market yearly - about 300x-1000x higher than what Gitcoin is doing now.

Gitcoin Passport

Gitcoin Passport is a tool for creating sybil resistance on Gitcoin Grants, but also the wider EVM world. It relies on verifiable credentials to create scoring of each unique identity on a basis of how human each user is.

Sybil Resistance is quite a small web3 market at this time, so it is hard to quantify. But sybil resistance is a hard problem that has eluded computer science researchers for decades. Similar hard problems being solved are breakthroughs and often have lead to commercial breakthroughs for the people that solve them. Just as likely is that someone else commercializes a breakthrough and the original persons who addressed the problem is left behind.

I think the upside case for Gitcoin Passport is that an ecosystem of sybil resistant dApps are built on top of Passport. I do not know how to quantify that. Real world identity is a very foundational part of the state based economy - There is a similar opportunity to become foundational important part of the web3 economy.

I think Gitcoin is well positioned to address the sybil resistance problem because it has so much more experience & so much more data to do it than any other web3 project.

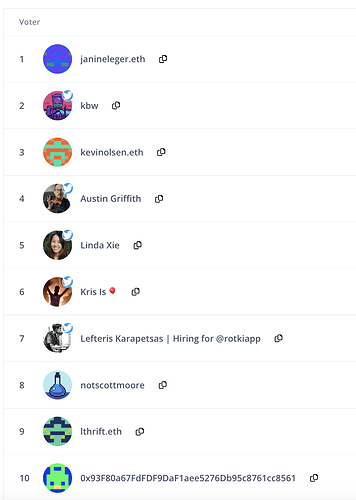

Social Capital

Gitcoin has a lot of social capital. With A list personalities like Vitalik talking about Gitcoin comes a lot of legitimacy. With the funding of A list projects like Uniswap also comes a lot of legitimacy. Being a leading brand in the ReFi space brings a lot of legitimacy.

This social capital is probably Gitcoin’s biggest asset right now. It is hard to quantify this social capital. There is probably a way to protect, extend, and monetize this social capital - especially if Gitcoin continues to grow.

GTC

In my opinion, the bull case for GTC basically boils down to:

- Grants will be successful & have $billions/year in capital going through it.

- Passport will be the foundation of a new sybil resistant economy in web3.

- Governance rights to manage these systems will somehow become valuable.

- GitcoinDAO will survive to get to that point.

BEAR CASE

There is 1 bull case. I think there are several bear cases, which I will go through individually below. Each bear case I think is independent from each other, and the more bear cases Gitcoin can avoid the more likely I think the bull case is.

-

Gitcoin needs to keep perpetually fundraising to fund it’s matching pool and no recurring source of funding has been found. This is an uphill battle, but one that Gitcoin has demonstrated competency at at small scales.

-

Gitcoin Grants relies on sybil resistence, a hard problem that there is no solution for yet. As long as there is capital to be made by doing so, Gitcoin will keep getting attacked by sybil attackers. This is an uphill battle, but one that Gitcoin has demonstrated competency at at small scales.

-

Gitcoin has a quite large team working for it. The team is illegible and opaque to outsiders, expensive, and slow to ship useful software. At times it can seem to me as an outsider that the team misses basic things in their product and go-to-market or seems the team almost tripping over itself. DAO Governance is hard but important, running a DAO is new territory, and it is not clear that Gitcoin has figured it out yet. Gitcoin has not explained its competitive positioning publicly or published its 2023 roadmap (like I said its illegible to outsiders) so I am operating with limited information here.

-

Gitcoin Grants and Gitcoin Passport need to find protocol market fit. The old product hosted at gitcoin.co showed it can do $6.5 million / quarter in funding. When will the new protocols flippen the old products in market? When will they find protocol market fit? Can they reach the $2.5 billion in serviceable market yearly I identify above?

-

The bear market will be long and so far has not been kind to GTC. GTC is required to keep the lights on at GitcoinDAO, and it is not clear where new buyers are going to come from. The token keeps going down. Finding a floor for GTC means creating a credible narrative of why GTC is valuable medium and long term and so far is not on track - at least to as outsider. There is presently no clear narrative or use case for GTC in sight, other than being used to dump on market and fund operations. This is also an uphill battle.

Of these bear cases, i think number 5 is the most pressing. Gitcoin’s continued operation depends on the reflexive belief that GTC has value. Reflexive = Directed back on itself. Ryan Selkis covers this in the 2023 Messari trends report, heres what he wrote:

“You might think DeFi protocols are financially set for life, but a deeper look into the com- position of each treasury suggests the opposite. The vast majority of the “value” in these token treasuries is coming from the reflexive belief that the market will always absorb the new supply. That may happen in bull markets, but things can unwind sharply when volumes subside. In fact, that’s exactly what happened during May’s market crash.”

If GTC goes to 50-75 cents, then Gitcoin might have a shorter runway than the bear market may last (2-3 years).

Conclusion

I was attracted to Gitcoin because it seemed different than many other projects and it seemed like a fun challenge to try and value it. I wrote this post to explain how I as a fan of Gitcoin view it in market. I am rooting for your success and I hope that these steel-mans of both the bull and bear case are helpful to others too. I wish you success in 2023 Gitcoin!