Many of you may know about our Cross-Stream DAO Operations, or CSDO, powerhouse team. If you don’t, CSDO is a group of workstream & initiative leads that come together to cultivate coherence across the DAO.

With all the world-regenerating we’re doing it’s easy for things to get lost. In our monthly CSDO Digest we’ll break down all the most important CSDO outcomes from every month, so let’s dive into November!

DAO-Wide Updates

During November, we held a Stewards Council election! The Stewards Council is a group of nominated Stewards tasked with reviewing budget proposals, coordinating high-level decisions that impact the DAO as a whole, and ensuring a collective vision for Gitcoin. All the nominations were submitted by Workstream Leads, after which we did the first quadratic voting ever on Snapshot!. You can get more details about the process and results of the election from our blog post. You can also check out the full proposal for the V2 of the Stewards Council here.

Proposals

Pods

Pods were ratified, and will become a new method of collaboration within the DAO! Pods are an experiment in cross-workstream collaboration. They are a meme to help us codify the best practices of cross-workstream collaboration and to help give this networked work 1) a home outside of the individual workstreams and 2) a consistent voice within the DAO.

You can get the full rundown of Pods and how they work on their notion page.

You can read the full passed proposal here.

Budgets

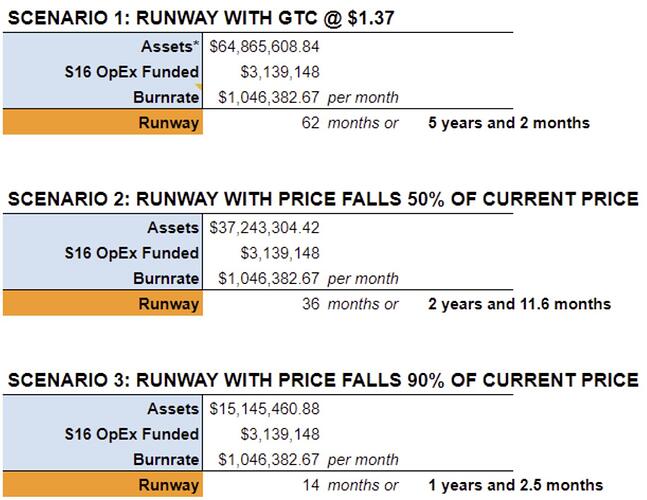

The S16 Budgets went live on Tally! This is the last step for workstreams in the current budgeting process. Here are the budgets for each workstream:

Key Discussions & Thoughts

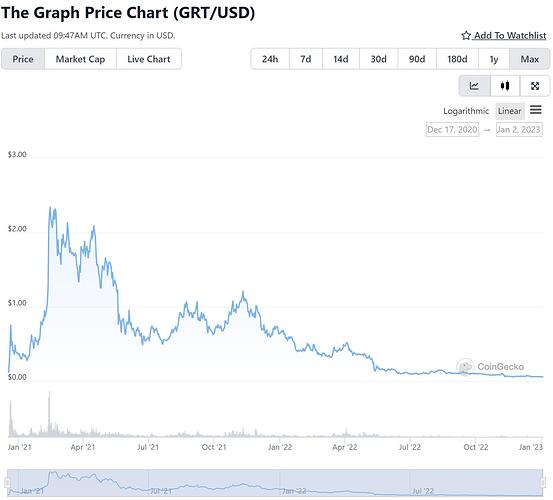

A decision was made to conduct salary evaluations and reporting across the DAO - Stewards have been expressing increasing amounts of concerns over the DAO’s financial stability in a worsening bear market, and a report demonstrating that our budgets align with the market and are consistent across workstreams will help during next budgeting season. DAO Ops’ Saf will be reaching out to workstreams for salary data, and comparing to data on OpenComp.

PGF’s Janine highlighted PGF’s efforts in getting community input on the strategy of the Grants Program in the community-driven Protocol future. There is a tradeoff between ensuring as many voices as possible are heard, and creating factions within the community with competing interests, so how we approach these conversations is highly strategic.You can relisten to the DAO Vibes session here.

MMM’s CoachJ is driving the development of a “Single Source of Truth” resource for contributors so that everyone has the information they need to do their jobs. Better information sharing at MMM has been game-changing to their team, and applying those learnings across the DAO are very welcomed.

While there were initial concerns from the PGF team about a potential partnership, PGF’s Ben West’ thinking here is that the mentioned company will spend this money anyways - so why not make it a democratic and community-driven process? PGF will be developing a statement on this partnership to share with the community and a strategy doc outlining how/why we choose to pursue partnerships with certain orgs and not others. The $500k has been committed for the year, but the round won’t be run until we are more comfortable with potential impacts on brand/community.

Work continues on the DAO Operating System, an initiative that impacts all workstreams in the DAO. You can check out this miro board to see what we’re doing to ensure operational efficiency at every level of the organization.

FDD’s Joe shared the workstreams thoughts and insights surrounding economic risk balancing. They highlighted what we currently do vs what we could be doing. You can see their thoughts on this miro board.

PGF’s Janine is continuing work on a pre-eth Denver retreat for external Gitcoin supporters. We’ll be hosting an IRL retreat before the Schelling Point Conference and EthDenver for core community members who have supported Gitcoin historically, been champions of public goods for the good of our broader community, and leaders who want to commit to funding and fostering projects in their community with positive sum games with a priority around protocol partners. With the newly-found cheaper location, ticket sales, and just a few sponsors, we should be able to cover the full cost of the event.

Note: This event is not intended for contributors, and instead is focused on external Gitcoin supporters. We are working on doing something separate for Gitcoin contributors.

For more information on how these discussions went, you can check out all of the CSDO Meeting Notes to read more, or the Gitcoin Transparency YouTube Channel to watch recordings of CSDO calls!

And that’s it for this month! Keep checking back monthly for future editions of the CSDO Digest!