Summary

Regen Vaults’ core idea is a Public Goods add-on on top of commercial ERC-4626 vaults.

Regen Vaults are a multi-tranche portolios configured with:

1 or 2 senior tranches donating interest/partial interest to “Gitcoin Grants matching pool address”

and being protected by single commercial tranche

serving as first-loss capital, using senior tranching capital to leverage yield.

Commercial Lenders are incentivised to invest into vaults that already have donating capital(APY boost). Donating capital is incentivised to lend into Senior Tranches because it is being offered additional protection.

On absence of donators willing to lend to senior tranches vaults behave like classic unitranche pool and still should make economical sense.

Abstract

“Regen Vaults” allow lenders to earn interest on their deposits while supporting public goods through one of two strategies: “donation of interest” or “protection of donating capital”.

Idea builds on top of TrueFi protocol maintained by Wallfacer: all mechanics for implementation of this idea already is possible within the protocol and had been thoroughly audited by Chainsecurity (Report)

Specification

- A Regen Vault is a pool of funds that are lent out to a selected asset manager to invest in accordance with a predefined strategy.

- It is structured to allow for different exposure to risk and yield.

- It is not strictly a Public Goods Funding only product but rather it is a composition of commercial and public incentives in one on-chain product.

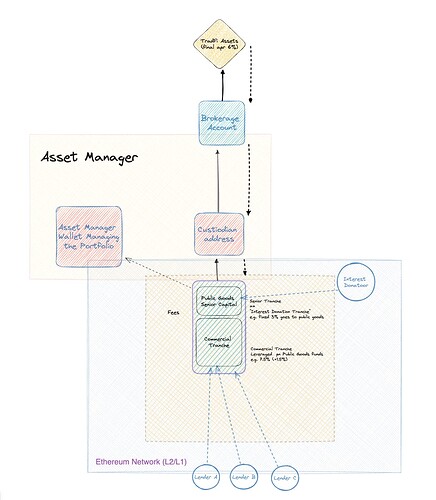

Regen Vault Trust Model

Let’s start with simplest possible usecase assuming only two-tranches setup which is useful for visualising the trust model:

Some implications:

- all lending happens on-chain, control of liqudity for Asset Managers happens on-chain, waterfall and senior-to-subordinate rations are being enforced on-chain

- Asset Manager can disburse the funds - only to a certain Legal Custodian Address.

- From there funds are being deployed into RWA through the brokerage account

- Asset Manager signs with Lenders an MLA where Asset Manager commits to certain strategy - like only T-Bills through Community Bank’s brokerage account

- Managers are approved via TrueFi Protocol proposals, with their corresponding Custodian Ethereum Address that had been confirmed.

- Managers are responsible for providing correct valuations and attesting for it. It can be verified by external parties.

- Manager cannot use any other address for disbursment of the capital. Only legally recognized custodians are allowed

- Manager has to have legal structures verified, traction and reputation to be approved by TrueFi DAO. Currently TrueFI is working with 3 potential Asset Managers.

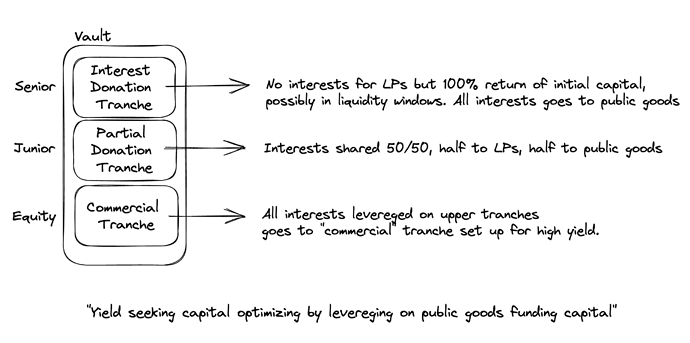

Tranching Mechanics Explanation

In another example:

- The pool is divided into three tranches:

- Interest Donation Tranche,

- Partial Interest Donation Tranche

- Commercial Tranche.

In the particular example:

- The Interest Donation Tranche is a 3% yield tranche where lenders donate their funds to support public goods quadratic funding via interest earning. Full 3% is being donated.

- The Partial Interest Donation Tranche is a 8% yield tranche where half of the interest earned is allocated to public goods quadratic funding and the other half is distributed to the lender.

- The Commercial Tranche is an uncapped yield tranche where lenders can earn high returns with smaller contribution on a field of public goods: protecting “donating capital”

- Commercial Tranche is a “liquidity engine” that allows PM to scale the vault - since this capital is locked till the end of Vault’s maturity. Worst case scenario, if there is no demand on upper tranches - than the vault is an “UniTranche opportunity”. If anyone though, is ready to “donate” some part of the yield, or all of the yield - they can choose upper tranches being additionally protected from Asset Manager mistakes:

- Interest Donation Tranche capital is protected by Partial Donation Tranche and Commercial Tranche

- Partial Donation Tranche is protected by Commercial Tranche

TL;DR

Upper / Donating Tranches get protection,

Commercial Tranche get higher APY on some additional risk.

Funds Management

- The Asset Credit Vault is managed by a selected asset manager* who will invest the funds according to a predefined strategy, signing Master Loan Agreement with lenders on deposit.

- Funds will be off-ramped only to a legal/confirmed custodian address and exchanged for fiat, then sent to the asset manager’s brokerage account to invest in accordance with the predefined strategy.

- At the end of the investment period, the funds are returned to the vault to be redistributed to the lenders.

Scenario Simulation

- Let’s assume each tranche has raised $1M each with a final vault performance of 6%, resulting in a final value of $3.18M (180k)

- Interest Donation Tranche: $1M deposited with 0% yield for LPs, 3% going to “public goods address”: $30k

- Partial Interest Donation Tranche: $1M deposited for 8% in total, half being 4% - yield allocated to both Vault LPs and public goods, resulting in a $40k contribution to public goods and a $40k yield to the LP.

- Commercial Tranche: $1M deposited for 7% total final yield, resulting in a $70k return, leveraging "on public goods financing

Motivation

Thought behind this idea is to find sort of symbiosis between yield seeking capital and public goods capital. Is it worth pursuing in your opinion? This post is an ask for feedback.

Benefits of Regen Vaults

- Overall in the above example, the Asset Credit Vault achieved a 7% yield donated to public goods: matching funds - $70k in total.

- “Donating” capital is being prioritized and getting some first loss guarantees

- “Fully Donating” capital might be offered liquidity windows.

- Donators are presented with two levels of engagement into public goods founding, donating all interest or splitting APY between donation and earning.

- for first loss capital, APY/risk ratio proposition can be very attractive if Public Goods Tranches are full.