Hi, I’m Garm from Glo Dollar, the stablecoin that funds public goods.

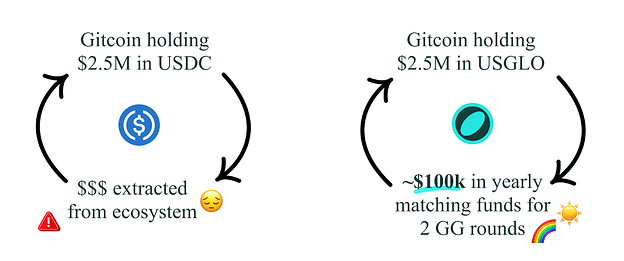

TLDR: I’m proposing that Gitcoin exchanges $500k of its USDC holdings ($5M today) to Glo Dollar (USDGLO) to unlock up to $20K per year for 2 new yearly Gitcoin rounds run by Glo Dollar.

What is Glo Dollar?

Glo Dollar (USDGLO) is a stablecoin similar to USDC. Unlike USDC, USDGLO funds builders in your ecosystem.

Glo Dollar is US issued & regulated and 100% fiat backed by a mix of cash and US treasuries.

The big difference with USDC is that Glo Dollar is structured as a non-profit, which allows us to donate all of the profits we make on the US treasuries backing Glo Dollar to builders in your ecosystem.

The funding potential of doing this is massive. Stablecoin companies generate $7.4 billion annually from their stablecoin reserves. By choosing to embrace Glo Dollar, we can funnel all of those profits back into your ecosystem by funding public goods. Here’s how that works.

More Glo Dollars = More (Automatic) Public Goods Funding. AutoPGF. ![]()

Thanks to Gitcoin swapping $100,000 of assets into Glo Dollar a year ago and leading by example, we’ve been able to kickstart the AutoPGF movement, and have since grown our market cap to $3.6 million. Glo Dollar is live on 7 chains.

Recent wins for Glo Dollar and AutoPGF

- The Mento Reserve converted $1M of reserve assets into Glo Dollars. The funds held will generate ~$40k in yearly funding for Celo Public Goods;

- Gitcoin exchanged $100K of USDC of its matching pool funds to Glo Dollar (USDGLO);

- Shutter DAO swapped $300K into Glo Dollars to fund Web3 public goods (currently Gitcoin, Protocol Guild, Giveth);

- Over $500K in matching funds for Gitcoin and Giveth rounds have been denominated in Glo Dollars, including CCN’s GG21 Climate Solutions Round, The GG21 Regen Coordi-Nation round, and various rounds on Giveth, including ones sponsored by Base, Celo, and Public Nouns;

- Glo Dollar donations are becoming more popular, with 2000+ Glo Dollar (USDGLO) donations on Gitcoin and Giveth. During GG21, ~8% of donations were made with Glo Dollars.

Our proposal: unlock ~$20K per year to run 2 additional Gitcoin rounds every year by increasing Glo Dollar holdings

-

Swap $500,000 of USDC holdings into Glo Dollar (USDGLO) through our issuing platform powered by Brale (no fees).

-

We’ll add a specific Gitcoin Builders Cause Area, where 100% of our earnings from this $500k holding will be channeled. In the current interest rate environment, this will generate ~$20k in funds per year. This is a sustainable source of funding as none of Gitcoin’s USDC holdings are spent.

-

Twice a year, the Glo Dollar team will run a “Glo Dollar x Gitcoin” round with at least $10k USDGLO in matching funds. We plan to run these rounds simultaneous with GG rounds, and will run them regardless of whether they’re selected as official community rounds. These rounds will support builders who:

- Create Public Goods;

- and build on top of Gitcoin protocols and/or Glo Dollar.

-

Gitcoin can always swap the Glo Dollar (USDGLO) funds back 1:1 to USD or USDC with our issuing platform powered by Brale for free.

Grants = growth:

Why we’re making this proposal now

One year ago, Gitcoin purchased $100K Glo Dollars as a first test in holding this stablecoin.

Since then:

- Gitcoin’s $100,000 buy happened when Glo Dollar only focused on poverty eradication. We’ve since expanded our funding areas to include Web3 public goods like Gitcoin, becoming more mission-aligned with Gitcoin and its community.

- Glo Dollar received a Bluechip stablecoin safety rating, ranking it among the top 10 fiat-backed stablecoins.

- We’ve demonstrated 12 months of stability—with monthly independent proof of reserves proving Glo Dollar was fully backed by the same asset mix as USDC.

- Gitcoin’s leading example was followed by crypto orgs like Polygon Labs, The Mento Reserve, the Optimism Foundation and the Stellar Development Foundation, by holding/supporting Glo Dollar with 6-7 figure amounts.

- We’ve established a track record of monthly donations and increased our market cap from ~$2M to ~$3.6M.

Relevant links:

- Glo Dollar website

- Glo Dollar’s bluechip stablecoin safety rating

- Glo Dollar X account

- Glo Dollar monthly donations

Voting options

Yes: Swap $500k USDC for $500k Glo Dollar.

No: Do not proceed with this swap.

Abstain: Choose not to vote on this proposal.