tl;dr

Goal: Deploy crypto-focused information markets (excluding sports/politics) that generate over $1M in volume, establishing Ethereum as the hub for information finance.

Ask: Run a Market Discovery Program using Butter to subsidize 10-15 experimental markets (prediction, advisory, decision, funding, etc.), identify what works, then scale winners to create replicable templates for the ecosystem.

Problem & Impact

OpenAI, Anthropic, and Google increasingly mediate how society accesses and interprets information. Truth is becoming dangerously cheap to engineer.

The 2024-2025 period marks an inflection point. ChatGPT and Claude are becoming the primary information interfaces for millions, bots overrun most social media feeds, and elections face broad misinformation campaigns. Meanwhile, Ethereum has matured enough to consider building alternatives.

The evidence for information finance (InfoFi) as a solution is compelling. Polymarket’s $16B+ cumulative volume demonstrates demand for truth-seeking mechanisms. Most importantly, information markets address the root cause of our information crisis: misaligned incentives.

Traditional media optimizes for engagement and advertising revenue, not truth. InfoFi creates markets where accurate information pays, transforming truth from a public good into a profitable venture. That users continue to return month after month to these platforms, finding value years after launch, gives us reason to believe we’re addressing a real problem.

Sensemaking Analysis

Our analysis draws from our own live experiments.

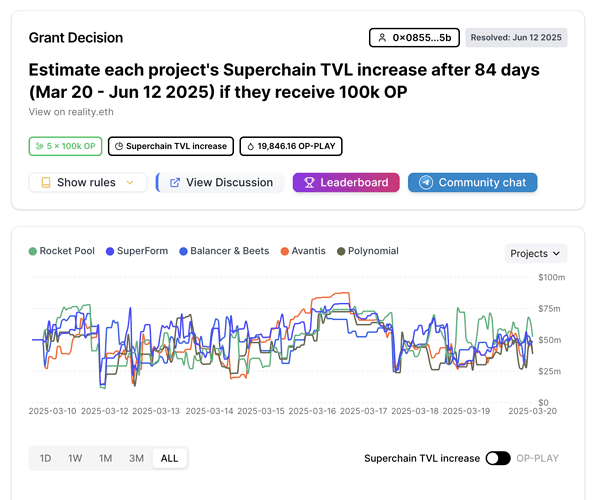

The Optimism Futarchy Experiment (March-June 2025) allocated 1M OP tokens—500K OP using our Conditional Funding Market, and 500K OP through the Optimism Grants Council—generating remarkable results: the futarchy cohort achieved $61.50 in net TVL per OP compared to $0.28 for the Grants Council—a 219x improvement in capital efficiency.

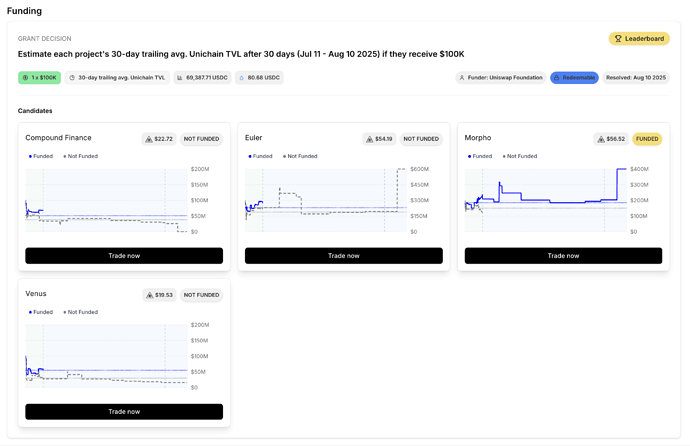

The Uniswap Foundation’s Conditional Funding Market provided additional validation. Their $100K allocation to Morpho generated $77.8M in incremental TVL over just 30 days.

Our approach combines quantitative TVL analysis tracked through DefiLlama, comparative performance metrics across cohorts, and time-series monitoring of daily patterns.

We build on research by pioneers in the field of information markets: Robin Hanson (Inventor of futarchy, George Mason University), Yiling Chen (Harvard), and Bo Waggoner (University of Colorado).

Our work builds on Vitalik Buterin’s November 2024 InfoFinance article, which defines our mission: improving prediction markets and information-aggregation tools.

Gitcoin’s Unique Role & Fundraising

Gitcoin is uniquely positioned to spearhead the InfoFi revolution. Seven years of funding $60M+ in public goods created the trust and infrastructure that information finance needs. Gitcoin pioneered Quadratic Funding and has publicly acknowledged its limitations, demonstrating the intent to find better mechanisms.

Our fundraising strategy leverages proven results. We’re in active discussions with the Ethereum Foundation, building on their renewed focus on ecosystem growth.

Success Measurement & Reflection

Our goal is to deploy a catalogue of crypto-focused information markets that do not include sports, politics, or price action, and generate $1M+ volume across all active markets.

We’ll track forecast accuracy (comparing predictions to actuals) and user retention, and monitor for fraud, e.g., wash trading. We’ll introduce a mechanism for the community to contribute to the market selection process.

The Ethereum community will celebrate this domain when a respected media organisation references information produced by Ethereum’s InfoFi markets, just as they default to Ethereum for DeFi today. Specific markets might include “Will EIP-4844 reduce L2 costs by >50%?”, “Which L2 will have the highest TVL in 2026?”, or “Which research areas will produce the highest number of conference acceptances?”

By February 2026, success means media coverage acknowledging Ethereum as the hub of information finance, with over 80% of non-sports/elections InfoFi volume occurring on Ethereum/L2s, and at least one major institution using or referencing these markets.

Domain Information

Domain Proposal: The InfoFi Domain for GG24

Domain Experts: The Butter founding team brings deep operational expertise from running successful experiments generating $100M+ in TVL impact. Our advisory board includes Robin Hanson, Yiling Chen, and Bo Waggoner.

Mechanism: We’ll use Butter, our own InfoFi venue. All allocation decisions derive from transparent, public market data.

Structure: Rather than funding rounds, we’ll run a Market Discovery Program. Phase 1 deploys 10-15 subsidized information markets (prediction, advisory, decision, funding, etc.) across technical (EIP impacts), ecosystem (L2 adoption), and governance (DAO decisions) categories. Phase 2 refines based on participation signals. Phase 3 scales the 3-5 breakout market types toward our volume target.

Our subsidy strategy includes initial liquidity provision ($5-10K per market) and trading incentives for accurate forecasters. Success means discovering which information markets the Ethereum ecosystem genuinely needs and will sustain beyond subsidies. This creates templates we can replicate, cementing Ethereum as the permanent home of information finance.