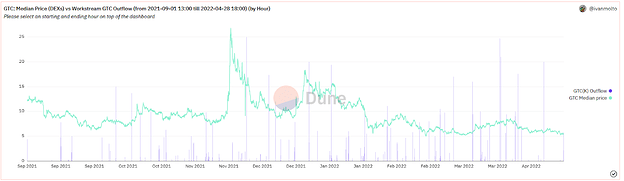

@ivanmolto and I have been looking into the correlation between GTC outflow from GitcoinDAO and GTC spot price. A common belief is that Workstreams compensating contributors with GTC would somehow negatively impact the price of GTC. We put this theory to the test through a number of queries in this Dune Dashboard to see if it holds any water.

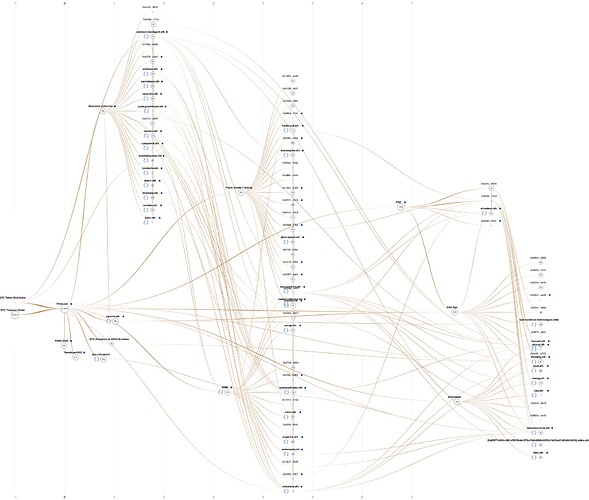

In order to produce a meaningful analysis we couldn’t just track GTC outflow from Workstreams and compare that to GTC price. To accurately test this hypothesis we need to take one step further and track GTC outflow from contributors in relation to price.

A common conception about contributors receiving compensation in GTC is that they will immediately sell their tokens for other assets, causing a massive sell wall and negative price movement as a result.

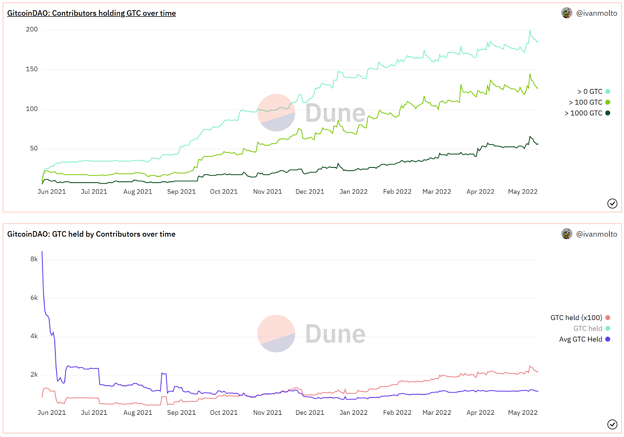

After analyzing 269 unique contributors over time we can see that this is far from the truth. The data show that contributors of GitcoinDAO are likely to hold their GTC and the average amount of GTC held by this group is increasing. The first figure below shows the number of contributors who hold more than 0, 100 and 1000 GTC respectively. The second figure displays the amount of GTC held (x100) in total by this group as well as their average GTC holdings. These metrics are all increasing.

We could not find a correlation between GTC outflow from Workstreams and GTC price movement:

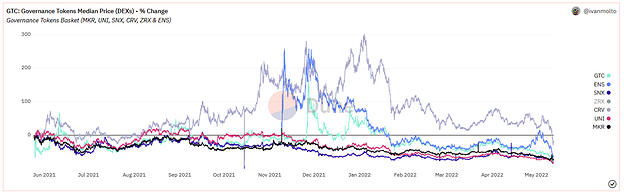

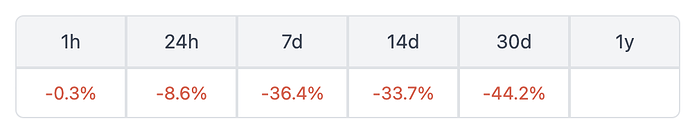

As we looked further into what could impact GTC we found a correlation between GTC and other governance tokens. In general, GTC seems to be following the movements of the market sector. The figure below show the price movement of other governance tokens and GTC, relative to their price on May 25th 2021:

In conclusion; the hypothesis that sending GTC to Workstreams who then pay contributors would negatively impact GTC price can not be proven through the data. GTC is however correlated to similar tokens in the sector.

We encourage you all to look through the dashboard and we welcome feedback on ways to improve these further. A couple of additional visuals and tweaks will be added to the dashboard in the coming days.

Enormous shoutout to @ivanmolto for the amazing job.

Our two previous dashboards can be found here:

GitcoinDAO: Governance & Financial overview

GitcoinDAO: Governor Alpha & Timelock