Authors

TLDR

- This post discusses the end-to-end funding lifecycle for Ethereum public goods, inspired by this thread.

- We believe that solving these problems creates a sustainable competitive advantage for crypto ecosystems.

- We outline the lifecycle of public goods funding,

- the cradle stage focuses on building and gaining initial funding,

- the maturity stage involves community building and surviving the “trough of sorrow,”

- and the unicorn stage is about achieving significant impact and receiving retroactive funding.

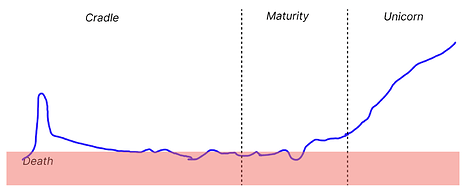

Private Goods Funding Project Lifecycles

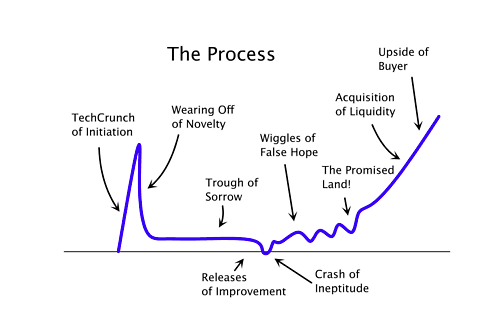

There’s a famous whiteboard drawing that shows the life of a startup, from getting its first coverage on TechCrunch, to its wearing off of novelty, to a prolonged “trough of sorrow”, to its finally crossing the chasm and getting sold for billions of dollars.

Startups of this type typically get funded by VCs. Most of them die in the trough of sorrow because they run out of money before finding product-market fit.

The funding infrastructure for startups is pretty well-established: they get some initial VC funding to build a product around their idea, they get more VC funding (and revenue) if they enter a growth phase, and eventually, if it all works out, everyone gets a large return on what they put in when the company has a liquidity event.

There’s also a value chain of different funders who specialize in funding different types and stages of startups. Early stage investors tend to be very different from late stage investors. Early stage investors are mostly betting on the people, so they need specialized domain knowledge and networks to find good deals. Late stage investors are more numbers oriented, so they will closely inspect the company’s metrics and the macro picture. Investors along this spectrum can provide valuable resources - including education, recruiting, mentorship, and more.

Public Goods Funding Project Lifecycles

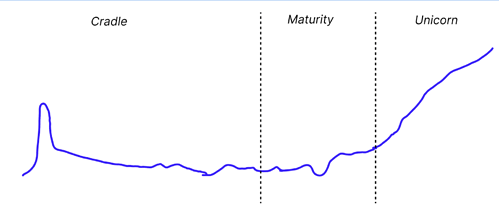

It’s interesting to consider what a similar funding lifecycle diagram might look like for the Ethereum public goods ecosystem, ideally funding teams before, during and after they achieve impact.

To accelerate innovation, there should be funding for every viable project from the “cradle to unicorn” stage of a public goods organization’s life cycle.

There will also need to be ongoing funding, validation, and other resources available, to help projects get through the “trough of sorrow” between the initial build and the path to becoming a unicorn. Not all projects will make it. In fact, most won’t. There should be no stigma if projects end up in the grave and teams move on (we should especially encourage learnings from these teams to be made public so that future teams do not make the same mistakes).

1. Cradle: the prospective funding stage

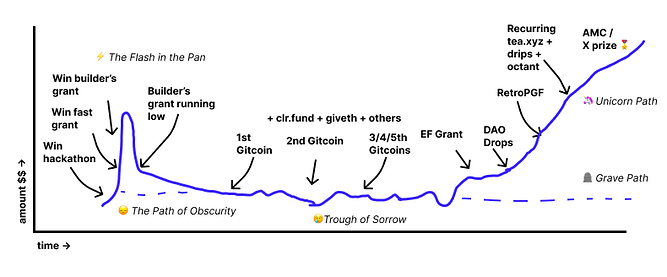

During the cradle stage (the early-to-middle of the graphic above), funding is needed to de-risk the upfront costs of starting something. People are afraid to quit their jobs. It’s difficult and time-consuming to apply to lots of grants programs.

But funding should not come without scrutiny. To truly enable builders, builders also need validation of which things create value and for how many people. The funding can come along with validation that your work is important.

Bounties and hackathons are good ways of seeding ideas, but they are unpredictable and create incentives for teams to keep switching projects / jumping ecosystems. There should be better pathways from winning a few small hackathons to getting a large builder’s grant, perhaps with a couple medium-sized fast grants in between. This would help more projects get off the ground and give proven builders an easier road to quitting their job and working full-time on something. This could also help keep builders focused on a particular ecosystem instead of jumping around from grant to grant.

During the cradle phase, projects should be focused on the most important thing: building. They should be building in public as much as possible. Anything that can be done to simplify their life + enable them to focus on building/learning, be it finding insurance or hiring a good smart contract auditor, is welcome. Ideally they are also not spending too much time worrying about where their next funding is coming from.

In our diagram, this stage starts with winning a hackathon and ends with getting a small grant from the Ethereum Foundation. They haven’t had any real impact yet, but they have proven worthy of a good amount of prospective funding to go build something.

2. Maturity: the community funding stage

Now the project has some money, but it is running very lean. It is building and experimenting with different things, but often no one actually cares yet.

The “trough of sorrow” is like the bear market for your project. It’s even harder when your trough of sorrow coincides with a funding bear market.

To survive the “trough of sorrow” and grow into a mature public goods project, you need to build a community and start having real provable impact for those people. This is the phase where community-funding mechanisms like QF and direct grants can be most valuable.

Although most projects won’t raise $100K this way, many should be able to get enough coins to survive and keep going. These mechanisms force projects to have a close ear to the community and generate awareness.

The projects that consistently do the best on Gitcoin grants are ones that have been around and built a reputation, not the ones that announce their presence to the world through Gitcoin. The same is true in our observation for grants on other funding platforms including clr.fund and Giveth.

The best projects mature during this stage with a good reputation in the community for offering a useful public good.

3. Unicorn: the retroactive funding stage

At some point, the project passes an inflection point where it is having much more impact on the ecosystem than it is being fairly compensated for. The hope is this is where large pools of retroactive funding come into play.

Ideally, we will start to see a variety of complementary mechanisms funding these projects. Yield from ETH staking or ETF profits (like Van Eck) being awarded to projects with a strong reputation. Increasing Optimism RetroPGF rounds with allocations decided by a group of badgeholders.

Right now these are mostly technocratic mechanisms, but over time there will hopefully be more bottom-up recurring revenue from public goods projects. Tea.xyz and Drips v2 are different composable ways of funding dependencies. This idea could be extended to any form of public good. The better we get at tracing impact and creating a culture of rewarding upstream impact, the more this could become a viable source of recurring revenue for public goods projects.

Finally, it would be amazing to see the equivalent of X Prizes or large Advance Market Commitments (AMCs) for public goods projects. These could be the equivalent to the public goods IPO. If these types of large retroactive funding mechanisms start to proliferate, then it will encourage more participation during the prospective and community funding stages.

4. Death is (sometimes) a feature, not a bug

Many projects will not reach sustainability, or unicorn status, and will die along the way. On some occasions, this is a feature, not a bug.

When a project fails, it can provide valuable lessons for entrepreneurs, investors, and the wider community. One of the primary lessons is the importance of market need: many projects fail because they create a product or service that doesn’t meet a strong demand. This highlights the necessity of thorough market research and continuous customer feedback. A failing project can also underscore the significance of timing. Even the most innovative ideas need to be timed to when market demand is beginning to happen.

Another key learning is the importance of flexibility and adaptability. Projects often operate in fast-changing environments, and the ability to pivot in response to market changes, customer feedback, or technological advancements can be crucial for survival. Failures also teach about the significance of team dynamics and leadership. A common reason for project failure is internal conflicts or a lack of clear leadership and vision. Thus, building a strong, cohesive team aligned with the startup’s goals is as important as the idea itself.

What is important to us as ecosystem builders is to:

- Do not let projects die because of a lack of funding, if they are on the right path.

- Accelerate the path towards death/retrospective/renewal if a builder is on the wrong path.

- There should be no stigma if projects end up in the graveyard and teams move on. We should especially encourage learnings from these teams to be made public so that future teams do not make the same mistakes.

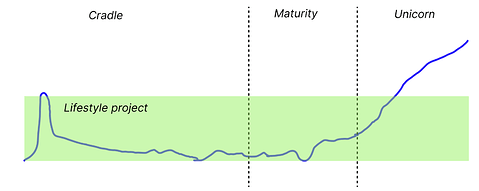

5. Not every successful project needs to be a unicorn.

Perhaps “unicorn or death” is the wrong frame. Many projects don’t want to become a unicorn. In fact, the unicorn worship is a legacy of the VC model where the entire thing hinges on finding a 100x exit that will return your whole fund.

There needs to be the lifestyle-business equivalent of public goods projects - There are opportunities to build tools that are small in scope, and provide immense value, but will never get to exponential growth - world changing/unicorn status.

Recommendations & Open Questions

1. Always grow the pie

One parallel we could draw from the VC / startup is that successful founders can become the next generation of investors.

We could see the present generations unicorns funding the next generation of public goods projects at the cradle stage. This is already happening with projects like 1inch and Uniswap going from being Gitcoin grants recipients to being matching pool donors + donors to protocol guild. This should be encouraged at the social layer.

We could enhance this social layer momentum by creating credible cryptographic commitments to fund the next generation. If each new project that receives funding in their cradle stage issues an EAS attestation that they plan to give 5% of their tokens to the next generation of projects, then that creates a quantifiable future commitment to public goods funding for the next generation.

Opportunities:

- How do we attract the next builders to make high integrity commitments to give back to public goods if they become unicorns?

- How do we build a social movement that makes doing this trendy?

- How can we aggregate these commitments to create credible commitments of future funding?

2. RetroPGF provides the opportunity to converge around the meme “Impact = Profit”

VCs push startups to accelerate and capture as much value as possible. The public goods push should be to create as much value as possible for the ecosystem.

Retroactive Public Goods Funding offers an opportunity to push for a different value capture mechanism that converges on the meme of “impact = profit”.

By introducing Retroactive Public Goods to an ecosystem, we can create a credible commitment to a big monetary payoff for public goods that create the most impact. Since it’s easier to judge quality retroactively than ahead of time, it is much easier to converge on “Impact = profit” retroactively.

But then, prospective public goods funders could change the earlier steps in the funding lifecycle. Allowing speculators to speculate on which public goods are most likely to get a retroactive reward later. Tools that allow users to “angel invest” in public goods earlier in the cycle may begin to create some movement here.

Another opportunity is to create Impact Attestations to credibly track which projects are having the most impact. These impact attestations at scale will form a Web of Trust which allows projects to all attest to each other’s impact. Tools like EAS and hypercerts can provide the foundation for these impact attestations. They become increasingly valuable when whale funders use them as signal detection for what to fund, and they can also be a valuable tool for builders to know that they are on a good path.

Opportunities:

- Build hypercerts/EAS into existing public goods funding projects.

- Build new Impact Attestation services that help people tell the difference between impactful projects vs not impactful projects?

- Build new prospective public goods funding tools that take advantage of future retroactive rewards.

3. Surviving the Cradle Stage

Creating a credible path to surviving the Cradle Stage is the most important unsolved set of problems in this space.

Open questions here include:

- If a builder is failing to attract funding/validation, is that because the ecosystem is broken, or because that builder has not yet found a problem area that is important enough to warrant funding?

- What kinds of safety nets do public goods builders uniquely need? Thinking adversarially: How can these be built such that they won’t be exploited?

- There are definitely some services like legal, back office, recruiting, audits, office hours, etc that all teams need. Will these be key to allowing small teams to be able to be independent on their own?

- Which of these are the services that would be most valuable to builders at the cradle stage? What’s the TAM for each new service in the cradle? If the TAM is large enough, we will begin to see firms pop up that service each of these niches. If the TAM is large enough how can we aggregate DAOs who pool resources to provide those? How do we attract builders to build services to provide these services?

- While grants are a good start, once the devs and the ecosystem work well together, there needs to be a second step to that relationship, one where the dev can feel comfortable and “at home” for the long run. Devs do their best work when we know the protocols in and out and can build long term relationships within an ecosystem. The touch and go model is not great. How do devs transition from point-in-time funding to recurring funding?

4. Are we just reinventing Venture Capital?

In some ways, this ecosystem funding lifecycle can begin to resemble the reinvention of venture capital.

In venture capital, it is common for a fund to accrue a talented roster of developers + other service providers that can assist founders with whatever they need.

We should carry forward what’s working here, but also be mindful of the opportunities available to reinvent these ecosystem services from first principles.

Composable funding models offer the opportunity for builders to have many different sources of capital and services (as opposed to one VC firm).

Retroactive public goods funding offers the opportunity for builders to focus on public goods, not just things that can extract value. Value is captured by the network and fed back into the network.

The supermodularity of web3 systems is also an opportunity. Because smart contracts are anti-rivalrous and accrue value the more people use them, there is an opportunity to provide momentum towards an exponential growth curve earlier on that will pay off later.

Solving this problem is the META

Does solving the “cradle-to-unicorn” public goods funding problem create a new META (most effective tactic available) for crypto ecosystems?

We believe that as crypto matures and fundamentals matter more + more, that funding your ecosystem’s public goods will become a sustainable competitive advantage, in the same way that access to jobs, schools, health care, and recreation are the competitive advantage of cities.

Prosocial behavior has evolved dozens of times independently in economies/natural ecosystems the world over (Wolves hunting prey together, humans banding together to form companies or nations, etc). It seems obvious to us it’ll also evolve into cryptoeconomic systems.

In a sense, it’s already happening with the meme of “Ethereum Alignment”. The projects that adopt a pro-Ethereum mindset and business model enjoy the many privileges of being in a network that supports each other (whether out of altruism or a rational economic interest to see both succeed).

As the ecosystem grows, there is an opportunity to extend this mindset to 1000s of DAOs that proliferate in the Ethereum ecosystem. Each competing for a place to add value in the value chain, these projects will bootstrap pro-social environments within their communities.

In this post, we looked at how to do it across a complete life cycle of a public goods project - from cradle to unicorn or cradle to death.

There are many open questions and opportunities in this design space that we can make progress on in 2024. If you are working on these problems and have something to add, please leave a comment below or in this telegram group.