Since announcing the network shutdown, many have approached me with questions about why the network is shutting down and with a desire to keep it going and transition ownership. While it is important to note that ultimately PGN is an experiment run by the Gitcoin Foundation, and so the decision to wind it down or transition it remains in the Foundation’s hands, I understand that my perspective is valuable, as I was most involved day to day. For that reason, I’m sharing the below in the hopes of explaining why I support a wind down, and with learnings that may be valuable for others building in and around the Public Goods ecosystem. MANY thanks to @sophia for her very valuable input and edits to make this retro as legible and constructive as possible.

Public Goods Network Retrospective & Recommendations

TLDR:

- Key learnings from running PGN

- Criteria needed for potential future success of the network

- Why I am supportive of a successful wind down

We deserve a network dedicated to funding and building public goods. It is my hope that as L2 innovations advance, the vision of PGN will one day be realized. While my idealism believes in a future PGN, my realism knows that its time has not yet arrived, at least not in its current form.

My hope is that sharing this external retro of my time launching and building provides additional context and background on my recommendations to continue winding down the network. It also aims to help everyone understand the process and reasoning behind the difficult decision to end PGN.

Key Learnings from Running PGN

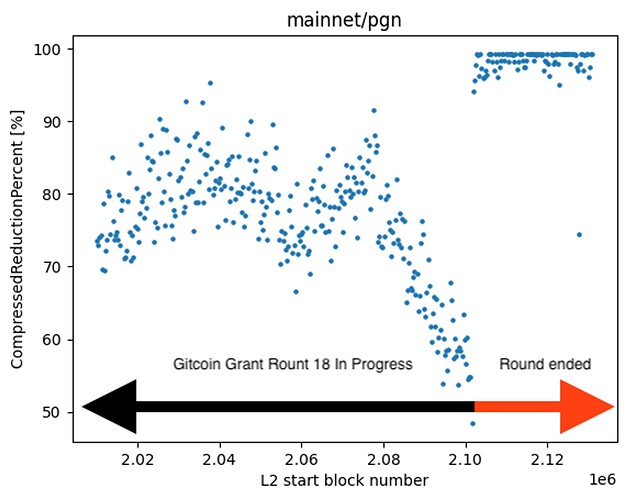

My approach to technology has always focused on users and their experience. I care about users first and foremost, and PGN has attracted communities with a broad spectrum of experiences and resources. While there were certainly (too) many airdrop farmers who bridged and still hold funds on PGN, the largest concentrated spikes of user onboarding occurred during Gitcoin Grants funding rounds, specifically GG18 and especially GG19. These were global grantees and donors who have looked to crypto as a new form and source of funding for their public goods projects. Public goods onchain users deserve an efficient, well-built, reliable, affordable, and accessible platform, perhaps more than any other L2 users.

Because PGN was never able to tap into sufficient resources, we were at a disadvantage in the L2 race for developer talent and dApp development. This led to a subpar user experience. I cannot stand behind the PGN UX for those two grant rounds and say it was high quality.

In particular, I felt that user pain when supporting grantees and donors from around the world with limited funds and limited English proficiency. Bridging and wallets, in particular, did not consistently work well and were expensive. There is still no DEX. For grantees, every dollar counts, and paying $50-100+ on bridging fees and gas was a substantial cost. Similarly for donors, these $50-100 fees swallowed up most of the funds they planned to donate. Moving forward, prioritizing an improved user experience with affordable and accessible tools would be crucial for PGN to better serve its public goods communities.

Criteria Needed for Future Success

While I will go into some of the detailed reasoning behind my thinking, my overarching takeaway is that PGN needed substantial liquid resources in order to survive and provide the experience users deserve. Relying on eventual revenue was insufficient. In retrospect, by not starting with substantial resources, we lost traction (in UX, deployed dApps, liquidity, partnerships, etc.) that we were never able to regain. Although there is interest to transition PGN to a new team, I’m not yet confident that there is a new team that can bring sufficient liquid financial (by my estimate, $500-750k/year) and social capital to the table at the level needed to make this happen.

To be clear, this is not a condemnation for anyone who has been involved at any stage. Everyone who contributed was amazing and so talented, both within the PGN team as well as the many Gitcoin contributors and member organizations. We all gave it our all, and I stand behind the effort, especially given how small our team was. No one was full time, and people were all pitching in however they could. But it wasn’t enough, and ultimately, our users deserve better.

PGN’s Inflection Point

As PGN hit its 6-months landmark, it reached an inflection point. PGN was launched to experiment with new primitives in sequencer fee generation and allocation, grounded in the unique mission of directing all revenue exothermically to public goods at large. Since launch, it accomplished important wins but also faced a few notable challenges that delayed its development.

As one of the first OP-stack superchains to launch, PGN likely launched too early, without critical infrastructure for a successful L2 rollout (ie, liquidity for expanded bridging and DEX use cases). PGN launched before key advancements like EIP-4844 and Celestia DA that drastically reduced data availability (DA) costs from around ~$70k (July - Dec) to ~$2k (Jan - now) per month. Additionally, the Superchain ecosystem itself continues to concurrently mature, meaning that early challenges in bridging and interoperability were not PGN’s alone but nonetheless impacted the PGN experience, user satisfaction, and opinions (ie, Metamask gas calculations, lack of support to run additional RPC nodes, etc.). For those who interacted with PGN and experienced this friction, trust and goodwill were lost. For potential new users, the network will need to meaningfully differentiate itself in the now crowded L2 landscape.

The following summary details my personal perspective on the successes, challenges, and requirements for PGN. While I would love to see a new future for PGN, I still haven’t been assured that there is a team that has all the key factors in place to ensure success. Rather than restarting the PGN experiment and putting users through another challenging experience, I think it’s the humane and correct thing to be strict about PGN’s requirements for success. It is my opinion that PGN and Gitcoin owe it to their community to not greenlight a future PGN unless we are certain these requirements are in place, and that a dedicated and committed organization was prepared to provide these resources and support over the long term.

Criteria 1: Team / Ecosystem

The lack of a dedicated engineering team that could quickly implement necessary infrastructure, identify paths forward with dapps, and implement necessary steps in-house was a major blocker for consistent, meaningful progress toward PGN’s overall goals. As folks looked to adopt PGN, questions on where to find core infrastructure (Graph nodes, Safe contracts, a Safe UI, etc.) were common. Unfortunately we didn’t have the resources to deploy and scale the infra ourselves (nor the financial incentives to woo teams into doing it for us).

The addition of Sophia (originally hired as DevRel and technical integration support) to the team brought much needed attention and acceleration to the technical side of PGN, and allowed us to understand the most efficient strategies to address those technical challenges. I also increased my commitment and focus on PGN, working with partners and Alliance members to establish the foundation for more regular content & narrative discussions while framing a more strategic roadmap for Q1 of 2024. This temporary bump in team capacity and skill showed what might be possible given sustained staffing, especially on the engineering and partnerships side.

Sophia’s direct involvement at conferences significantly deepened relationships with pivotal partners. We were able to secure a few key dependencies at no cost, accomplish the deployment of core dApps, and meaningfully improve community adoption and willingness to deploy and support PGN. This was a strong indicator of the level of commitment that is necessary among a team, which can only be achieved with a full-time team dedicated to PGN.

Requirements:

The minimum viable team members needed to support a successful long-term network would be:

- Protocol Lead - with strong social capital, BD operations, & technical knowledge

- Senior engineer - with strong L2 experience & knowledge

- DevRel / Community Manager - with strong technical skills & relationship building abilities

- Marketing / Growth - with strong writing, PR, and ecosystem knowledge

- Designer - to support marketing efforts as well as frontend UX

In addition, presence at future crypto events is critically necessary in order to maintain PGN as a front of mind competitor in the L2 space and to deepen relationships with key partners. PGN will need to have a sustained presence at crypto events year round, and be featured in speaking engagements at these events, which can be costly. Much of the $500-750k I estimated above would need to go toward staffing and travel, and in my opinion is a non-negotiable criteria for success.

Criteria 2: Alliance / Governance

Alliance members participated consistently in meetings and in modest additional actions such as advocating in forums and amplifying PGN on socials. They provided input towards defining public goods and initial governance for distributing PGN funds, as well as defining the technical dependencies required for deploying on PGN. However, despite their participation, the reality was that the majority of partners were not planning to deploy or fill blockspace on PGN in the near term, primarily due to a lack of omnichain plans, though they did intend to provide meaningful contributions to governance. Alliance members also lacked the capacity to take on larger needs, such as marketing or maintaining documentation.

Although PGN never reached a point where there were funds to govern, it is worth noting that there were and will likely continue to be debates around how these funds should be used and governed. The discussion ranged from completely exothermic (e.g., solely directed to funding external public goods projects - though even there, the question arose of which public goods, for example, climate change vs. diversity initiatives vs. Ethereum infrastructure) to whether a portion (and how much) should be dedicated to developing in-house public goods infrastructure. There was also the question of how much should be directed back to fund the actual PGN team and budget.

For reasons of alignment and funding, PGN never intended to launch a token, but this raised the obvious question of who would then decide these matters and how. There is a draft governance outline and basic recommendations on what a governance structure might look like (e.g., different types of members based on participation types, to decide on fee distribution vs. receive fees), and ultimately, the top priority was to generate revenue so that funds exist to be distributed. This major question will need to be addressed in the long term.

Requirement:

These major questions will need to be addressed in the long term.

- What public goods are being funded?

- How are funds being governed?

- What percentage of funds are reinvested back into PGN?

- Will PGN forever be at a disadvantage if profits are donated?

- Who will provide the necessary liquidity to fund PGN if it doesn’t have future profitable prospects?

Criteria 3: Tech & Infrastructure

During GG19 in November 2023, significant issues hindering PGN became apparent. These friction points prevented PGN from offering a high-quality on-chain experience for users and dApps building on the network. These unresolved challenges significantly compromised both user experience and brand trust. This impact was felt not only by consumers but also by Gitcoin, the largest user of PGN to date. The discovery of these limitations was a key factor in the decision to wind down the network.

Specific technical challenges included:

- Staffing Shortages: Delays were primarily caused by inconsistent staffing, hindering progress on key technical aspects like USDC, Safe UI, a DEX, and improved wallet and bridging options.

- Pacing with Superchain and Law of Chains: Plans to introduce contract-secured revenue as a distinguishing feature for PGN proved to not be possible due to compatibility issues with the Superchain and restrictions from the Law of Chains. Although there were proposals to integrate CSR into the OP Stack, governance processes moved too slowly and there has not been meaningful progress on this to date.

- Integration Deficiencies: There were significant gaps in integrating essential infrastructure, particularly with wallets like Metamask and L2 to L2 bridges such as Socket or Hop, leading to high transaction costs. Additionally, there was a lack of clear communication and guidance for global users on navigating VPNs for interacting with the network.

The OP Labs team provided invaluable assistance, particularly in unblocking the Safe UI deployment. They consistently offered constructive solutions and clear paths forward to address technical challenges through their 2024 Superchain development efforts. Additionally, the Biweekly Builders Call gained consistent momentum, showcasing 1-2 deployed dApps or infrastructure projects each call, highlighting the grassroots growth of the developer community.

While a short-term path to technical maturity for PGN existed in Q1 2024, long-term success hinges on establishing a unique value proposition. This requires not just technical prowess, but also distinct dApp and UI experiences. Currently, the “killer use case” for PGN, the specific types of dApps that would thrive on PGN compared to other networks, remains unclear. While Gitcoin was originally envisioned as a potential anchor tenant, technical challenges and delays have shifted internal priorities. Addressing this unanswered question about PGN’s UVP will be the top priority moving forward.

Requirements:

- Frictionless On-Chain Experience: PGN needs highly functional, accessible bridges, wallets, and decentralized exchanges (DEXs) for a smooth user experience. Ideally, these wouldn’t be standalone solutions but integrated within existing, heavily used platforms.

- Committed Alliance Members: If the Alliance continues, involving members in Builders Calls would foster technical collaboration and identify their needs. This united approach would boost community engagement and ownership within both groups.

- Closer Partnership with Superchain: PGN should establish itself as a key player of the Superchain, collaborating closely with OP Labs, partners, and other Superchains.

- RaaS Provider: A guaranteed budget to pay for RaaS fees for, at minimum, 12 months. This is estimated at around $70k a year ($36k RaaS fee + an estimated $30k of cushion room for DA costs if PGN is not profitable).

- Omnichain Strategy: Exploring an omnichain strategy with Layer Zero could improve accessibility for developers and users by reducing reliance on PGN solely.

- Improved Relationship with Gitcoin: Gitcoin will always be a primary strategic partner. While Gitcoin could eventually provide the onchain volume itself to sustain PGN, there are numerous hurdles to completing this, including lack of required and consistently functional infrastructure, substantial reduction of social capital and goodwill toward PGN by key Gitcoin team members and workstream leaders, and user friction in the PGN experience. As PGN works to address and remove the various challenges that have hindered its progress to-date, it would need to eventually go back to Gitcoin with a clear proposal of how it has improved functionality and accessibility, and how economically it would be beneficial to Gitcoin to return to and prioritize PGN as a top network. However this will only be possible once PGN has established itself as a stronger player technically, and with Alliance backing beyond Gitcoin.

- Finding a “Killer App”: PGN needs to decide if developing a unique in-house killer app is feasible with its resources, and if yes, then what the functions of this app/experience would be. This is still probably the most important question to answer for the future of PGN: what is it that a user can do on PGN that is a better experience and makes more sense on PGN than any other Network. How will PGN differentiate itself not only through its mission to fund public goods, but through its UX and technical development.

Criteria 4: Business Strategy & Financial Prospects

While technical challenges and development are at the core of most of the work, the business model for PGN is where the network has ultimately most suffered, and where quantitatively the need for improvement is most clear. While the rollout of Celestia DA in January reduced costs by 98% and significantly improved financial prospects, PGN would still need to increase its transaction volume from its current 1.5m to 2m monthly transactions in order to consistently break even.

Requirements:

- Financial Resources: A clear runway of funding is needed to support RaaS costs, staffing, infrastructure deployments, builder ecosystem incentives, and other network experiments.

- Incentivizing Adoption: PGN needs to drive increased adoption of transaction-heavy dApps, and financial incentives through airdrops or points could be a compelling strategy. Some other potential ideas include:

- Bootstrapping CSR: Airdrop $5,000 to the addresses that consumed the most blockspace, rewarding responsible resource usage and potentially sparking community engagement.

- Community round incentives: Increase the matching pool for any community running a Gitcoin Grants round under PGN, directly supporting community-driven projects.

- Rewarding early adopters: Airdrop tokens to anyone who creates a PGN Hypercert or mints an NFT on PGN, recognizing and incentivizing pioneering users of the platform.

- Building Brand Authority: PGN would need to continue to build its brand authority and unique narrative through publishing content and amplifying via X, Farcaster, forums and other mediums. This would include co-marketing with Optimism and Superchain partners to build off of the shared brand, visibility and trust of these partners, and through twitter spaces and case studies as well.

- Superchain Partner Engagement: Following discussions with Superchain partners such as Lyra and Mode, it was discussed to hold monthly Superchain partner meetings to share information about relevant the apps, infra, and identify opportunities for coordination, e.g. to synchronize pull requests efforts to infra partners for joint integration as a united Superchain.

Wind Down Plan and Asset Migration:

UPDATED: The PGN team, in cooperation with Conduit and Optimism, is working on the most efficient and affordable method of making assets available post network shutdown, which is still slated for June 2024. We are committed to ensuring that all users are able to receive their funds. We still highly recommend users bridge their assets off the network.

Through conversations with Conduit, our rollup provider, and Optimism, the hope is that as Superchain infrastructure matures, opportunities for seamless asset movement will become available. We are currently exploring options to extend the wind-down date and do not intend to shut down the chain until 99% of assets are bridged off the network. The estimated funding required to extend our contract with Conduit for an additional 12 months is around $70k ($36k RaaS fees + an extra $30k buffer for data availability fees if PGN continues to be unprofitable).

Currently, shutting down without proper bridge infrastructure could lead to the current community assets being frozen or burned. Therefore, we highly recommend renewing our RaaS contract for a year. In the worst-case scenario that PGN continues to be unsuccessful, waiting a year allows us to leverage significantly improved interoperability and infrastructure to minimize the risk of asset loss.

Final Thoughts:

My hope is that this retro and set of requirements gives some insight and visibility into some of the challenges and learnings for what it takes for a successful future for PGN. While my role is now simply as a supportive team member to coordinate the wind down of the network and ensure users are protected, I do not hold any formal decision making authority in this role. I applaud and appreciate the optimism (no pun intended) of public goods champions to seek a future for PGN. I hope that this provides a more thorough understanding of what it would really take to make PGN a success, and a sober outline of the responsibility that anyone would take on as a future steward of the Network.