TL;DR:

Our current public goods funding mechanisms rely on external funding from profits generated from private/club goods (left-quadrant goods). Unlike left-quadrant goods, they don’t have effective feedback loops to capture value from the impact of common/public goods and therefore cannot compete with such goods and create an “Impact = Profit” paradigm. We need to integrate the mechanisms we have with mechanisms that can create effective feedback loops and therefore produce a self-sustainable funding mechanism.

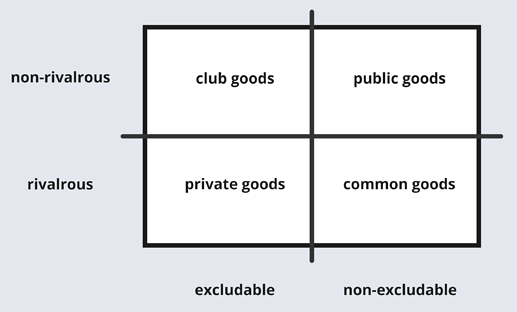

If you ever came across a talk on public goods, you’ve probably seen some version of the chart above. In the bottom left quadrant we have Private Goods, which are rivalrous and excludable (meaning that if you consume the good it’s unavailable to others and that people can be restricted from accessing it). In the top left quadrant we have Club Goods, which are non-rivalrous but excludable (meaning that if you consume a good others can still consume it, but access is still restricted). In the bottom right we have Common Goods, which are rivalrous and non-excludable (diminish with consumption but access can’t be restricted). And finally in the top right quadrant we have Public Goods, which are both non-rivalrous and non-excludable (don’t diminish with use and can’t be restricted from access). Common examples of the different types of goods include food or cars as Private Goods, cable TV as Club Goods, fish stock and forests as Common Goods, and air and information as Public Goods.

So why should this chart keep you up at night? Because it is at the root of most of the crises faced by society today. More precisely, it’s not the types of goods that create the crises but the fact that we currently only have effective economic models for the top and bottom left quadrants. Why is this such a problem? Let me explain.

Instead of thinking of distinct goods that fall within each quadrant, let’s think of just one good: a book. If you’re selling a physical book in the market it is both a rivalrous good and excludable. But you can also have the same content in a digital form and give access to it to your paying subscribers. Then the book becomes a Club Good. You can also donate the physical book to a public library, in which case it becomes a Common Good. Finally, you can put the digital copy online for anyone to download, turning the book into a Public Good. So these quadrants don’t just describe distinct types of goods. They describe strategies for how we produce goods.

Impact = Profit?

If you want to maximize your profits from the book your strategy will be in the top or bottom left quadrants. If you want to maximize the impact of the book on society, your strategy must be up and to the right. If you want to maximize efficient use of resources, you’d also opt for the top right quadrant, since the investment in writing the book is the same in all quadrants but you consume the least amount of resources if the book is digital, and get the most economic impact per unit of input.

Did you notice the problem? While public goods are the most impactful and economically efficient, they are not profitable to produce. Meanwhile, private goods are profitable to produce but they’re a lot less economically efficient and impactful than public goods. This means that people have an economic incentive to produce goods that don’t use resources efficiently and have relatively little impact on society. They also have little to no economic incentive to produce public goods, even if they’re massively beneficial to society.

But it gets worse; to maximize profits, private goods producers may offload some of their costs onto society in the form of negative externalities. This means that while producers make the profits, the rest of society suffers from the negative impact of externalities. So maximizing profits can not merely result in minimum impact, but in a negative impact on society! With advances in technology the negative impact can grow exponentially, and at some point be catastrophic.

If we want to avoid catastrophe, we need a way to align impact and profit. If people have an economic incentive to produce impact, and if greater impact means greater profits, we can move toward a much more prosperous society that uses scarce resources efficiently. It’s not enough to merely have ways to fund public goods. The funding has to be proportionate to the impact, and it has to be comparable to the profits in the top and bottom left quadrants. Without these elements it would still be more profitable to produce private goods with exponential externalities, and so we won’t be able to change our trajectory.

Crypto Funding Mechanisms

Unlike traditional systems, we have mechanisms in the blockchain space that allow more democratic, community-driven, and transparent forms of funding for public goods. These include quadratic funding (QF) and retroactive funding (RF).

The idea in quadratic funding is that projects receiving many small donations from a large number of donors would be matched to a greater extent (by donations from a matching pool) than projects that receive the same amount in donations but from fewer donors. The funds in the matching pool then come from large donors. While QF matches the preferences of the community much better than traditional systems, and creates social dynamics that drive participation, the funding source is still not tied to the impact created by contributors.

If a public goods project created twice as much impact, but donors (who make their money in the top and bottom left quadrants) got less profits this quarter, the project is unlikely to get any more funding. And since there is no feedback loop between the impact projects created and donors’ profits, donors have no incentive to contribute more to matching pools when their profits suffer.

Retroactive funding is a more recent mechanism for public goods funding. The idea is to fund public goods based on realized impact instead of expected impact. Since realized impact is easier to measure, the mechanism can guarantee that projects benefiting a community would receive funding in proportion to their contribution.

While evaluating the impact of projects is a challenge that some of the greatest minds in crypto are trying to resolve, the source of funding is no less of a challenge. That’s because unless the funding is directly tied to the impact created by the public goods (if there is an effective feedback loop between them), we’d still trapped in the old paradigm. Though public goods contributors have an incentive to produce more impactful goods then less impactful ones, they still have an even greater incentive to produce private goods that create little (or even negative) impact.

Feedback Loops

The funding mechanisms we looked at presented ways to take money generated in top and bottom left quadrant work and allocating that money to top right quadrant work. In other words, they rewarded impact from extrinsic sources, not from capturing the intrinsic benefit of the public good to society.

These mechanisms may be better than traditional institutions in determining what the community wants to fund or providing funds based on impact. However they do not create an effective feedback loop where the impact a project generated is captured to then reward contributors. But if we don’t have an effective feedback loop then we don’t have a funding mechanism where creating impact can compete with private sector work. Funding common and public goods from extrinsic left-quadrant sources will not get us a self-sustainable funding mechanism. It cannot compete with left-quadrant economic models with effective feedback loops, and so cannot scale to produce the “impact = profit” paradigm that we yearn for. And without such a funding paradigm we cannot tackle the effect of exponential externalities, and we’re still stuck on the same dystopian trajectory. What then can we do?

The good news is that we don’t have to start from scratch. Well-designed crypto mechanisms tend to be modular and composable; if one part of the mechanism works well but another needs improvement, it may be possible to “swap” the part that needs improvement for a different solution. Both QF and RF are public goods funding solutions that create dynamics that were not possible in traditional systems. We need to build on these to develop a better solution.

Consensus Mechanisms

While no effective feedback loops exist yet for public goods, there is one area where we have a loop that captures that value of common goods, and that is in consensus mechanisms. Bitcoin and Ethereum, the two most prominent blockchain protocols, have funded the common good of network security (miners or stakers following the rules of the protocol and validating transactions while creating new blocks) for over $1 trillion in value. That is a few orders of magnitude larger than any other crypto public funding mechanism!

Network security is a common good because while anyone can benefit from using the blockchain permissionlessly, it is a good that needs to be provided continuously, and therefore consumes resources over time (rivalrous). And yet, the funding for this common good comes from currency inflation within the protocol. It doesn’t come from government taxation, donations, or other ways of transferring value from the left quadrants.

What gives value to the cryptocurrency is its supply and demand. So if more currency is produced to pay for network security it has to be balanced by either increased demand for the network or “sinks” that decrease money supply in other ways.

The Path Forward

We still don’t know what is the optimal issuance formula to reward network security. It is clear however that if we want a self-sustainable model for funding common and public goods we should be looking a lot closer at consensus mechanisms, since these are the only mechanisms currently creating effective feedback loops for right quadrant work. If we harness the power of the consensus mechanism, and combine it with other mechanisms, we will likely be able to progressively expand impact-based common and public goods funding until we can eventually fund any kind of common and public good.

Since the impact of any public good on an ecosystem cannot be simply hardcoded into the protocol, we will certainly need to integrate the system with other mechanisms; We would need to gauge social consensus, prevent bad actors from gaming the system, deal with sybil attacks, and so on. Solving these problems will be undoubtedly challenging, but it is worth the effort if we can get closer to the goal of sustainably funding public goods and aligning impact with profits.