Summary

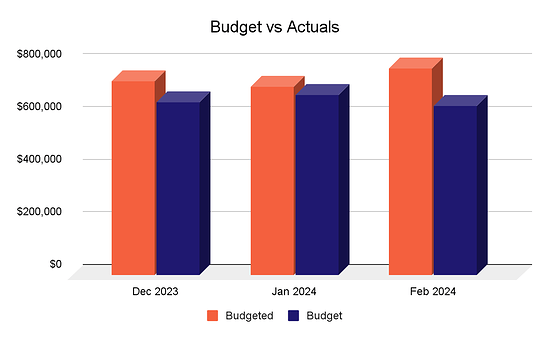

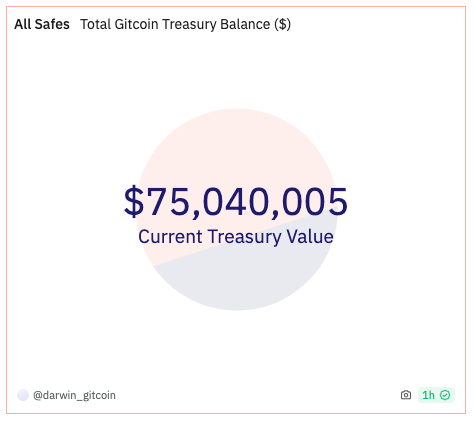

February 2024 kicked off Season 21 for our organization, signaling a period of strategic reorganization and financial strength. During this transition, the DAO skillfully managed to enhance its financial standing, with the treasury value soaring to $75,372,436. Notably, this surge was driven by a remarkable 26.11% increase in the GTC token price (from $1.63 to $2.06), highlighting the confidence in our ecosystem. Operational expenses for the month totaled $642,359, demonstrating an impressive 8.23% reduction from our targeted budget, reflecting our commitment to fiscal responsibility. In this report, we provide a comprehensive overview of our financial performance for February 2024, emphasizing key metrics, budgetary analysis, and the strategic pathways guiding our future endeavors.

- Last Month’s Treasury Holdings: $57,981,399

- Current Treasury Holdings: $75,040,005 (Includes both stablecoin and GTC holdings)

- Variance (+$17,058,606 - 29.42%): Mainly driven by the favorable effect on GTC token holdings, with a notable 26.11% increase in value, alongside a reduction in monthly operating expenses across all workstreams, amounting to -$642,359.

- Budget Variance: 18.43% lower than the targeted budget

Runway

The treasury’s GTC holdings have experienced a surge in value, with the price of GTC rising to an average of $1.851963 per token over the past 30 days. Consequently, our Runway has significantly expanded to 95 months, reflecting the treasury’s remarkable growth trajectory.

As of the latest assessment, the total GTC held in the treasury amounted to $61,564,867, with each token averaging $1.851963 in value. Presently valued at $68,148,211, this underscores the substantial impact of GTC’s performance on our financial reserves.

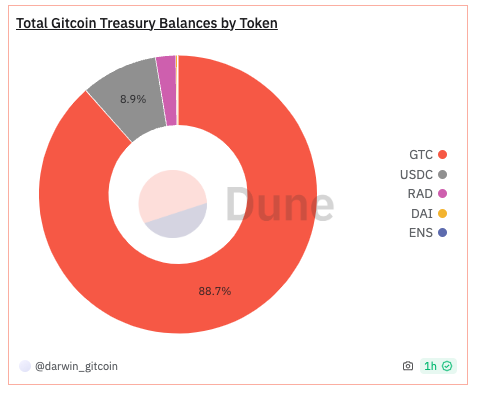

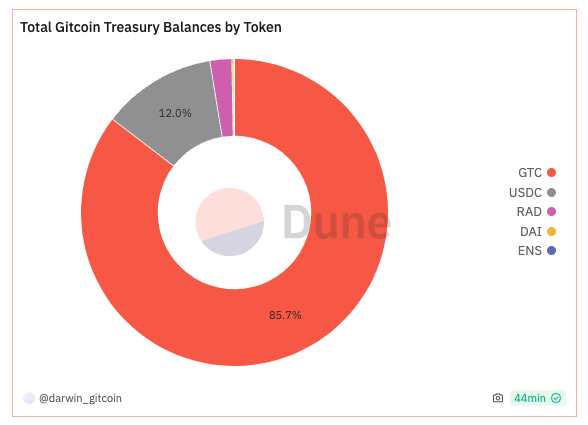

Our current reliance on GTC stands at 90.89%, emphasizing the significant influence of this token’s performance on our treasury. To mitigate associated risks and ensure financial resilience amidst market fluctuations, diligent monitoring and exploration of strategies to diversify our treasury holdings are imperative.

Last Month’s Expenditure: $642,359, which is a commendable 8.23% ($57,641) below our targeted budget of $700,000. This disciplined adherence to the budget further strengthens our commitment to efficient resource allocation.

*March **

- Figures ran on March 15 2024

*February **

- Figures ran on February 20 2024

Token spend in February

During February, our total expenditure in USD reached $642,359. This breakdown comprises $534,979 in USDC, 28,751 GTC valued at $44,996, and $62,385 in USD on Rain.

Key Financial Insights February

Total Contributor Costs

- The total expenses associated with contributors, encompassing both full-time team members and part-time support (including headcount and external consultants), stand at $554,352. This marks a decrease of -$96,615, translating to a -14.84% reduction compared to the preceding period. It’s noteworthy that amidst ongoing reorganization, headcount costs experienced a rise due to severance payments. Additionally, the revised budgets for Grants Lab and Passport incorporate allocations for open positions, which may be filled during this season. Nonetheless, despite these adjustments, we have successfully maintained expenditures within the original budgetary framework.

Other Notable Operating Expenses

- There were no significant expenses recorded in February that required a detailed breakdown.

- Software & Subscriptions: $19,815. 15.02% under budget ($23,317).

- Travel, Lodging, and Meals: $10,681. 16.77% under budget ($12,833).

- General and Administrative: $57,511. 42.69% under budget ($100,347).

This breakdown shows how we’ve saved a lot across different expense categories, sticking to our goal of spending wisely and efficiently.

Also, MMM took care of paying for expenses related to ETHDenver, covering about $26,166 in February. Remember, this spending should technically come out of the total budget set aside for the ETHDenver event, which is $71,750. This detail is important when we’re evaluating how well the Work Stream (WS) and the DAO as a whole are doing.

Summary

| Actuals | Budget | Variance | % Difference | |

|---|---|---|---|---|

| February | $642,359 | $787,465 | -$145,106 | -18.43% |

Monthly Breakdown

February

| Actuals | Budget | Variance | % Difference | |

|---|---|---|---|---|

| Headcount | $531,151 | $581,037 | -$49,885 | -8.59% |

| Other Consultants | $23,201 | $69,931 | -$46,730 | -66.82% |

| Software & Subscriptions | $19,815 | $23,317 | -$3,502 | -15.02% |

| Travel, Lodging and Meals | $10,681 | $12,833 | -$2,152 | -16.77% |

| General and Administrative | $57,511 | $100,347 | -$42,836 | -42.69% |

Break down by business unit / work-stream:

Merchandising, Memes, and Marketing. As the work-stream approached its conclusion, expenditures from the Multi-signature wallet totaled $115,137, encompassing the disbursement for ETHDenver amounting to $26,166. Consequently, the net expenses attributable to MMM activities in February amounted to $88,972.

Within the Grants Lab business unit, expenditures totaled $336,912 out of a budgeted allocation of $412,009, resulting in a surplus of $75,097.

Meanwhile, the Passport business unit expended $189,139 out of a budget of $218,024, leaving $28,884 unutilized from their approved budget.