I support this proposal. If $GTC needs to do justice to its investors this needs to be done. I’d like more such proposals to flow through as I hold these GTC

Thank you all for sharing your thoughts so promptly! We’re glad so many of you see value in the strategies we’re proposing, and very much appreciate the kind words some of you’ve shared.

Addressing some comments below:

Thank you @SEEDGov for your support. We’d be happy to discuss GTC liquidity and assist the DAO in any way we can.

Thank you @robioreefeco for taking the time to review our proposal and provide your feedback.

We wanted to address your points below, as we believe many of them are already covered within the proposal.

- Smart Contract/Protocol Risks: We understand that smart contract risk is a fundamental aspect of engaging with blockchain technology and DeFi, it is also kind of the whole point and thus difficult to avoid. Both Enzyme and MYSO are battle-tested and well-audited protocols. If we were to avoid established smart contract protocols entirely, there would be very limited avenues. See below for more context:

-

Covered Call Risks: The “GTC Strategy” section, particularly under “Strike and Expiry Selection,” details how we intend to mitigate the risk of losing tokens at an undervalued strike price. Our strategy involves setting strike prices far above the current market price (120-150% depending on short/longer duration) and continuously rolling over the strategy. The goal is to earn yield with a minimal probability of conversion.

-

Liquidity Management/Governance Oversight The “USDC Strategy” section, under “Avantgarde DeFi Yield Vault”, specifically addresses the withdrawal process and we further elaborate on this and the governance/oversight mechanisms under the “Implementation and Execution” section; which includes the use of a separate Avatar safe controlled by the Gitcoin Governor contract and a 2 out of 5 multisig with representatives from Avantgarde, MYSO, PGov, Tane, and SEEDGov, outlining the permissions and controls in place for managing the treasury assets.

-

Provide Backtesting/Risk Management: As mentioned in the “Proposed Covered Call Strategy” section, we have conducted backtesting on GTC’s price history and included a link to the detailed backtesting analysis within that section, as well as a link to what we believe are the most relevant points on covered call risk management. See below:

We hope this clarifies the points you raised. We are confident that the strategies offer a balanced and safe way to generating yield on the Gitcoin DAO treasury while prioritising risk management.

Thank you again for your feedback, and we welcome further discussion.

I agree with the notion that DAO treasury should diversify it’s revenue stream.

Thank you for the proposal, @Avantgrade.

We appreciate your efforts in advancing the DAO’s treasury management strategy, a crucial step for its sustainability. We weren’t heavily involved in the discussions for SGTM 002 and SGTM 003, but we recognize their importance and agree that further progress is necessary.

We appreciate the goal and the general idea, and let us share some questions for better clarity.

1.Following the approach in SGTM 002(for the Matching Pool), was increasing the treasury’s ETH allocation to capture staking yields considered? If this path wasn’t chosen, could you elaborate on the rationale behind that decision?

2.Regarding the USDC strategy, we would love to know how the 7.5% performance fee can be justified, especially when compared with other platforms. We also ask how the 7-15% target APY is realistic, considering the linked Enzyme vault’s current performance (~5% APY).

3.We are also a bit skeptical about the GTC covered call strategy. With GTC only ~20% of the treasury while it’s critical to include the native token strategy for other DAOs like Compound and Arbitrum, is the risk of reducing this allocation necessary? We also might need to define the target/goal of the treasury management strategy and should discuss if GTC strategy is indeed needed to meet our goals?

For instance, deploying $5M USDC out of the $7M currently held in this wallet at a 10% APY could potentially generate $500k per year based on simple calculation.

While it’s clear that income from treasury management alone is unlikely to cover all DAO expenses, this $500k could cover the majority of the estimated $609k needed for DAO operations, as detailed here.

Additionally, we face potential issues: if our own DAO initiatives significantly increase the GTC price, the strategy could force sales, conflicting with our long-term holding goals. We should also consider the risk that effectively repurchasing GTC later (e.g., through the planned put options) might not always work out smoothly or as expected.

Therefore, we should clearly define target GTC holdings and establish a minimum threshold. If our holdings fall below this minimum, it should prompt us to review and potentially adjust our overall treasury management strategy, including how we utilize options.

Thank you @Tane for your thorough feedback. We clarify the points you bring up below:

Regarding increasing the treasury’s ETH allocation for staking yields:

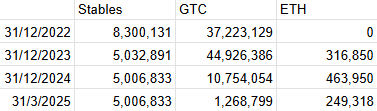

There are different considerations for the allocation of the Matching Pool, which does not have the same starting composition and also has its own cashflow needs. We believe that the treasury was too volatile in the past based on the adverse reaction of the community to price moves that can be considered normal and within the bounds of statistical expectations given the volatility of the assets involved (see year-over-year changes in USD terms below).

While the balance between different assets in the treasury could naturally change with organic price moves back to where stablecoins again represent a smaller portion of the overall portfolio, we feel the priority right now should still be on managing risk and not increasing it.

Regarding the USDC strategy, the 7.5% performance fee and 7-15% target APY:

A 7.5% performance fee is lower than many similar strategies in this space, especially considering this is an actively managed strategy (that adapts to changing market conditions to optimise yield while adhering to a conservative risk profile).

Regarding performance, the target APY is based on historical yields and ultimately the yield environment across DeFi during the holding period will be a large driver. DeFi yields are inherently dynamic and fluctuate based on market conditions, protocol incentives, and overall demand for borrowing and lending. The 7-15% range reflects our realistic expectations considering historical data and potential market scenarios. We shared a couple of charts in the proposal illustrating the volatility of these yields over time, please find them here.

On the performance of the linked Enzyme vault, whilst this does follow the same strategy from risk perspective as the proposed vault, the existing structure was built with a different architecture (it powers a regulated fund vehicle) and accordingly the realised performance figures include a number of offchain costs - the proposed vault used for this prop is fully onchain and will not include these costs (which have made up ~50% of the regulated fund’s total expenses incurred since inception).

Regarding the GTC strategy:

We believe this strategy allows us to generate valuable yield on an otherwise idle asset in a way that aligns with the DAO’s long-term goals and improves the DAO’s financial sustainability. To reiterate, our intention with the GTC strategy is solely to generate yield on our existing holdings on an ongoing basis, with no intention to sell GTC outright. Yes there will be a small 5-10% probability of hitting strike prices and converting in the short-term, but again we have means of rotating back into GTC and even earn additional yield in the meantime, so we believe the “risk” associated with an unlikely but still possible conversion is being overplayed.

We acknowledge your points about GTC representing ~20% of the treasury but also understand the DAO’s need to improve its financial situation. The $609k cited for operations doesn’t encompass all budget requirements as far as we understand it, and the $5M USDC will likely be drawn upon for Foundation operations and other needs.

Regarding DAO initiatives increasing the GTC price, we obviously share your enthusiasm for DAO initiatives that could achieve this. We work closely with the Foundation and the DAO and would be thrilled to see such success come this way. As outlined in the proposal, we will continuously monitor market conditions and the impact of Gitcoin’s initiatives to adjust the covered call parameters (strike prices and expiry) accordingly to ensure the strategy remains aligned with the DAO’s long-term holding goals.

We do want to address what appears to be a misconception that sales are forced when in reality strike prices and expiry dates can be set according to the DAO’s needs and preferences. Again, we will work with parameters where the probability of conversion is low, and set strikes at a comfortable distance from the current spot price.

To further illustrate with an example, if a covered call was set with a 30-day expiry and a 130% strike, and the premium was 2%, then if GTC increases by 30% after 30 days, there’s no foregone upside. In fact, the DAO is better off, having converted at 130% of the spot price and also earned 2%. If GTC rallied by 35% in 30 days, the foregone upside would be “just” 3% (conversion at 130% plus 2% earned vs. the 135% spot price increase).

So conversion doesn’t necessarily lead to an inferior outcome than simply holding, and secondly, one can accommodate and integrate price views into the strategy by setting strikes accordingly. Historically, a short-term rally of the magnitude needed to hit the simulated strikes is improbable according to the backtesting. Even in the event of such a rally, the DAO would realise a profit at a significantly higher price point, which would likely be viewed positively given the current financial situation.

You are correct that writing put options doesn’t guarantee the repurchase of GTC if the strike price is not reached—but again, these parameters are adjustable and we can set strike prices and expiries with strong probability of execution. If the DAO for some reason would be in dire need of immediately acquiring additional GTC, we could just outright buy it. But since we believe there would be no need for such a rush, we could buyback at shorter duration intervals (say 7, 14, 30 days) to allow the DAO to earn additional yield on the stablecoins while having the option to buy back GTC at a predetermined price.

Regarding your example of deploying $5M USDC at a 10% APY generating $500k per year, while the simple calculation is correct, it’s important to note that current average yields on, for example, Aave are closer to 5%—though we aim to outperform these baseline rates through strategic allocation and active management.

Lastly, we agree that defining target GTC holdings and establishing a minimum threshold is a valuable consideration for the overall treasury management strategy. We are in ongoing discussions with the Foundation, and the efficient, value-aligned management of the GTC holdings remains a key priority.

Let us know if you need any further clarifications!

@Avantgarde Thank you for this amazing proposal. It seems 10% APR on Stable coin is little too high in my opinion. Since it’s a large sums of assets we are investing, why not create our own protocol for Gitcoin and develop strategies around GTC, It would be great for attracting external investors as well. And We the Gitcoin community can rally behind it with our own fund, jus saying !! ![]()

- Research

- Development of Staking Protocol ( with good strategies and good APR% )

- Deployment

Thank you, @Avantgarde for addressing our earlier questions and concerns. The detailed responses provided have effectively clarified most of the points raised, and we greatly appreciate the transparency.

In conclusion, we support this proposal. Given Gitcoin’s current financial situation, pursuing additional yield through the outlined treasury management strategy is both prudent and justified. The risks you’ve explained appear acceptable and manageable within reasonable control measures.

This aspect is essential for the effectiveness of the overall treasury management strategy, and we look forward to further clarity on this point in future discussions or updates.

Snapshot vote is live: https://snapshot.box/#/s:gitcoindao.eth/proposal/0xcf00de512cb500c78178a32db3a93528d7b5983d51105c5372151867eaeb1dce

Gm community - We’re happy to say that the proposal passed with 99.99% of votes in favour! Thank you to everyone that took the time to vote, we greatly value the support and trust placed in us, and aim to deliver the best results possible for the Gitcoin DAO.

Next steps involve setting up the infrastructure as outline here, followed by an onchain Tally vote to move the assets to be managed into the Avatar safe so that we can begin executing on the strategy. We’ve already started the process and hope to have the proposal ready later next week or shortly thereafter given the upcoming Easter holiday.

We’ll be back with an update once the proposal has been queued on Tally.

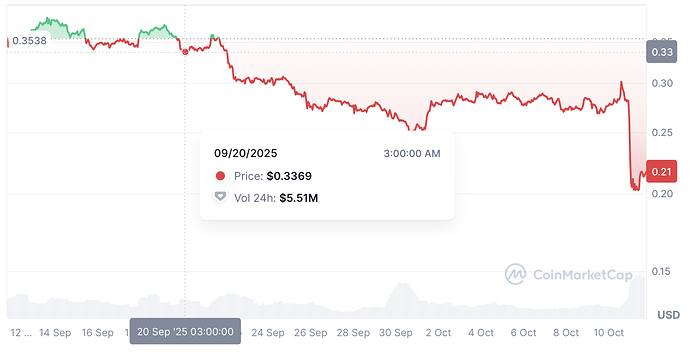

Now please work on getting the price up to some respectable levels. Investors in GTC have been hammered very badly that a $28 token is down to $0.33 as of today. GTC needs to be a top 100 token and I think Avantgarde is more than capable of doing it

Thank you @Recce for your feedback and for expressing your concerns about the GTC price. We understand the frustration of seeing the token’s value decline significantly. However, it’s important to clarify that the strategies and overall mandate focuses on prudent treasury management – specifically, generating yield on idle assets to grow the reserves and improve the DAO’s financial sustainability.

Actively pushing the token price upwards is not within the scope of treasury management. Token price is primarily driven by market forces, adoption, and overall sentiment, which are influenced by a wide range of factors beyond the direct control of us as a treasury manager. Our expertise lies in responsible asset deployment and risk management to improve the long-term financial health of the DAO, which we believe ultimately contributes to the ecosystem’s strength and potential for future value appreciation.

Would recommend engaging with the various threads and posts on GTC utility highlighted by @owocki in this thread here for more context on the work being done re GTC utility etc.

Gm Gitcoin community!

Following the passing of the Snapshot temp check, the onchain Tally proposal has been queued and voting starts in less than 24hrs and ends early Wednesday next week.

We’re mindful of the various public holidays taking place across the world today, tomorrow and Monday next week, and would greatly appreciate if delegates can find the time to get votes in sooner rather than later.

Thank you all, we look forward to start executing on these strategies!

Gm and thank you to everyone that supported the proposal and helping it get over the quorum line - exciting to see all the new Stewards voting!

As soon as the proposal has been executed, we will allocate the funds as outlined. More updates to follow soon!

![]() In Favor I fully support this proposal. Activating idle treasury assets to earn yield in a sustainable way is a smart move. It aligns with long-term financial health without compromising the tokens. Excited to see Gitcoin lead by example in responsible DeFi.

In Favor I fully support this proposal. Activating idle treasury assets to earn yield in a sustainable way is a smart move. It aligns with long-term financial health without compromising the tokens. Excited to see Gitcoin lead by example in responsible DeFi.

Gm Gitcoin community.

After having deployed the SGTM 004 assets in late June, July was the first full month for the deployed strategies outlined above. As a reminder, 5M USDC were deposited into Avantgarde’s DeFi Yield Vault on Enzyme, and another 1.6M GTC were deployed into a covered call strategy on MYSO.

Below we provide the first update and will continue to do so here in this thread on a monthly cadence.

July Update

The 1,600,000 GTC deployed into a covered call strategy via MYSO resulted in a premium of 10,072 USDC, which were subsequently deposited into the same DeFi Yield Vault as the 5M USDC. The covered call expires on 21st of September, at which point the strategy can be rolled over, depending on the call’s outcome.

The DeFi Yield Vault saw an increase of 0.47% (or 5.8% annualised) in July. After a muted period for stablecoin yields which saw the supply rates of USDC on Aave struggle below 4%, the environment has shifted in the last week with a significant uptick in risk appetite following positive regulatory news in the US.

The vault has taken the opportunity to reposition into higher yielding opportunities, within the context of its focus on large and battle tested protocols with high capacity. Expected returns have increased, with a portion of the portfolio fixed at 10% until September, and an increased allocation to USDC lending on Morpho, which is currently yielding 9%.

I was in favor of this proposal and love to follow these updates. The utilization of sustainable DeFi strategies being employed is a pleasure to see for a ReFi public goods funding platform and DAO like ours.

August Update

The DeFi Yield Vault saw an increase of 0.79% (9.92% annualised) in August. Risk appetite saw wild swings during the month, as ETH reached a new all time high before retracing over 10% into the end of the month. Funding rates whipsawed in tandem with price action, ending the period relatively subdued. Stablecoin yields remained healthy and the strategy maintained its positioning through the volatility, having secured a portion of the portfolio at a fixed 10.5% at the end of July and earned an average of 9.4% on the floating rate component through the period. The vault continues to focus on large and battle-tested protocols with high capacity and will look to adjust positioning into the end of September and redeploy capital as current positions mature.

September Update

The DeFi Yield Vault saw an increase of 0.78% in September. Crypto prices moved higher in the first half of the month with ETH peaking at 4760 before moving into a period of choppy price action into month end. Funding rates followed an intuitive pattern, as strong risk appetite gave way to muted leverage demand as prices declined in the last two weeks of September. Stablecoin yields remained healthy through the majority of the period and the strategy continued to benefit from its allocation to fixed yield into the positions expiry in the last week of September. Opportunities were more muted in the last week, with the vault maintaining more exposure to floating rates until better fixed yields present themselves

With the market rallying in the summer, GTC also saw price go higher, from 0.203 in late June up to as high as 0.45 in mid August. This rally saw the covered call on 1,600,000 GTC exercised at a strike price of $0.3334 per GTC, yielding $533,203 USDC for the DAO (see this link for full details). Since then, prices have come down to $0.2163 as of October 11th. After checking in with the Gitcoin team, the acquired $533k USDC will be deposited into the DeFi Yield Vault alongside the other ~$5M USDC to earn yield. Should the DAO have a strong preference to instead utilise the USDC as collateral to buyback GTC via cash-secured puts, we’re happy to consider and elaborate on that further.

As of today, the Avatar safe holds roughly $5,533,000 USDC.

October Update

October proved to be a historic test for the crypto space, breaking the multi-year “Uptober” trend, including the severe flash crash on 10/10, which triggered a record level of liquidations across the space. The DeFi Yield Vault, where the DAO’s stablecoins are currently allocated, saw an increase of 0.19% over the month (2.30% APY), as risk appetite and leverage demand waned, compressing yields in the second half of the month. Against this environment, the strategy took the opportunity to adjust positioning, increasing the allocation to attractive fixed yield positions against a backdrop of declining risk sentiment.

November 6th Addendum

- The first week of November has seen significant volatility in prices and also a number of notable events within DeFi.

- The Avantgarde DeFi Yield Vault has no direct exposure to the Balancer v2 exploit, no direct exposure xUSD, no direct exposure to the Moonwell exploit, and no direct exposure to Compound comets

- There is heightened volatility and large shifts in liquidity as markets continue to digest these events. We continue to monitor second order effects closely and our current assessment is that any potential secondary impacts at the strategy level are small and contained.

- Whilst risk is elevated, there have also been significant opportunities in otherwise sound markets that are impacted by this short term liquidity squeeze, leading to spikes in yield and abnormally high returns for those in a position to take the other side. Avantgarde has retained a high level of liquidity, which enables us to take a balanced approach in this environment, through a combination of controlled de-risking and measured allocations to capture opportunities from short term dislocations.

Dear Gitcoin community, given recent events and as a follow-up to the November 6th addendum, we are here providing another update:

As you may be aware, the market was shaken by recent events surrounding Stream Finance and its yield strategy xUSD, which announced a $93 million loss last week and subsequently halted all withdrawals. Among other things, this event had an immediate and severe domino effect on Elixir, which had significant exposure to Stream. The loss of this backing caused Elixir’s deUSD stablecoin to de-peg and collapse, evaporating liquidity across the ecosystem and preventing withdrawals on underlying Morpho vaults, impacting a number of players in the space.

Our vaults had zero direct exposure to xUSD, nor did we have exposure to any Morpho markets where xUSD was used as collateral. The primary knock-on effect we have been monitoring is with Elixir’s deUSD, as Elixir (the entity) has lending exposure to Stream. Due to the uncertainty surrounding Elixir’s exposure to Stream, the sdeUSD market on Morpho became illiquid, with all supply being borrowed. The Avantgarde USDC Morpho vault had a ~2% position, allocated to lending USDC to the sdeUSD market on Morpho. Due to our internal risk management framework and portfolio constraints at each allocation layer, the lookthrough exposure to the affected Morpho market was limited to ~1% in the DeFi Yield Vault where the DAO is invested.

To prevent the position from growing as it accrues an exponential amount of interest and protect against further impact, we redeemed the liquid ~98% of the vault’s assets from this specific Morpho vault to segregate the funds while leaving the distressed 2% exposure to the sdeUSD market contained within the Morpho vault contract. That 98% liquid component has been moved to Aave as a temporary, defensive measure where they are currently earning a safe baseline yield, pending redeployment into the new, upgraded Morpho v2 vaults which we had already been in the process of building a migration plan for.

Segregating the funds ensures that all future on-chain accounting for the main, healthy portion of the vault is accurate and, importantly, enables the DAO to retain their full claim on any potential recovery value from the isolated 2% position. The resolution of the sdeUSD position remains unclear. If the loan is repaid (the 2% exposure), there is potential upside as Stream’s debt grows (currently accruing a yield north of 200% APR), though this recovery remains highly uncertain.

We will continue to monitor the situation and will update the DAO if any recovery becomes possible. Thank you for your continued trust in us, we are proud to be serving the Gitcoin community.