Avantgarde x Gitcoin: Strategic Asset Management for the Matching Pool

Summary

As of today December 2nd, just under $24m worth of assets (mainly ETH and WETH) are sitting in the Gitcoin matching pool without a structured process around asset allocation and are currently in unproductive assets. Unlocking the potential of these assets is essential to support the program in expanding community funding capabilities and enabling Gitcoin’s ambition of reaching a $50 million Gross Marketplace Value through high-impact grants that catalyze ecosystem growth.

In this proposal, we put forward a path to making these assets productive and implementing a strategy that can support Gitcoin’s long-term goals.

Intro

This proposal outlines a clear path for the Gitcoin community to enhance the productivity of the Matching Pool, providing:

- A recommended strategy for allocating assets between growth-oriented assets (e.g., ETH) and stable assets to support Gitcoin’s long-term grant-making goals.

- A rationale for prioritizing the growth strategy (70% ETH / 30% Stablecoins) as the default allocation, given its potential to grow grant funding while maintaining flexibility to adapt over time.

The strategy will be implemented transparently and non-custodially, in collaboration with Avantgarde Finance, ensuring alignment with Gitcoin’s mission and adaptability to future market developments.

Avantgarde is a crypto native asset management firm that caters primarily to DAOs, foundations and protocols, specializing in natively run on-chain asset management, leveraging DeFi protocols and tools to build solutions for clients. Our company is headquartered in London with operations in the UAE, Bahamas and Panama.

Avantgarde has been active in DeFi since 2016, notably as co-founders of the onchain asset management protocol Enzyme, and brings decades of experience from reputable TradFi firms to help DAOs and Foundations optimize treasury management strategies, improve financial sustainability, and support long-term growth. Past and current clients include Uniswap, Arbitrum, Safe, Gitcoin, Nexus Mutual, amongst others.

Strategic Asset Allocation (SAA)

Having a higher allocation to ETH and other growth assets can improve the average expected outcome, but also leads to more negative outcomes in the event crypto prices perform poorly over the holding period. The strategy asset allocation decision should trade off the need to preserve capital to meet near term grant spending versus the desire to grow the level of grant spending over the longer term.

Current Position

Over 97% of the matching pool is currently in ETH, WETH, and other long tail assets including ENS, and memecoins such as AKITA INU.

Options across the Risk Spectrum

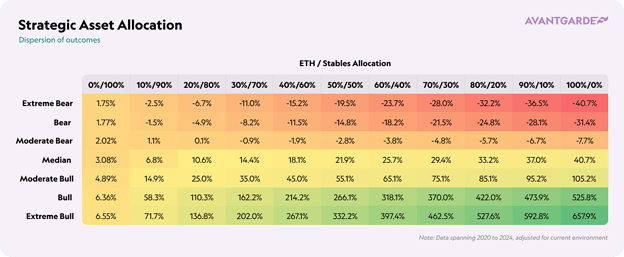

The Strategic Asset Allocation (SAA) framework spans a range of approaches across the risk / return spectrum. Without a crystal ball, the optimal allocation depends on risk tolerance and the desired tradeoff between growth potential and potential worst case scenarios. Using historical data on ETH and stablecoin yields, the table below illustrates the potential distribution of 1-year returns across various market environments for allocations ranging from 0% ETH / 100% Stablecoins to 100% ETH / 0% Stablecoins.

We show that the median return increases with higher allocations to ETH in a bull market, with the bear cases all having an increasingly negative outcome with a higher allocation to growth assets.

(Source: Avantgarde, CoinGecko, DeFiLlama)

To provide a clear understanding of the spectrum, we categorize the SAA options as follows:

- Conservative (30% ETH / 70% Stablecoins): Prioritizes stability while incorporating some exposure to growth assets for modest upside potential.

- Moderate (50% ETH / 50% Stablecoins): Balances growth and stability, offering a middle-ground approach for those seeking a mix of risk and reward.

- Growth (70% ETH / 30% Stablecoins): Emphasizes growth while maintaining some stability to manage liquidity and downside risks.

- Aggressive (100% ETH / 0% Stablecoins): Fully allocates to growth assets for maximum upside potential but is highly vulnerable to market downturns.

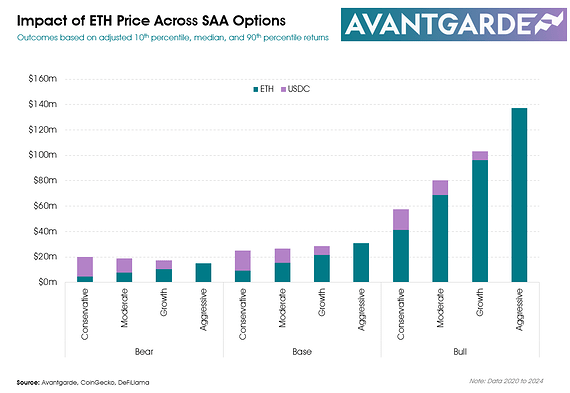

The chart below illustrates the potential impact of price movements on the value of the matching pool for different allocation options across different market environments (note this does not take into account potential grant spending nor yield generated from market selection).

Market Selection (MS)

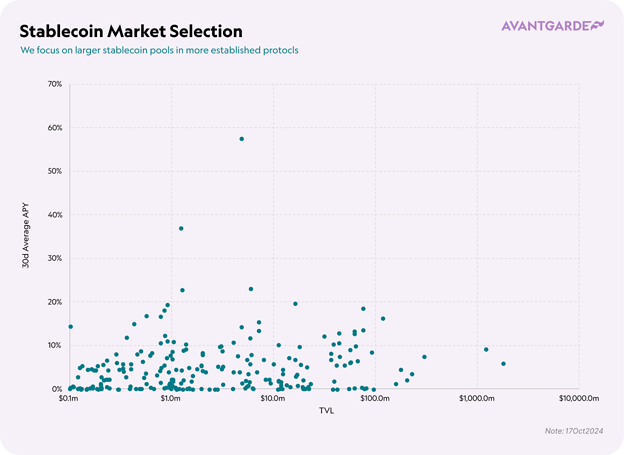

Given the pace at which DeFi evolves, we feel it is impractical to fix the exact portfolio of markets to allocate to within governance, as yields move quickly and require dynamic allocation. Instead, we propose return objectives for allocations within each category, battle-tested protocols for the most part, while retaining some flexibility for measured allocations to more dynamic opportunities in recognition that the opportunity set could change significantly over the course of the investment horizon. This approach ensures that the Matching Pool remains securely positioned while still able to take advantage of shifts in the market to optimize returns.

Growth Assets Category

The soft objective for the growth asset category is to outperform ETH.

Current Position

Roughly $15.5m of the total pool (~85%) is at the time of writing in ETH or WETH. Another $2.2m (12% of total) are in other long tail assets including ENS, and memecoins such as AKITA INU.

As discussed above, the majority of the return in this category will be driven by price movements. That said, we will also look to deploy strategies to enhance returns over and above the base performance of ETH.

Proposed Solutions

For the core allocation within the growth assets category, we will look to allocate to staking ETH strategies, focusing on the larger and well established protocols. Though there are a number of innovations within ETH staking across the risk spectrum, as highlighted in the SAA section, levels of yield have been low relative to the price volatility of ETH. Hence we will run a lower risk approach focused on capital preservation for the majority of the ETH allocation.

However, depending on the opportunity set provided by the market environment, we will look to maintain flexibility within the growth assets category to allocate a proportion to higher yielding positions and/or to diversify ETH price risk, within the context of well established and battle tested protocols. This could include measured exposure to non-ETH tokens such as BTC and other bluechip projects within the Ethereum ecosystem, or strategies such as looping on liquid staking tokens.

Stablecoins Category

The soft objective for the stablecoin category is to outperform USDC.

Current Position

The Matching Pool currently only contains ~$470k in stablecoins, less than 2.6% of the total portfolio. The majority of these are not currently productive assets and not earning any revenue.

Proposed Solutions

Allocate to the stablecoin pools across DeFi, focusing on the largest and most battle tested protocols whilst focusing on diversification, looking to earn a higher yield than sDAI (and/or sUSDS).

We believe this objective is achievable based on realised performance of strategies we have run in practice and also the observed opportunity set across large and well established DeFi protocols including: Aave, Compound, Curve, Ethena, Pendle, Maker, Morpho, Spark, and Uniswap.

Source: Avantgarde, DeFiLlama

As per the Strategic Asset Allocation section, we recognise that the primary roles for stablecoins are to reduce volatility and to provide a source of liquidity for funding grants in the near term. Therefore, we believe it is prudent to maintain a liquidity buffer of USDC (exact % dictated by the prevailing market environment) which is unallocated and not exposed to any smart contract risk within DeFi. The downside is that this will not earn additional revenues for the Matching Pool.

Strategic Recommendation

We recommend adopting the growth strategy (70% ETH / 30% Stablecoins) as the default allocation. This strategy provides good potential for expanding the grant pool over time while maintaining flexibility to diversify into more conservative allocations as the market develops.

The growth strategy aligns with Gitcoin’s goals of growing the grants program by leveraging potential upside in ETH, while still maintaining a prudent allocation to stablecoins for near-term liquidity needs and as a countercyclical buffer during periods of market weakness. Over time, as the matching pool evolves and market conditions change, we can periodically reassess and adapt the target allocations if deemed necessary by the community.

This iterative approach ensures that the allocation remains aligned with both Gitcoin’s long-term ambitions and the evolving needs of the grants program.

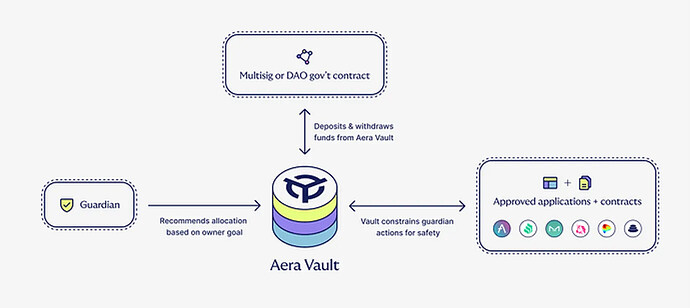

Infrastructure

We propose to keep the assets in the same multisig and add Avantgarde Finance as a signer on the multisig to line up transactions. In some cases, the use of the zodiac roles modifier might be used to embed smart contract roles & permissions to allow Avantgarde Finance to execute faster within a controlled environment.

Reporting

Avantgarde Finance will provide monthly (written) reporting on the performance of assets. A quarterly community call will be organized too.

Fees

We propose a performance fee of 10% subject to high water mark (resets whenever fees are payable), with no other management fee involved; where performance for any assets in the Growth category is measured against ETH, and assets in the Stablecoin category against USDC—though we remain flexible and open to feedback.