(10 ![]() takes based on the @vitalikbuterin 2026 public goods funding episode and a recent survey of publicly available + self reported data - if you want your data included, pls DM me )

takes based on the @vitalikbuterin 2026 public goods funding episode and a recent survey of publicly available + self reported data - if you want your data included, pls DM me )

TLDR - where a reformed space PGF space could go

-

there is still a healthy amount of traditional grants, but also a fledgling pluralism of innovative onchain PGF mechanisms.

-

provable mechanisms over unprovable vibes: onchain PGF has shifted from feel-good charity to verifiable, flowing, dependency-driven funding.

-

privacy + open source prioritized: foucs on the public goods that are existential for ethereum’s survival.

-

fund your dependencies: deep funding and similar systems route capital based on real upstream impact, not popularity contests.

-

sustainable revenue flows: sequencer fees, oss licensing models, and yield-based pgf (like octant) create ongoing funding instead of hoping donors show up.

-

ai + zk as coordination tech: ai evaluates huge dependency graphs, zk enables private, manipulation-resistant governance.

-

coalitional funding: l2s, app-chains, and protocols fund their own ecosystems, and if they share dependencies, create coalitions - creating a network of pgf funding sources instead of relying on one big pot.

-

pluralism as strength: multiple pgf funding innovators (gitcoin, op, arb, clrfund, giveth drips, octant, nouns, etc.) create antifragility, increase innovation, and reduce capture risk.

1. where the money comes from now

a. mostly traditional grants (the old reliable)

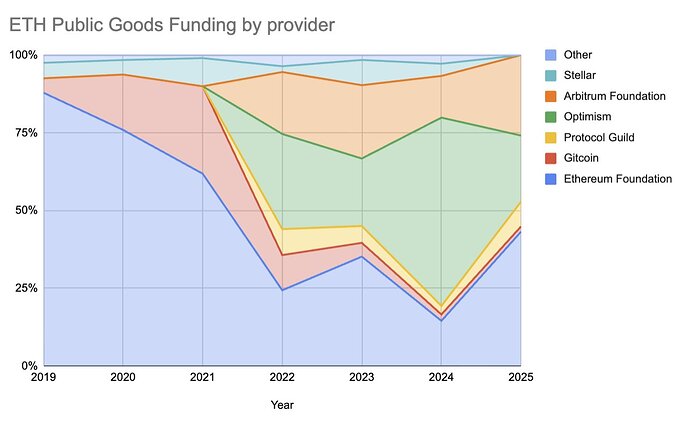

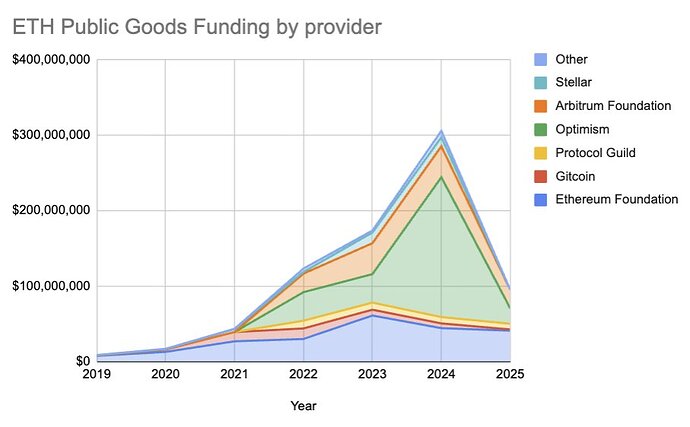

Most money in ethereum public goods still comes from the traditional grant programs of L1s and L2s - for example Ethereum Foundation, Stellar, Optimism, Arbitrum, etc

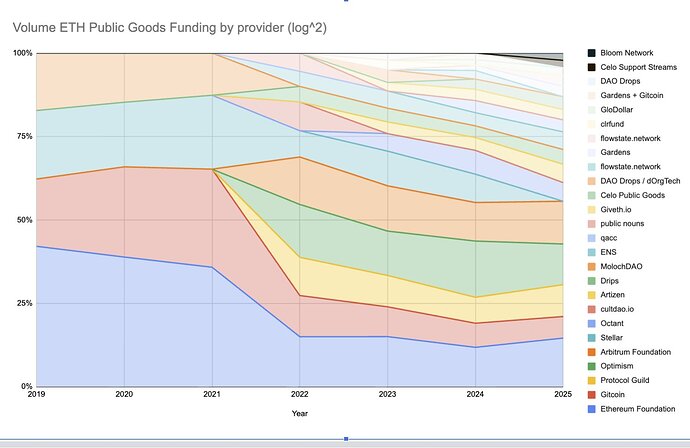

(stacked area chart of the funding_distributed_in_usd for each provider - in percentage terms)

(stacked area chart of the funding_distributed_in_usd for each provider - in absolute terms)

b. the long tail of innovation.

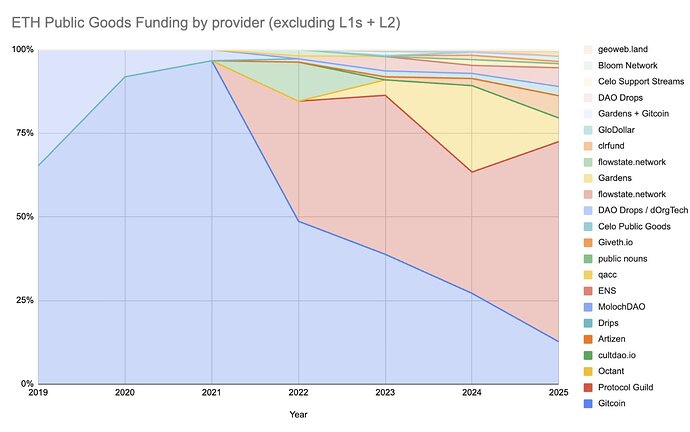

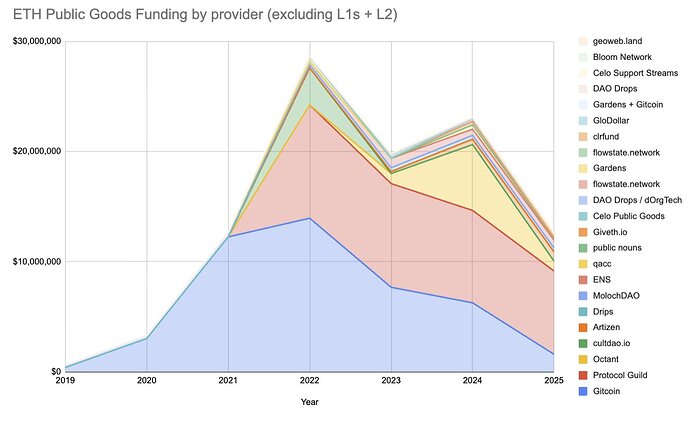

Gitcoin and MolochDAO were early exceptions to the L1/L2 norm - channeling single digit percentages of the funds themselves in 2019 - 2021.

Protocol Guild storms the scene in 2022, soon becoming a major staple of funding.

This is followed by a rather long tail of experimentation + innovation.

(stacked area chart of the funding_distributed_in_usd for each provider that is not a L1/L2 - in percentage terms)

(stacked area chart of the funding_distributed_in_usd for each provider that is not a L1/L2 in absolute terms)

2. pluralism is a feature, not a bug

Early in Ethereums history, the Ethereum Foundation was the primary funder of public goods.

In 2019 and 2021 Gitcoin + MolochDAO were new onchain ways of funding Ethereum public goods.

In 2021, we saw an explosion of innovation – protocol guild, optimism, arbitrum, drips, octant, dow drops, clrfund, public nouns… cultdao… And so on…

(stacked area chart of the log^2(funding_distributed_in_usd) for each provider)

In 2025, it seems clear that pluralism in public goods funding is here to stay. this is a good thing, it’s

benefits:

-

reduces capture

-

increases surface area for good ideas + accelerates innovation

-

creates redundancy

-

prevents any one funder from becoming a “kingmaker”

-

allows builders to route around broken institutions

this is deeply aligned with ethereum’s ethos.

3. the vibes era is over.

2021 pgf trended towards “regen vibes.” money sloshed around, quadratic funding felt like a universal good, and everyone funded everyone.

after a cycle of stagnating ETHUSD price, belts tightening across the board, and the decline of vibes-based funding,

- the old world is gone.

the future is verifiable, narrow, and structural funding from revenue or yield

the reformed pgf space is about:

-

Proof of impact, not vibes

-

tight apertures, not “fund everything”

-

mechanisms that survive a chaotic, adversarial world

-

focus on ethereum’s existential infrastructure

-

funding from sustainable structural places like revenue or yield

2021 era quadratic funding assumed a kind of more universal + abundant altruism.

2026 pgf assumes a messy, fragmented world and builds bottom-up credibility into the architecture.

the big unlock in the reformed pgf world is moving from “we hope donors show up” to structural, sustainable flows.

some directions this could head:

4. structural, sustainable, revenue flows

to scale pgf, we need to connect revenue centers to cost centers. right now, revenue in most projects comes from block rewards (l1s), sequencer fees (l2s), and protocol fees (defi). these flows already fund one provable public good: blocks. proof of work/stake makes block production measurable, so rewards can be routed automatically. clean loop.

the problem is that most other public goods haven’t been provable, so they’ve been funded by vibes, grants, and political processes instead of built-in economics.

the shift in 2026+ is about closing that gap. deep funding, oss licensing, protocol guild, and dependency graphs make more public goods as provable as blocks. once impact is legible, revenue from l1s, l2s, and defi can flow to these cost centers sustainably.

the long-term vision: expand the set of provable public goods so pgf becomes structural rather than charitable. when revenue centers can see and support their dependencies, the flywheel sustains itself.

5. oss licensing as a revenue engine

this is the big new idea:

-

add harberger-style “openness taxes” to licenses

-

make “fund your dependencies” part of the rules

-

require profit-sharing only when someone goes proprietary

this takes the trillions of dollars built on open source and turns a tiny fraction of it into a sustainable pgf river.

One promising project to follow is (PSL) Profit Sharing License by RaymondCheng.

6. yield-based pgf

people are far more willing to donate yield than principal. this is huge psychologically and structurally.

is the canonical example and breakout leader in this market segment.

d. privacy and open source are priorities

these two categories are existential.

-

open source - ethereum runs on oss. It’s good practice fund our dependencies. Its also a great way to build bridges into the real world.

-

Privacy - privacy keeps pgf and governance mechanisms from turning into bribery markets. zk and programmable cryptography are the enabling tech… these are the pillars of the reformed pgf stack.

7. funding your dependencies

deep funding is the flagship here.

it:

-

builds a real dependency graph of the internet

-

uses ai to rank millions of edges

-

uses jurors to spot check

-

allocates money based on actual upstream value

and the best part: accountability becomes endogenous eg if people stop using you, you stop getting paid. no more “cozy” projects hanging on because they’re socially connected.

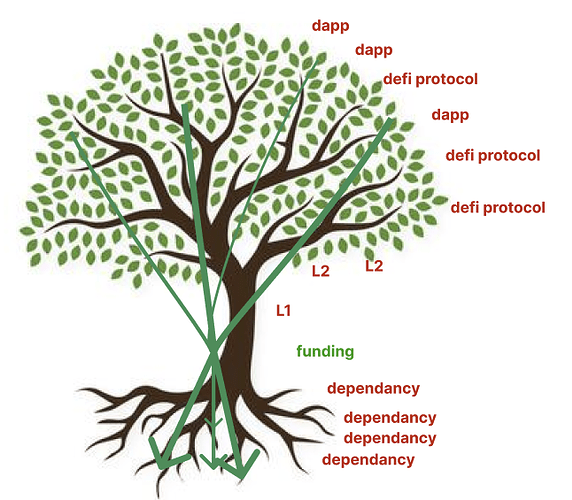

8. the polycentric tree of l2s and apps

zooming out, pgf becomes polycentric: each l2, app-chain, and protocol funds its own dependencies, and those funds flow outward like mycelium.

instead of one big donor trying to fund everything, we get coalitional funding: many smaller ecosystems each supporting the public goods they rely on, which collectively covers the whole stack.

this replaces “general charity” with economic incentives embedded in the architecture. when every layer funds its own upstream dependencies, and those layers overlap, the ecosystem forms a resilient coalition of funders rather than a single point of failure.

(authors rendering of a childs picture of how funding could flow at scale )

9. new pgf builders should work with the new, not the legacy

during the episode, we discussed how new pgf builders should work with the new, not the legacy:

-

most legacy treasuries resist change.

-

new ecosystems are hungry, fast-moving, and open to new primitives.

if you’re building novel pgf infra in 2026, the energy is mostly on the frontier: new zk ecosystems, new app-chains, new oss licensing standards.

note: there are a few exceptions to this rule - Filecoin and Gitcoin for example are prioritizing supporting novel pgf mechanism builders, i’m sure there are others. If you know of one, tweet me!

10. new pgf builders should leverage ai + cryptography are the superpowers

the reformed pgf space is now possible because two technologies matured:

ai

-

assists jurors

-

evaluates massive dependency trees

-

surfaces reasoning

-

powers continuous onchain mechanisms

zk / programmable cryptography

-

enables privacy

-

enforces credible neutrality

-

reduces manipulation

ai gives us scale. zk gives us integrity.

conclusion

the big picture is this: ethereum public goods funding is not dying, it’s molting. the vibes-era skin is coming off, and underneath it a more durable, mechanistic, scalable pgf ecosystem is starting to take shape.

the last cycle showed us the limits of charity, the fragility of vibes, and the danger of relying on any single funding monolith. the next cycle will be defined by pluralism, proofs, sustainable revenue, and novel privacy + ai tech that actually works at internet scale.

if 2017–2021 was about discovering that pgf mattered, and 2021–2024 was about experimenting wildly, then 2026+ is about operationalizing what we’ve learned: fund your dependencies, build provable systems, embrace coalitional funding, and use ai + zk to turn funding from an art into an engineering discipline.

I think we’re heading toward a world where funding flows continuously instead of in one-off rounds, and where oss and privacy are treated as the existential infrastructure they truly are. in short: a world where OSS dependancies are not an afterthought but a core part of ethereum’s economic engine.

the work ahead is not trivial, but it’s exciting. this is the frontier. if we get it right, we will leave behind a pgf system that is more credible, more antifragile, and more regenerative than anything that came before it. and if you’re building in this space: now is your moment.