As a first foray into treasury management in collaboration with the #workstream-discussion:public-goods-funding we stewards, @Yalor, @androolloyd @Pop , @HelloShreyas & @AcceleratedCapital propose partnering with the ICHI community to create $oneGTC:

A stablecoin to accelerate the funding of Gitcoin DAO.

Why

$oneGTC will provide the GitcoinDAO with a toolset for generating greater resources that can go towards digital public goods. It will enable a significantly increased value for $GTC token and greater economic freedom for the contributors of the DAO. By using the ICHI system we are able to unlock the value of the token treasury, allowing us to retain more value within our ecosystem and decrease the sell pressure for our workstream contributors.

-

Having a stable token for the GitcoinDAO allows us to fund work streams with certainty, instead of being victims to market fluctuation.

-

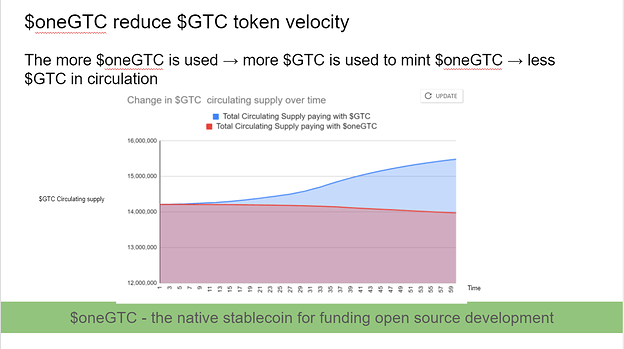

Using $oneGTC as our preferred token instead of market selling $GTC will lead to retaining more value within the Gitcoin ecosystem (see chart)

-

A success of this experiment will lead the way to other open-source projects unlocking the value of their scarce assets, Gitcoin should lead the way in empowering communities and helping them unlock their treasury.

What:

Following other top projects like Filecoin and 1INCH, we propose partnering with ICHI to build $oneGTC, a stablecoin minted with a mix of $USDC and $GTC.

- $oneGTC is a native stablecoin for funding the ongoing operation of the Gitcoin DAO, as well as rewarding contributors new to the Gitcoin ecosystem.

- ICHI has built the only stablecoin design to be governed by a specific crypto community.

- GitcoinDAO will govern the $oneGTC treasury, and can apply any strategies it likes to grow it’s collateral, or decide to incentivise activities using it’s earnings.

- Allocate the next 45,000 GTC outlined here to bootstrap the $oneGTC treasury, with an additional $100k worth of tokens to provide liquidity for the pools, matched by $100k worth of ICHI rewards for LP’s from the ICHI community.

To learn more read here:

- [Proposal] $oneGTC - a stablecoin for the Gitcoin community -

Proposal Discussion - Gitcoin Governance

Proposal Discussion - Gitcoin Governance - Join an ICHI <> Gitcoin Telegram discussion group

Proposal Stage:

Initial Target: - The first step to delivering this is to get consensus on the value of this proposal, we require a clear signal via snapshot from the token holders to show their support for this treasury scheme. Once approved the ICHI team can deliver the token treasury in 7 business days.

- The first step to delivering this is to get consensus on the value of this proposal, we require a clear signal via snapshot from the token holders to show their support for this treasury scheme. Once approved the ICHI team can deliver the token treasury in 7 business days.

Budget: There is no additional budget required to deliver this proposal, we propose using 45,000 GTC allocated to workstreams to bootstrap the oneGTC treasury, with $100k in $ICHI provided by the ICHI community to reward liquidity providers who add USDC to the pools.

There is no additional budget required to deliver this proposal, we propose using 45,000 GTC allocated to workstreams to bootstrap the oneGTC treasury, with $100k in $ICHI provided by the ICHI community to reward liquidity providers who add USDC to the pools.

Plan and Timeline: See plan above, timeline is 10-14 days from treasury deposit.

See plan above, timeline is 10-14 days from treasury deposit.

Individual/s Responsible: We are partnering with the ICHI community a few of whom include:

We are partnering with the ICHI community a few of whom include:

- @Lior

- @37 Aces, Chief Technical Officer

- @masanobufukuoka, Farmer

- Samuel Mendenhall, core dev

- Vladimir Stemkovski, core dev

- Kobayashi, ecosystem

- Ethan Lehman, community

All ICHI team can be found here.

Ultimately they will be responsible for delivering the working treasury scheme and token, and @Yalor & @androolloyd will be responsible for overseeing the work being done and ensuring that it is delivered on-time and within the existing scope outlined above.

This proposal will be open for discussion for 2 weeks leading up to the next Gitcoin Stewards Call August 2nd, a corresponding snapshot can be found below:

oneGTC - snapshot vote Open Monday July 26th - August 3rd.

Thank you for engaging with this proposal, even if you just give us your stamp of approval it means a lot. We are here to serve the DAO and hope through the creation of oneGTC to ensure a longer lasting and more sustainable treasury for years to come

Original $oneGTC proposal [Proposal] $oneGTC - a stablecoin for the Gitcoin community