Novel Situation #1 - (A situation that suggests Gitcoin Policy needs updating…)

“Grant Applicants should not have a token”

TL:DR This criteria is outdated since a large number of projects now use token based governance systems. We can revise this to read “Grant applicants should not have a token other than governance tokens” to remain true to Gitcoin principals. We need to update it because we are denying quality deserving projects that should be eligible imo.

One of Gitcoin’s legacy eligibility criteria reads “the project should not have its own token or have raised VC funding…” This comes from the earlier grant round criteria and is a carry over from a time when the general crypto space was less mature. Daos were not yet popular and had not determined that token-based voting was the preferred decentralized decision making method.

It is important to notice that the language in this guidance is suggestive (‘should’) and not mandatory (unlike with quid pro quo or hate speech criteria where the wording is ‘must’ and/or ‘shall’). This criteria is suggestive in nature not a mandate.

The development of the dao, with token voting, marked a key shift in the general decentralization movement. Now, for maybe the first time, groups of individuals could use legacy web2 tools combined with blockchain technology to rapidly coordinate around goals or themes.

Uniswap and Bankless might have been some of the earlier groups to become a dao and rapidly coordinate using governance tokens. Both are long term recipients of Gitcoin grant donations. The technique of creating and distributing governance tokens to a community which then forms (or already has formed) a Dao is commonplace. Token based voting is the number one method by which daos govern imo. Left alone, this system might be fine. Unfortunately it exists within the framework of the free market.

A market made even more free by the proliferation of pseudonymous and privacy enhancing tools and techniques associated with cryptocurrency and blockchains. And this free market is very observant. And created tokens become publicly accessible. When some project shows success potential the market wants to invest in and have some control over said project. The easiest way to do this is to accumulate governance tokens. Many governance tokens end up with some ascribed value and are traded on both centralized and decentralized exchanges. Even if this goes against the wishes/values of the founding team.

This creates the issue. At one time Gitcoin banned projects with (monetary) tokens. This was before tokens became the primary decentralized governance technique of daos. Now we have projects that meet all the eligibility criteria except for the ‘…should not have its own token…’ item. At this state in dao governance it seems inappropriate to deny funding to projects based on the existence of its own token. More critical, is how the token is used.

Greater investigation and analysis is called for. Questions I might consider include:

Examine the initial token distribution- how decentralized vs just the founding team?

Examine the general project tokenomics- how decentralized vs just the founding team?

Is the token actively used in governance?

How long was the token used in governance before it became traded on any exchange?

Is the token generating revenue and what happens to that revenue?

How much has the token increased in value since inception?

How much are the general operating expenses of the project? Using general operating expenses and token value change since inception, can it be determined if a project is earning or losing revenue? Again what happens to that revenue?

What are the metrics around trading the token? What is the total daily volume traded?

Is token deflationary or inflationary?

It is difficult to determine the true nature of a token without detailed financial auditing which goes beyond the expectations of an average grant reviewer.

In conclusion, I find it really is the reason for the existence of a given token that determines its effect on gitcoin eligibility. Did the token get created to facilitate governance or to generate centralized profits. If there is any evidence that the token got created for governance, I recommend the project be deemed eligible. Even if the free market used the created token for speculation. Unfortunately this opens the door to projects categorizing any and all tokens as gov tokens. To mitigate this we may need to consider the greater reputation of a project in the space.

Lastly, I would change the official wording on that criteria to:

“Grant Applicants should not have a token other than governance tokens.”

Would love to hear other opinions on this matter. Do you think a project should be denied Gitcoin funding because it has a token used for governance? Why or why not?

Here is what Bright ID stated to the fdd:

Hi, Grants Appeals team,

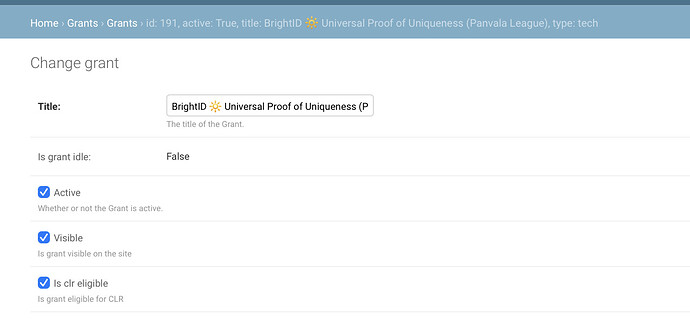

I’d like to outline the case for our appeal of matching funds eligibility dispute. The matching eligibility was disputed on the basis of the recent launch of the $Bright token.

$Bright is a community token for the community surrounding BrightID to decide on its usage.

I understand and in general agree that projects that raise funds through a token sale should remove themselves from matching fund eligibility.

$Bright was not sold, however; it was given away to BrightID verified individuals, through a process we called the “fairdrop” (“fair” being used to signify that tokens were primarily distributed to unique humans, not wallets).

Bright DAO is a 1Hive Gardens DAO that only deals in its own token, $Bright. It is also not the entity that manages the BrightID Gitcoin grant.

The entity that manages the Gitcoin grant is a Delaware non-profit Legal DAO called BrightID Main LLC, receiving its non-profit sponsorship under the Grantcoin Foundation (DBA Hedge for Humanity). Philip Silva is the member that has submitted KYC on behalf of the Delaware non-profit to be able to receive donations through Gitcoin. I have CC’ed him in this email.

Though I don’t think any quid-pro-quo accusations were raised, I’ll mention just in case that we were careful to avoid communication about the upcoming fairdrop in our grant description and tokens were fairdropped to Gitcoin contributors and projects based on their trust bonus usage, but not based on donating to BrightID.

More information about the $Bright fairdrop and token in general are found in the BrightID Gitbook.

It’s my feeling that if $Bright receives enough price support that Bright DAO alone can fund the non-profit initiatives of BrightID, we should stop asking for donations from Gitcoin users, CLR.Fund users, Giveth users, and the Ethereum foundation. I hope we can reach that day soon.

Let us know if Philip or I can help clarify anything.

Feel free to make this appeal public. I don’t believe I’ve said anything that shouldn’t be public knowledge.

–Adam Stallard, Founder, BrightID