Lowering Cost to Value - a strategic value driver

TLDR

- Gitcoin has relaunched as a growth toolkit for EVM-based ecosystems, expanding from Quadratic Funding to include Direct Grants and Retroactive Funding.

- Lowering the Cost to Value (CTV) of building new mechanisms is a strategic goal, enabling more ecosystems to participate and enhancing Gitcoin’s agility.

- Upcoming tools like Allo 2.1 and AlloKit aim to reduce the CTV, making it easier for developers and communities to build capital allocation mechanisms on Gitcoin’s platform.

Target Audience

- The goal of this post is to create strategic understanding across

- Grants Lab Executives

- Grants Lab Devs

- Gitcoin Citizens

Introduction

In 2024, Gitcoin re-launched as a growth toolkit for EVM based ecosystems. We believe that Grants=Growth, and that Gitcoin’s Grant tools are growth power tools.

To enable this vision, we are going multi-mechanism. Instead of just using QF for every ecosystem, we now have Direct Grants, Quadratic Funding, Retroactive Funding - a complementary toolkit that we can cross-sell.

As we embark on this multi-mechanism future, especially vis-a-vis a changing market 2025 Trends To Watch , we need to deal with the realities of having limited resources. To do this, we must become proficient in a multi-mechanism world. This means figuring out which mechanisms to build, which our community will build, and which we won’t build - either because we don’t have the resources or because they are not relevant to Gitcoin’s USP. We are presently beginning to build shared understanding an muscle around this with our Mechanism Evaluation Framework.

Low CTV - a value driver

Right now, Grants Lab have a policy that:

Generally, we want a $1M deal to build anything. $1M would be additions/extensions to a mechanism (support your identity in MACI) or a new tool.

If it’s a net new mechanism the expected GMV should be $5-10M and initial customer commit $2M+

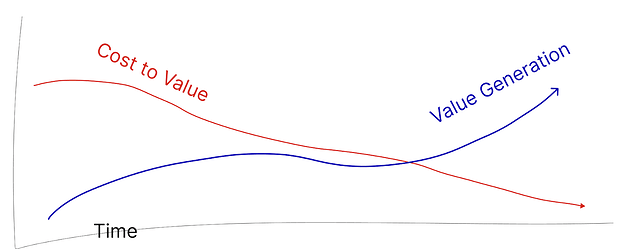

This post examines Cost to Value (CTV) in the past, and posits that it is an important metric for Gitcoin to enable more strategic agility and inclusiveness in the future.

CTV so far

Let’s examine the CTV of mechanisms built on Allo Protocol So Far.

| Who built it? | CTV | 2024/2025 Gmv so far (projected) | |

|---|---|---|---|

| Trad QF | Grants Lab | $millions | $6m ($12m) |

| EasyRetroPGF | Owocki + Carl + OP Grant | $200k | $500k ($2m) |

| REDACTED | Raid Guild | $130k | $0m ($100m) |

| Streaming QF | Geoweb/Superfluid | $0 | $100k ($100k) |

| MACI QF | Nick/MACI team | $100k | $700km ($700k) |

| Endaoment QF | Endaoment | $0 | $29k |

| Grants Ships | Dao Masons | $0 | $100k |

| Impact.Stream | Impact.Stream | $0 | $200k |

| Conviction Voting | 1Hive | $0 | $??? |

CTV in the future

Right now, we have a policy that

Generally, we want a $1M deal to build anything. $1M would be additions/extensions to a mechanism (support your identity in MACI) or a new tool

If it’s a net new mechanism the expected GMV should be $5-10M and initial customer commit $2M+

What if we could lower these requirements?

As a straw man, let’s assume that we are able to bring the CTV of a new mechanism down, according to the following schedule.

| Year | Cost to Gitcoin (addition) | Minimum Commitment (addition) | Cost to Gitcoin (new mechanism) | Minimum Commitment (new mechanism) |

|---|---|---|---|---|

| 2024 | $100k | $1m | $500k | $5m |

| 2025 | $10k | $100k | $50k | $500k |

| 2026 | $1k | $10k | $5k. | $50k |

| 2027 | Marginal | Marginal | Marginal | Marginal |

Why would we do it?

Having it be very cheap to build a new mechanism on Allo would enable a strategic agility that Gitcoin has not ever seen before. Low CTV would increase the breadth of tools built on Allo, as more builders are brought to the table. Gitcoin/Allo would become the most exhaustive, most powerful, capital allocation toolkit on the market. This cycle would likely be reflective, further attracting more builders to allo.

Low CTV would also increase inclusiveness. No longer would you need to have $5m to have a new mechanism built on Allo. By being inclusive of ecosystems that don’t have a lot of $$$, we increase the number of ecosystems that could take advantage of allo.

How would we do it?

We are already making investments to reduce the CTV on Allo. The first inflection point is Devcon this year, in which we are releasing Allo 2.1, AlloKit, and Indexer v2. This suite of tools will make it much easier to build on Allo.

Future inflection points we could build are

- Having easy hello-world Allo Kit apps that do common funding mechanisms like QF, RetroPGF.

- A drag and drop UI, where anyone can build a new capital allocation tool without coding at all.

- An AI Allo tool, where you could build a new capital allocation tool without coding at all.

- Enabling GItcoin Citizens to build on Allo via Citizen Grants, Hackathon prizes, and/or Token Swaps.

- We’re open to more inflection points and should brainstorm them with the team.

Conclusion

In conclusion, lowering the Cost to Value (CTV) of building new mechanisms on Gitcoin’s Allo protocol represents a pivotal shift in the platform’s future. By reducing the financial and resource barriers to innovation, Gitcoin can unlock unprecedented strategic agility, allowing a broader range of ecosystems and builders to engage with the platform. This approach fosters inclusiveness, enabling even smaller communities to benefit from Gitcoin’s powerful capital allocation tools. As Gitcoin continues to invest in and release tools like Allo 2.1 and AlloKit, the vision of creating the most exhaustive and accessible capital allocation toolkit becomes more attainable, driving growth and impact across decentralized ecosystems.