thanks for the thoughtful response carlos! i’ve got a few areas i want to respond/engage eventually… but this one is one that immediately brings up something for me

i might be overindexing on this… but i would challenge everyone to look at such divisions like the differences between MMM/PGF (but also other divisions like misaligned priorities between the grants stack/allo team) one layer up the governance stack. eg try to look at it from a network level instead of a narrative level. one way to induce this frame is “imagine youre kevin/kyle/a gtc steward/anyone else with a network wide vantage point and people are always coming to you to complain about each other and you’re just trying to figure out protopia aka figure out how to piss away less budget/brand/opporutnity-cost on any type of coordination failure, especially feifdom-like, conflict every quarter”

from the perspective of PGF for shell, everyone throwing them under the bus. from the perspective of MMM, they feel stuck also but in different ways.

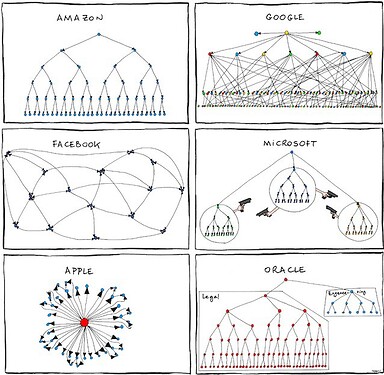

from where i stand its just a lot of finger pointing across the groups/feifdoms. while it’s gotten a lot better since a year ago, gitcoin still (in some palces) looks like microsoft whereas i think it maybe should look a bit more like facebook’s org or like an impact network.

feifdoms are a really bad way to organize in a competitive ecosystem if you think about it from first principles for a bit.

some ways to solve this

- modularize the workstreams to be smaller + so there is surface area for feifdoms to evolve

- formalize the conflicts between groups into a political economy where these modules compete in a market against each other

- formalize the way the dao makes budgeting decisions to align budgets with those who create value so that people always have a SSOT on where their job/salary stands ( a la

job_security = prioritization = GTC_utility_produced + revenue_generated_in_usd. ) without having to go through some tribal leader to get an answer. - solve for the fact that low engagement/low output individuals can stick around indefinitely without being noticed (as long as theres no active layoff round going on). conversely, solve for the fact that high engagement/high output individuals do not have job security.

- follow the best practices from impact networks book (especially the ones about building trust across social difference)

- recognize that we shouldnt expect to “solve” for this anytime soon, but instead this will be a slow backburner process of “addressing” it for the next 12-18 months while the DAO is focused on the object level issues of its competitiveness in a crowded markets + product market fit + revenue.

- bring in external stewards who have a lot of clout + time to engage + pick apart the issues. i have a unicorn i might bring in / announce soon

- “culture eats strategy for breakfast” so realize that many of these issues are cultural / training. invest in education to build the right regen cutlure internally.