Proposal Description

Short Summary

Allo Yeeter is a user-friendly tool built on top of the Allo Protocol that streamlines recurring, multi-address fund distributions (“Yeets”). Each Yeet creates a reusable Allo Pool, so recurring payments are quick and straightforward. Allo Yeeter integrate with popular Web3 event tools like POAP, allowing communities to distribute funds based on event attendance. By simplifying the distribution process, Allo Yeeter aims to drive significant GMV (Gross Merchandise Value) through the Allo Protocol, targeting $500K–$1M annually.

Impacted Stakeholders & Expected Outcomes

- Greenpill Stewards & Leads : Easily manage Chapter/Guild payouts and project funding with minimal friction.

- Community Managers : Automate recurring contributor payments via CSV or POAP-based lists.

- Grant Operators : Simplify disbursing grants to multiple recipients, increasing transparency and efficiency.

- Web3 Event Organizers : Airdrop funds to event attendees (POAP holders) and reward staff instantly.

Motivation

- Why We Are Submitting This Proposal

- Existing on-chain tools often make recurring or event-based fund distributions tedious. By leveraging Allo’s reusable pools and integrating with event protocols (like POAP), Allo Yeeter reduces friction, increases user adoption, and drives more capital flow through Allo.

- Potential Conflicts of Interest

- The team behind Allo Yeeter is also passionate about the broader Web3 ecosystem, but there are no direct conflicts that compromise the integrity of this proposal.

- Why the Citizen Grants Program Should Adopt This Proposal

- Community Engagement : Encourages frequent, transparent funding of community members and initiatives.

- Network Growth : Brings new DAOs, event organizers, and grant operators onto the Allo Protocol.

- Financial Sustainability : Streamlined on-chain transactions expand the total GMV passing through Allo.

- Recycling GMV & Building a Circular Economy

- Concrete Example : The Greenpill Dev Guild alone disbursed over $50K in quarterly payouts. If these funds had been funneled through Allo, they would have added significantly to Allo’s on-chain volume.

- Scaling Across Greenpill : With 15 active Chapters and Guilds in the Greenpill Network, each handling up to $50K per quarter, we could see $500K–$1M in annual GMV if these payouts recycle back into the Allo ecosystem through Allo Yeeter.

- Circular Economy Benefit : By making it easy to repeatedly use Allo Pools, Allo Yeeter helps capital stay within the Allo ecosystem—reinforcing a self-sustaining loop of distributing, receiving, and reallocating funds on-chain.

Previous Work

Linked below is our previous proposal for Allo Yeeter, which has served as a foundation for our current approach:

Specifications

Scope of Activities

-

Core Features

- Reusable Allo Pools : Every “Yeet” automatically creates or reuses an Allo Pool for future allocations.

- POAP Integration : Fetch attendee wallets for simple event-based payouts.

- CSV Upload Support : Allow bulk uploading of addresses and amounts.

- Intuitive UI/UX : Ensure frictionless onboarding and minimal steps to Yeet funds.

-

Technical Details

- Front-End Stack : Next.js, TailwindCSS, RainbowKit, Viem.

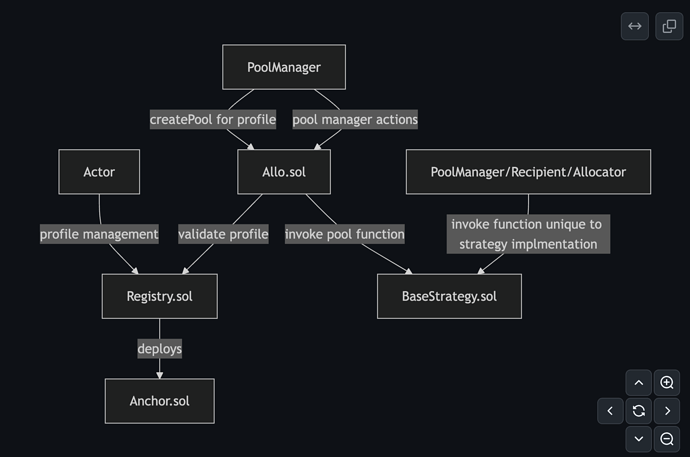

- Allo Protocol : Custom strategy that ties each distribution to an Allo profile/pool.

- Security & Reliability : Code reviews, potential audits, and robust QA for stable mainnet deployment.

-

Deliverables and Artifacts

- Product Requirements Doc

- Figma Designs & Prototypes

- Workflow Diagrams

- Open-Source Code in GitHub Repo and Project Board

Roadmap and Milestones (3-Month Deadline)

We plan to launch and iterate quickly, with a major showcase at ETHDenver 2025 in late February.

Complete MVP (January/February 2025)

-

Overview : We will quickly start to integrate reusable pools and POAP lists to start internal testing in late January and early February to ensure stability by ETHDenver.

-

Activities

- Finalize key features (CSV uploads, POAP integration, Allo pool reusability).

- Conduct QA testing, fix bugs, and refine UI.

- Initiate outreach to 1–2 DAOs as pilot partners.

-

Expected GMV Outcome : Onboard at least 1–2 pilot communities, generating $20K–$30K in monthly disbursements.

Showcase at ETHDenver 2025 (February 2025)

-

Overview : During ETHDenver we will use Allo Yeeter in Greenpill activations and other regenerative events throughout the conference targeting the multitude of use cases and users.

-

Activities

- Live demos, workshops, and direct user feedback sessions at ETHDenver.

- Sign on 2–3 additional partners (DAOs, event organizers).

- Rapidly integrate user feedback, focusing on feature refinements.

-

Expected GMV Outcome : Grow total monthly volume to $25K–50K for community disbursements with an additional $50k-100k from ETHDenver activations setting the stage for further adoption post-ETHDenver.

Refine & Scale (March 2025)

-

Overview : After ETHDenver we will gather insights on our activations and measure how effective Allo Yeeter was for allocating capital.

-

Activities

- Implement post-ETHDenver feedback, finalize new partner onboarding.

- Deploy marketing push showcasing success stories from pilot users.

- Introduce analytics dashboards for tracking real-time GMV..

-

Expected GMV Outcome : Achieve $80K–100K monthly distribution volume, positioning Allo Yeeter on track for $500k–1 million annual GMV by year’s end.

Benefits

- High GMV Potential: Allo Yeeter has the capacity to drive significant GMV growth, aligning with Greenpill Dev Guild insights that show quarterly payouts of $50K. When scaled across 15 active Greenpill chapters and guilds, this could generate substantial annual volume directly funneled through Allo, reinforcing its value as a core tool for recurring fund distribution.

- Community & Ecosystem Growth: Integrations with POAP and future event protocols attract a new wave of users to Allo.

- Ease of Use: Simple “Start Yeet” workflows, CSV uploads, and automatic Allo Pool creation reduce friction for repeated fund distributions.

Drawbacks

- Dependence on Allo Infrastructure: If Allo experiences downtime or architectural changes, Allo Yeeter is directly affected.

- Adoption Curve: While the UI is designed to be simple, DAOs and event organizers may need initial guidance to fully switch to a new tool.

- Security & Trust: Winning over large treasuries requires thorough code audits and proven reliability.

Budget Overview:

Development

- Description

- Finalize MVP.

- Post-ETHDenver fixes & feature updates

- Ongoing technical support for pilot users

- Amount : .$16,000

- Product Management : $3,000 to oversee development cycles, coordinate feedback, and align priorities.

- Design : $3,000 for UI/UX improvements and refining front-end workflows.

- Engineering : $10,000 for full-stack development (front-end and back-end integrations).

- GMV Impact : A polished, stable product attracts new partners, ensuring recurring monthly volumes.

BizDev & Partnerships

- Description :

- Direct outreach to DAOs & event organizers

- ETHDenver networking to secure high-volume treasuries

- Amount : $5,000

- Business Development Leads : $4,000 for identifying partners, running meetings, and maintaining relationships.

- Documentation : $1,000 for creation of onboarding materials, use case decks, and pitch content.

- GMV Impact : Each partnership can funnel tens of thousands monthly, pivotal to reaching $500k-1M annual GMV.

Marketing & Outreach

- Description :

- Demos & workshops (esp. at ETHDenver)

- Case studies, success stories

- User guides & walkthroughs

- Amount : $4,000

- Graphic Designers : $1,500 for creating visual assets, presentations, and case studies.

- Engagement Coordinator : $1,500 for hosting workshops, live Q&A sessions, and guiding user onboarding.

- Business Development Leads : $1,000 for organizing campaigns and coordinating ETHDenver marketing efforts.

- GMV Impact : Showcasing real user success encourages more DAOs and communities to adopt Allo Yeeter.

Contingency & Audit

- Description :

- Code audits

- Bug bounties

- Unforeseen user requests or security updates

- Amount : $3,000

- External Auditors : $2,000 for third-party security audits and code reviews.

- Bug Bounties : $1,000 for incentivizing internal and external testers.

- GMV Impact : Secure tooling gives organizations with large treasuries confidence to move significant funds, directly increasing GMV potential.

Analytics & Reporting

- Description :

- Build GMV tracking dashboards

- Data-driven outreach campaigns

- Amount : $2,000

- Researcher/Data Analyst : $2,000 for building dashboards, analyzing GMV data, and creating actionable insights.

- GMV Impact : Real-time performance metrics help identify and capitalize on top GMV opportunities (e.g., large DAOs, popular event organizers).

Total : $30,000

Measures of Success & KPIs

- Monthly GMV

- Target: $80–100K by March 2025.

- Annual Objective : $1–2 million by end of 2025 (with potential to hit $500K–1M just within the Greenpill Network alone).

- Number of Yeets Completed

- Target : At least 50 Yeets completed across DAOs, events, and community initiatives by March 2025.

- Annual Objective : Grow to over 200 Yeets by year-end to establish Allo Yeeter as a standard tool for recurring fund distributions.

- Active Pools & Partnerships

- Target : Onboard at least 5 unique DAOs, guilds, or event organizers actively using Allo Yeeter by March 2025.

- Annual Objective : Expand to 20+ active partnerships across DAOs, events, and community organizations by December 2025

- User Satisfaction & Retention

- Target : Achieve a retention rate of 75%+ by March 2025.

- Annual Objective : Retain at least 75% of active users while steadily improving user satisfaction through iterative updates and support.

Non-Financial Requirements

- Marketing & Community Support: Inclusion in Gitcoin/Allo newsletters, social media, and community calls.

- Technical Consultation: Periodic syncs with the Allo Protocol team to ensure seamless integration.

- Ecosystem Access: Introductions to relevant DAO communities, event organizations, or grant councils to accelerate adoption.

Conclusion

Allo Yeeter is poised to drive substantial GMV through the Allo Protocol by providing a simple, reusable, and event-friendly fund distribution solution. Over a focused 3-month period, culminating in a major ETHDenver demo, our team will onboard key DAOs and event organizers, ultimately targeting $1–$2 million in annual on-chain flows. Moreover, existing community payout data from the Dev Guild and Greenpill chapters shows a path to $500K–$1M in annual volume simply by recycling these payouts through Allo. With a modest $30,000 budget, we will aggressively pursue partnerships, refine the user experience, and build the trust needed for recurring multi-address fund distributions at scale, thus creating a circular economy where funds are continually recycled within the Allo ecosystem.

Thank you for your consideration in supporting Allo Yeeter!