Introduction

The utilization of ETH staking for public goods funding is heavily neglected. This proposal looks to resolve this by proposing a framework for a staking solution that enables stakers (incl. the Gitcoin treasury) to delegate their assets and pass on a % of their staking yield over to the Gitcoin Grants Program.

Depending on the structure of this solution, Gitcoin DAO approval may or may not be required, but I welcome everyone to provide their opinions/feedback to finalize the structure of this offering. This proposal uses StakeWise, a white-label ETH staking solution that allows any entity to launch a fully comprehensive, non-custodial staking solution in a permissionless manner. Think of this as creating a public goods version of Lido, where the Gitcoin community can configure the entire solution to best suit Gitcoin’s needs. An overview of the StakeWise protocol is provided at the bottom should you wish to dive deeper.

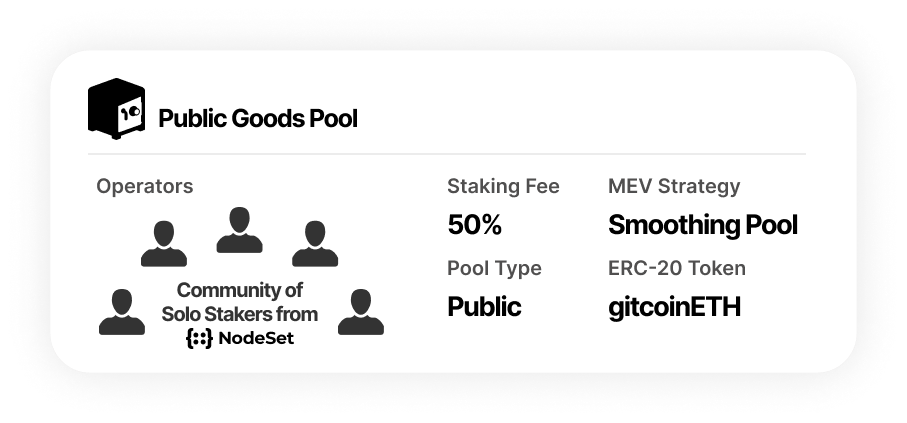

Gitcoin ETH Staking Solution (Example)

Gitcoin launches a Public Goods Staking Pool in partnership with node operators of its choosing. This example specifically highlights a partnership with NodeSet - a collection of 100s of Home Stakers who will stake the capital on behalf of the Pool.

The Pool’s staking fee is set to 50%, split 80/20 between Gitcoin Grants and NodeSet, and its distribution is automatically handled by the Pool smart contract. Note, the StakeWise infrastructure is free to use and consequently 100% of this staking fee is passed onto Gitcoin and the node operators.

Gitcoin stakes its own treasury into the Pool, earning 50% of the staking yield and automatically sending the other 50% towards funding grants on its platform. As a public staking pool, anyone can delegate capital in a permissionless manner and use their ETH staking returns to contribute to public goods funding.

No development work is required by Gitcoin. The deployment of the staking pool takes minutes and Gitcoin’s operator partner(s) handles the daily staking operations. Stakers can utilize the StakeWise UI to stake and unstake.

Due to the nature of the StakeWise platform, any stakers in this pool would also be able to mint the main StakeWise liquid staking token, osETH, to access DeFi with their staked capital. Care must be taken however, as the large pool staking fee could impact staker’s ability to mint and use osETH in the long-term.

Requested Feedback

Please provide your general feedback to this proposal. There are lots of parameters that can be configured in this solution, such as what MEV relays are used and whether the pool issues stakers with an ERC20 token or not. Most importantly though, I would like to hear your thoughts on the following 3 topics to help structure the key features of the solution:

-

Who should Gitcoin partner with as the node operators for this solution?

This could be commercial operators, solo stakers, or a mixture of both. The NodeSet solution was used as an example as I believe it aligns with the ethos of Gitcoin and would ensure the Gitcoin ETH staking solution contributes to the decentralization of the Ethereum network. -

What percentage of staking rewards would stakers be happy to assign to public goods funding?

50% was used in the example, but this can range from 0% to 100%. Just bear in mind the node operators will likely also require payment for servicing the staking pool. Gitcoin is free to negotiate with node operators on their fee to make this solution as cost effective for stakers and maximize the public goods funding potential. -

Should Gitcoin set this solution up itself or have a 3rd party, such as StakeWise, create the solution instead? If the latter, would Gitcoin be comfortable with the staking pool still being branded as Gitcoin? This is where the DAO would likely need to vote for approval.

StakeWise Deep Dive

StakeWise Deep Dive

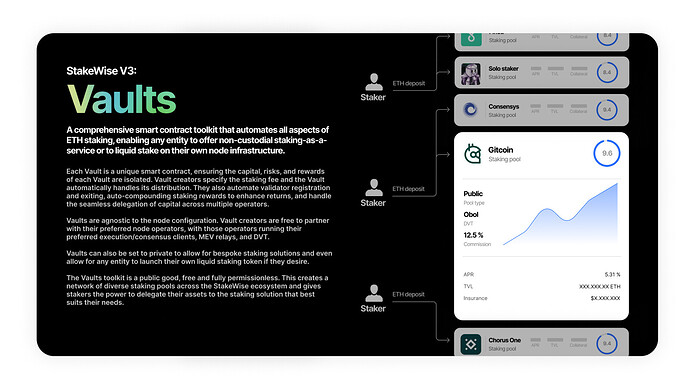

StakeWise was the first non-custodial liquid staking protocol on Ethereum, live since early 2021. Launched in November 2023, the V3 upgrade white-labelled the protocol’s architecture, allowing any entity to create its own fully customized staking solution in a matter of minutes and allow their stakers to access DeFi through a liquid staking token, osETH. The StakeWise V3 protocol consists of two layers:

- Vaults - A comprehensive toolkit enabling anyone to launch and run their own staking pool.

- osETH - Liquid staking token and single layer of fungibility across the StakeWise ecosystem.

StakeWise Docs