Epistemic Science Foundation: Ethereum’s Lab for Funding What Matters

Experimental Infrastructure for Verifiable Meaning & Allocation Integrity

Domain Proposal for GG24

1. Problem & Impact

When a measure becomes a target, it stops being a good measure.

Ethereum’s public goods funding is falling into the Goodhart’s Law trap:

allocations drift toward what’s most visible, countable, or popular — rather than what sustains real long-term value.

The pattern:

- Rounds over-index on short-term attention

- Metrics reward volume over depth

- No real-time tools to detect bias or drift

The blind spot:

We lack a verifiable, adaptive way to

- Spot metric drift when it happens

- Validate claims across evaluators and perspectives

- Adjust funding logic without rigid dogma or aimless relativism

Why now:

- Capital flows are growing — early bias will calcify

- AI-generated participation will flood attention metrics

- Governance will depend on credible public goods evaluation

If we don’t act now, bias will harden into infrastructure.

Evidence from Kevin Owocki’s Meaning Awareness framing, past Gitcoin distributions, and governance forum debates makes this clear: the pain is known — what’s missing is infrastructure that self-corrects.

2. Sensemaking Analysis

Lenses applied:

- Goodhart’s Law → metric drift over time

- Gödel’s Incompleteness → no system can fully define its own legitimacy

- AI evaluation cycles → learn from latency and feedback loops

- Real-Time Epistemic Telemetry (RET) → proposed live integrity metrics

Sources:

- Kevin Owocki’s talks and writings

- Gitcoin governance forum debates on legitimacy

- Observations from Optimism RetroPGF rounds

Synthesis approach:

Quantitative review of past funding patterns + qualitative themes from governance + analogies from AI and epistemic governance research.

Ethereum doesn’t lack metrics — it lacks verifiable diversity and adaptability in applying them.

3. Gitcoin’s Unique Role & Fundraising

Why Gitcoin:

Ethereum’s most visible public goods allocator — with the trust, infrastructure, and evaluator base to experiment at scale.

Unique leverage:

- Run side-by-side tests of verification methods

- Embed RET dashboards into live rounds

- Host a zk-sealed method registry for ecosystem-wide use

Why a network approach:

A single body defining “meaning” is brittle; a federated evaluator network is resilient, adaptive, and capture-resistant.

Funding path:

Raising $50K+ is realistic via Optimism, Protocol Guild, CLR Fund, alumni donors, and impact DAOs — blending direct sponsorship with matching pool incentives.

4. Success Measurement & Reflection

6-month milestones:

- 3 pilots with RET + zk proofs in live funding contexts

- Launch of EpiSci.org Method Registry (5+ verifiable methods)

- First Gitcoin rounds with allocator dashboards for diversity, bias, and drift

Impact signals:

- Increased evaluator diversity index

- Reduced bias concentration

- Higher claim-to-outcome alignment

- Positive feedback from evaluators + applicants

Success means allocators feel confident, applicants feel respected, and Ethereum becomes the home of verifiable meaning.

5. Domain Information

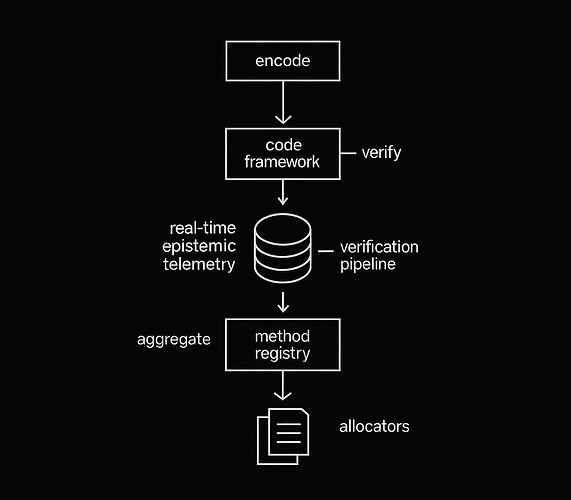

The Epistemic Science Foundation domain will embed verifiable meaning and allocation integrity into Ethereum’s funding systems. It will draw on symbolic governance, public goods funding design, and live evaluation process expertise. Core mechanisms include method registry contracts on Ethereum, zkSNARK verification pipelines, and real-time epistemic telemetry dashboards. The domain will run multiple sub-rounds, each piloting a different verification method, with results feeding into the registry for cross-ecosystem adoption.

Figure 1: High-level epistemic science process flow.

Closing Statement

Ethereum’s promise as a coordination layer depends not just on what we fund, but on how we know it matters.

The Epistemic Science Foundation turns that into infrastructure — embedding self-correcting, verifiable meaning into the heart of our public goods ecosystem.

If we succeed, Ethereum will not only allocate capital more wisely — it will lead the world in funding with integrity.