NB: This is one proposal of many, following the Treasury Mgmt discussion shared on 09 April here

Kudos

Thanks to @owocki for lighting the fire + co-authoring this post, @Jeremy for spot-checking, and @darwinmvr and @Sor03 for supporting the numbers.

TL;DR:

The bull market is here.

We are asking for $5M in GTC from the treasury to swap into stables and put back into the treasury to be prepared for the next bear market.

We’ll repeat this cycle with additional proposals once the cycle from this proposal has been completed. We aim to lay the tracks for a longer Gitcoin runway.

Background

With approximately 30M GTC in our timelock, we want to strategically expand our stablecoin reserves.

How we see it:

-

1 year of bull market

-

1 year of bear market

-

2-3 years of boring sideways chop.

-

(repeat)

To achieve sufficient runway over the next 12 to 18 months, we’re proposing the following approach to incrementally divest our GTC holdings:

-

For a 12-month strategy: We propose to methodically sell approximately ~300K GTC each week.

-

Extending to an 18-month timeline: A more gradual approach would involve selling around ~200K GTC weekly.

*NB - this is unrelated to the current swaps we execute for workstreams, business units, and the Foundation wallets. We’ll be monitoring prices and liquidity (hawkishly) to maintain a steady uptick in these transactions.

Treasury Diversification Plan

-

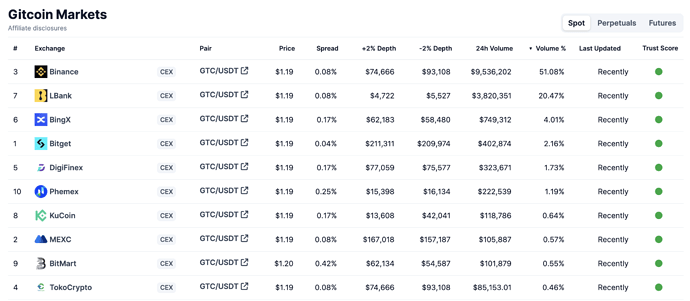

Incremental Sales: Utilize a Dollar-Cost Averaging approach to sell GTC, aligning sales with market conditions to avoid significant impact.

-

Price-Optimized Selling: Implement limit orders for a portion of the GTC, aiming to capture value while managing market dynamics efficiently.

-

OTC Transactions: Over-the-counter deals to move larger amounts of GTC without affecting exchange prices, ensuring our actions don’t disrupt the market.

-

Liquidity Management: Conduct these sales during high liquidity periods to minimize slippage, aligning with our commitment to market stewardship.

NB: These swaps will all be on-chain to remain transparent and trackable to the community.

Proposal for Management of funds:

Option A: Gitcoin’s Foundation can spearhead these initiatives, repeating proposals until we hit targets.

- This would ensure speedier transactions, still go through governance, and hold a singular accountability

- Cons: Given current capacity, more challenging to report (however, everything will be on-chain and we can include in the Foundation’s monthly financial report).

Option B: Form a council for executing these swaps and managing updates, using a 3/5 multisig.

- This ensures strategic and democratic use of these funds

- Cons: Slows down the process by chasing a group of people to propose, review and execute swaps

We can facilitate the formation of yet another council to oversee the swaps for the funds being requested and be stewards of future cycles. This group would oversee the direct diversification efforts of the treasury and coordinate with DAO multi-sig signers to ensure all financial movements align with our overarching strategy (as mentioned above). This council’s could responsibilities include:

-

Submitting DAO proposals for reallocating funds, similar to this proposal’s initial $5M to be approved.

-

Proposing and executing swaps in a staggered and strategic manner.

-

Report back to the community with status of reserves and yields.

The council is not permitted to do anything other than the above responsibilities.

Community Engagement and Governance

This proposal is a collaborative effort. We invite the Gitcoin community to actively participate in refining, endorsing, and implementing this strategy, ensuring its alignment with our collective goals.

Looking Forward

By securing additional reserves in USDC, we’re taking Gitcoin out of survival mode and planning for sustained innovation and growth, even in challenging market conditions.

Calling out loud and clear one final time, this is not the only proposal that will be brought forward for treasury diversification.

This strategy falls within a lower risk/easier execution vector - expect more proposals to follow, and further (meatier) discussions to come out of it @ccerv1 ![]() .

.

Clarifications and Final Thoughts

-

For direct execution, funds will be sent to Coinbase, avoiding the need for an intermediary multisig. This is an option though, and feels more effective for the initial execution.

-

IF deemed imperative by this group - We invite community nominations for council members, seeking individuals committed to transparency, strategic financial oversight, and regular communication.

-

While optimistic, we’re aware of market volatility risks. Our strategy includes constant market monitoring and flexibility in our approach to adapt as necessary. We’d (I) would love to keep GTC within our coffers as much as possible, and welcome feedback on holding our governance token in high regard.

Once we’ve received feedback from the community - we will move to a formal proposal with the following votes:

-

Yes, fund the $5M and execute directly via Coinbase.

-

Yes, fund the $5M and form a council for execution.

-

No, do not fund the swaps

-

Abstain