From: Paige Donner, Oxygene, LLC & Alex Kim, Homebase

“2024 is the Year of RWAs” - Blockworks

The Why:

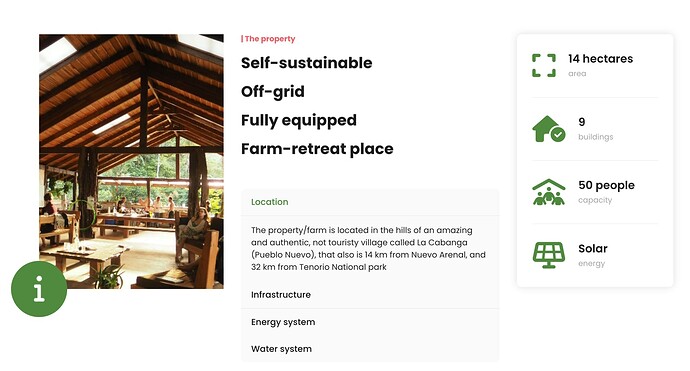

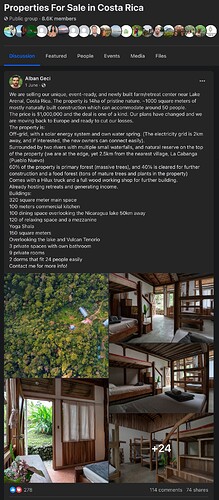

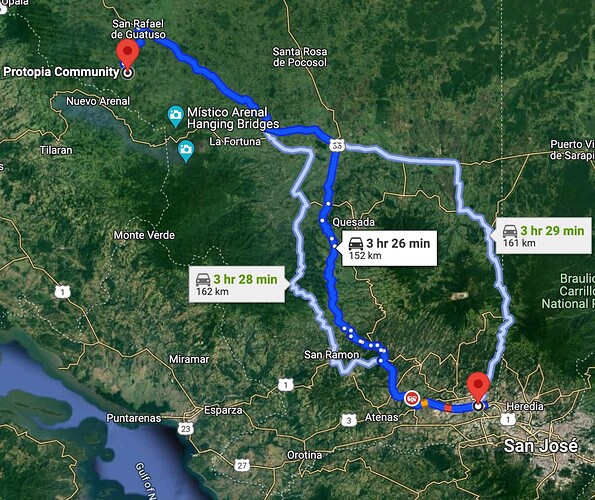

The intention of this proposal is to provide a method of Treasury diversification by investing into real world assets (RWAs) or ‘hard assets’. We propose a Gitcoin DAO managed investment in revenue yielding real estate such as a working Eco-resort, or co-working residence, where accommodation provides recurring revenue.

The equally pragmatic reasoning behind this proposal is to provide the wider Gitcoin community/ecosystem anchor ‘Schelling Points’ that foster relationship building, work retreats and work-life balance. The property could also include a winery or agricultural holdings enhancing the resort’s self-sustainability and providing on-site community building diversions during staycations and work retreats.

The fundamental model here is less one of ‘Wooffing’ and more one of Jimmy Buffett’s Margaritaville style resorts (currently valued at well over $1B)

Importantly, property management and upkeep will be governed on-chain using a bespoke governance platform in order to decentralize property management and facilitate remote stewardship of logistics, staff, maintenance and upkeep.*

The ownership of the RWA will be held by the GitcoinDAO and/or Gitcoin Foundation. The fractional Property Use Rights will be shared among the wider Gitcoin community with the sole qualification for fractional property purchase being that the purchaser must be a current or past Gitcoin grantee or matching funder.

This basic model is built upon a synthesis of HomebaseDAO and ChateauDAO with advisory by Homebase.

TL;DR ![]()

- RWA (real property) as Treasury Diversification

- RWA (real property) for co-working and remote site team building

- RWA as simplified, more accessible property accrual for wider Gitcoin Ecosystem orgs and QF Round participants

- Travel & Luxury: an industry that will not be displaced by AI

- EcoResort / Remote Work & Co-working Residency (more in the style of Buffett’s Margaritaville franchise, less in the style of Wooffing)

- Sustainable energy integration

- Historical Building Renovation in France - 40% subsidy provided by French government for qualifying properties

- DAO (or Gitcoin Foundation) retains Property Deed

- Property Rights Users - own, are free to sell or keep, their Property Use Rights

- Revenue generation model based on accommodation use and fractional, tokenized lease purchase

- Native dApp for calendar booking, property maintenance and property management governance

- Low cost SBA loans available for such purchases

We propose that the property deed be held by the Gitcoin Foundation (or DAO) as a hard asset used for treasury diversification, fiscal conservation and as a potential revenue stream for the foundation and the DAO.

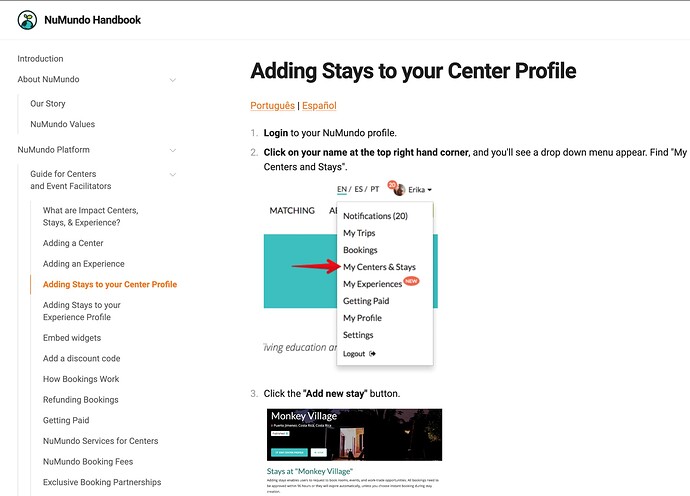

![]() The Fractional Use shares that are offered for purchase to the wider community will be for designated time use.

The Fractional Use shares that are offered for purchase to the wider community will be for designated time use. ![]()

For example, in the case of an Eco-Resort that can accommodate up to 100 guests at a time in 50 double-occupancy rooms, the fractional shares will be made available in increments of 2-weeks per year use time for a 5 year block. This means that a purchaser can pay $XX to use the property two weeks per year for a consecutive 5 year period.

We propose that these Property Use Rights be represented by RWA digital asset (NFT) holdership. We propose that Property Use Rights have a 5-year duration before mandatory renewal or re-selling. We also suggest that each fractional Property Use Right ‘owner’ must hold the access token (RWA digital asset) for at least 12 months (to prevent flipping) prior to selling on the secondary market.

![]()

![]()

An example of how this could break down for a 35 Room B/BA former 4-star resort in the South of France surrounded by 3 hectares of property, a small lake, a river. The property comes fully furnished, has a beautiful large dining room, common living room, on-site restaurant, professional grade kitchen, outside terrace and comes with a separate caretaker’s house.

Eco-Resort Uses Case: Property Price $3.9 M (Images below Property Ex. B)

- This 4* HOTEL property is: 35 en suite Bed/Bath rooms, dining room, lounge, game area, grounds of 3 hectares.

- COST $3.9 M

- Each unit (B/BA room) is sold for one month use per year for a total unit availability of 11 months per year.

(One month is reserved for property upkeep and maintenance.)

- 11 x 35 = 385 units to sell = $10,130 at cost

- Units sell for base price of $17K —--------> Total Revenue Potential $6,545,000

- Annual usage and property maintenance fee is also due from RWA token holders (like a Membership due)

- This particular property has a 2 B/BA Owner’s House. This is reserved for the founders’ & friends use.

** Gitcoin ecosystem organizations will also have the privilege of reserving rooms or privatizing the entire resort for Remote Team Meetups and other org functions.*

Property Use Right digital asset RWAs can also be ‘gifted’ to org or company employees and contributors. This means that partners and contributors can earn and receive a Property Use Right RWA digital asset for their consistency in providing matching funds for QF rounds or other contributions. The Property Use Right RWA digital asset does not confer title to property or property ownership rights but does allow for 2 weeks annually of fractional property use rights (TUP = Time Unit Purchase) per RWA held for 5 years (total use per RWA token is 10 weeks over the course of 5 years).

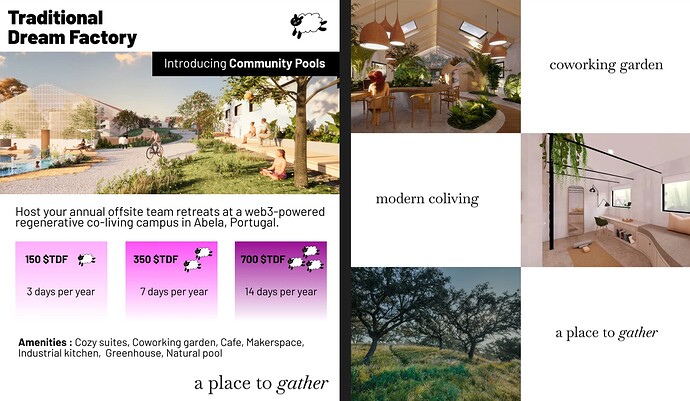

2nd USE Case - Co-Working Residency

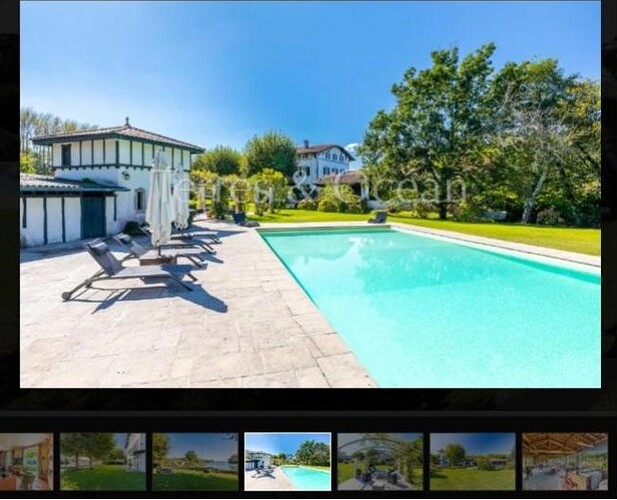

Property Example A

Biarritz, France.

€2,550,000 9 BD/BA Pool & Pool House, 3 hectares, stables, private pontoon

*Biarritz is a Web3 hub in France, is a beautiful coastal town on the Atlantic, just on the border of Spain. It has a strong surf, tech and culinary culture.

23 minutes from Biarritz, on the banks of the Adour, this bourgeois house of more than 560 m2 is built on a beautiful 2.7 ha park. Beautiful 18th century residence, it has beautiful outbuildings, a large swimming pool with its comfortable pool house, horse boxes and a tack room. and its private pontoon on the banks of this busy river. Historical and dear to the people of Bayonne. The house has three levels with fourteen rooms including nine bedrooms. The living rooms consist of a library lounge, a reception lounge, a dining room opening onto a very spacious sheltered terrace, and a large kitchen with refined decor. There is a laundry room, a pantry and two spacious offices. The house is surrounded by lawns, large trees, beautiful stones and dominates the surrounding fauna and flora. This property is above all an exceptional site which brings a good quality of life and an atmosphere of authenticity with the most up-to-date comfort.

WHY France?

In homage to public goods and public goods funding, the properties that will be considered are properties that are of historical and/or cultural value that are in need of partial restoration.

Why?

The French government offers a 40% subsidy for restoration and preservation costs for historical and/or cultural buildings. The country has a wealth of chateaux that are withering in neglect.

With astute curation, a property can be purchased, restored with the help of the French government’s subsidies, thus providing needed work for regional artisans and craftsmen. The final result is that of cultural preservation and public goods longevity while enhancing the personal wealth of the property owner.

USE CASE Example (Already Exists in Market)

![]() Chateaushi - This is an historical property development consortium that is crypto friendly. They offer fractional ownership of properties using a membership model. Their approach is one of luxury with strategic partnerships now in place with the former editor of the Michelin Guide, several celebrity chefs and other luxury travel tie-ins.

Chateaushi - This is an historical property development consortium that is crypto friendly. They offer fractional ownership of properties using a membership model. Their approach is one of luxury with strategic partnerships now in place with the former editor of the Michelin Guide, several celebrity chefs and other luxury travel tie-ins.

Tokenized Property As A Public Good

Here in this proposal, we seek to honor the Gitcoin Community’s dedication to public goods, ecosystem cultivation and growth, and shared, enriching experiences that offer sustainable outcomes.

In this regard, we propose that we entertain strategic partnerships with Solar Punk, ReGen, Kundalini Yoga and clean energy communities and more like minded tribes…

Clean Energy Hubs: The really long vision is to build these RWA communities into clean energy hubs where solar energy, and one day, fusion energy, is farmed for our own use and the use of the surrounding communities. (More on that to come…).

Business Model

We are considering two business models, with an emphasis on the first:

An EcoResort &/or Co-Working Residence with suitable accommodations for multiples of groups, can be purchased outright by GitcoinDAO or the Gitcoin Foundation or a partnership between the two. The RWA is held in trust and maintained in the Treasury portfolio as a valuable, tradeable hard asset.

This approach works for the following reasons:

-

2024 is the "year of RWAs’ (BlockWorks)

-

Gitcoin DAO is looking to be a ‘product/ protocol’ DAO with diverse offerings to the community

-

Diversifying treasury holdings into something tangible and substantive such as real estate further strengthens the responsible fiscal position of the DAO

Offering fractional Property Use Rights into RWA holdings for the larger Gitcoin community means that the community members can begin their own real estate fractional use journey ( such as like Pacaso, Homebase, traditional timeshares);

Community members and the different grantee orgs can continue building community and relationships within and among the Gitcoin Grantee ecosystems; Depending on the strategic property investments - agriculture yielding / winery/ EcoResort - the property could be self-sustaining and, eventually, show revenue from local production in addition to revenue generated by accommodations use and appreciation of real value in real estate ownership.

Business Model #2

Launch on Grant Stack as a funding round. We approach capital investors who would then take the position of the holder of the RWA asset. In return, they would match fund in a QF round the Property Use Right fractional ownership purchases that the individual Gitcoin grantee community members and orgs raise.

This would function as a traditional QF Round, except in this case the match funders would retain the deed to the property that is purchased using their capital. But they would share their capital investment by match funding using the QF formula. Each amount raised by community members, who seek to become fractional owners in the property by purchasing Property Use Rights as outlined above, would be match funded by said benefactor/ capital investor.

Monetization Models - Gitcoin Foundation Retains Property Deed, Fractionalizes Time Unit Purchases (TUP - see monetization break down above)

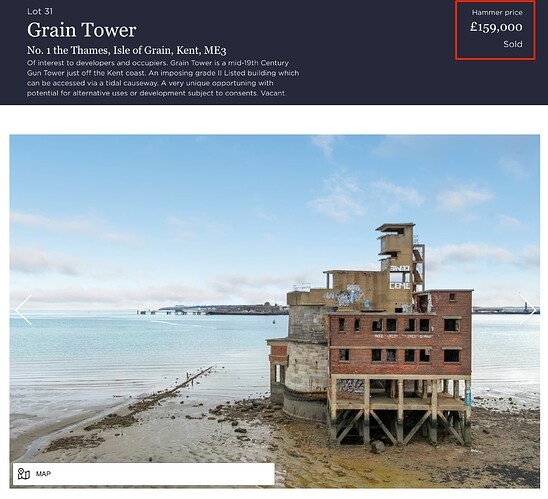

Property Example B:

Eco-Resort - Former 4-star hotel property near Sarlat, Dordogne, France

- Fully Furnished, recently renovated

- Restaurant

- Lounge

- Reception

- Staff Accommodations (Four Bedroom/ Four Living Room Stone House)

- Barns and Outbuildings

- Suitable for Horses

- Guesthouse/Gite

- Swimming Pool

- Two estuaries

- Wooded Park, hundred year old trees

- Lake

- Wheelchair accessible

- Outdoor Terrace and Lounge

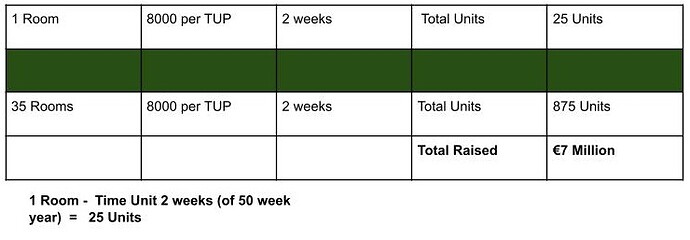

**35 Rooms - Time Unit 2 weeks = Total 875 Units **

**Each Unit sells for EURO 8000 = EURO 7 Million **

**Time Unit Purchase (TUP) entitles owner to: **

Use of 2 consecutive weeks of double occupancy room during the calendar year (of the 50 available weeks)

Duration of use is 5 years (i.e. 2 weeks per year for 5 years) at which time the holder has the option to renew at a highly favorable market price or to ‘sell’ back to the foundation or on the second market within the Gitcoin ecosystem. (This is to prevent single owners or groups from sitting on Property Use Right units for unlimited lengths of time).

Owner Use fee - while in residence, the owner-guests will pay a weekly linen, property use and upkeep fee (about EURO 500 per week). This may or may not include light snacks and breakfast. The owner use fees will go towards property upkeep, housekeeping and maintenance.

*At full occupancy of 35 rooms x 500 Per Owners Use Fee = €17500 per week (for staff, food, property upkeep, etc).

Owner Qualifications:

- Past or present Gitcoin Grantee

Must hold onto the TUP NFT for at least 12 months (before trading or selling)

Can trade time/ use with other Approved Members (on internal booking site)

After 5 years have priority to renew TUP purchase for an additional 5 years at a preferential price (If they don’t renew, the TUP reverts to the marketplace administered by Gitcoin where the holder/seller is credited with the majority of the selling price, less an admin fee kept by Gitcoin Foundation/DAO)

Gitcoin adjacent groups (example Optimism, Arbitrum, Giveth, Polygon, Filecoin, Lido, 1Inch, etc.) can pre-book entire property for DAO/Org functions with due consideration for others’ booked time.

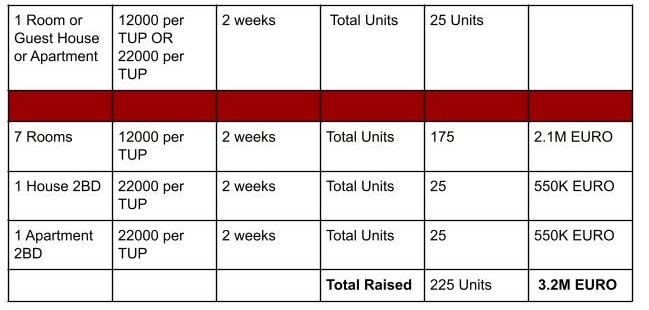

- 7 Rooms, 7 Baths

- 2 Bedroom (separate) Apartment

- 2 Bedroom (separate) Gite

- 52 HA forest and Agricultural land

- Extensive Outbuildings - including Pigeon House

- Swimming pool, tennis courts, Stables

- Near Lake

- 2 Hours to Nice airport

- Property Cost: EURO 2.5M + tax

- Fractional Ownership of 50 weeks X 11 Rooms (TUP = Time Unit Purchase)

1 Room - Time Unit 2 weeks (of 50 week year) = 25 Units

7 Rooms - Time Unit 2 weeks = Total 175 Units

1 Separate Two Bedroom House = Total 25 Units

1 Separate Two Bedroom Apartment = Total 25 Units

Each Room Unit sells for EURO 12000

Each 2BD Single Dwelling sells for EURO 22K Per Unit = EURO 3.2 Million

*The water availability and acreage of this property opens up the possibility to construct Tiny Homes around the land for use as dwellings sold as RWAs per Time Unit Purchase.

Time Unit Purchase (TUP) entitles owner to:

- Use of 2 consecutive weeks of double occupancy room during the calendar year (of the 50 available weeks)

- Use is for 5 years, after which the RWA leasehold must be renewed at purchaser’s original price or can be sold on the secondary market at market competitive prices

- Note: Use cost while on-premise for linens, upkeep, housekeeping, grounds maintenance an additional $500/ wk

OPTIONS for Loan Funding - SBA Loans 7(a) and 504

SBA 7(a) loans are more common and can be used to purchase or refinance owner-occupied commercial real estate at any amount up to $5 million. To qualify, investors must have good credit and put down at least 10 percent of the property’s purchase price. The term of the loan can be up to 25 years, and interest rates can vary based on current market conditions and the applicant’s qualifications.

SBA 504 loans are similar to their 7(a) counterparts; however, there is no limit to how much an investor can borrow. Investors must have good credit and provide a down payment of 10 percent of the purchase price. The term of the loan is typically 20 years, and the investor must occupy at least 51 percent of the property. Unlike SBA 7(a) loans, these mortgages are not funded entirely through a private lender. Instead, they are made available through Certified Development Companies (CDCs), nonprofit entities that promote economic development within their communities. Typically, a commercial lender funds 50 percent of the project, and a CDC finances up to 40 percent.

Please post your thoughts, suggestions, feedback here ![]() .

.

And feel free to reach out to Paige &/or Alex on Telegram:

@PaigeDAO

@akim0x