Not financial or tax advice. This post is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This post is not tax advice. Talk to your accountant. Do your own research.

In my 5 years in the web3 space (2017 - 2022), I’ve seen oscillations between Abundance & Scarcity & back again.

During the last supercycle, major assets like BTC or ETH went up 20-50x and then down 95% from there.

I want to write a little bit about that history, and why I think it matters today.

Abundance - 2017/2018

When I first joined the space in 2017, ETH had gone on a run from the 10s all the way up to 1400.

At the time, everyone was getting into web3 (what we then called ‘crypto’). ICO promoters were all over linkedin. The membership of our local blockchain meetups grew 500%. It was a social movement that many people who were in tech or tech-adjacent were becoming involved in.

When I joined Consensys in late 2017, I was employee number 400-500, on a run up from Consensys having a dozen or so employees to having over 100 employees.

In January 2018, we had a Consensys mesh retreat in Portugal. It was a place where we could meet all of our coworkers, and participate in various activities like hiking, cooking, or going to parties with prominent music performers and even fire dancers at magnificent historical castles.

During this period of abundance, Consensys was hiring. It was common for 2 or 3 people to join a team in a week, and then 2 or 3 more joining in the following week.

More & more projects were greenlit as capital rushed into the space. Investors were in landgrab mode. 100s of experiments blossomed.

There was one problem with all of this of course. The tech didnt really work well for anything but capital formation (at the time - the main use case for ETH was ICOs).

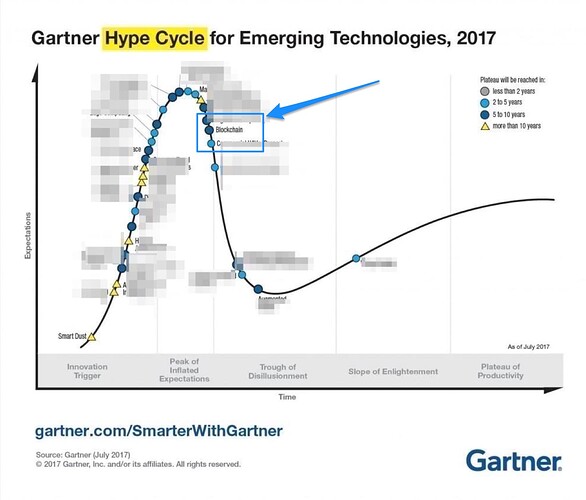

Here’s what the Gartner Hype Cycle looked like in 2017. Youll see that blockchain was at the “peak of inflated expectations”:

The these inflated expectations, the fact that any mainstream use cases were years out, and the irrational exuberance of the bull market, sowed the seeds of the next period of scarcity.

Scarcity - 2019/2020

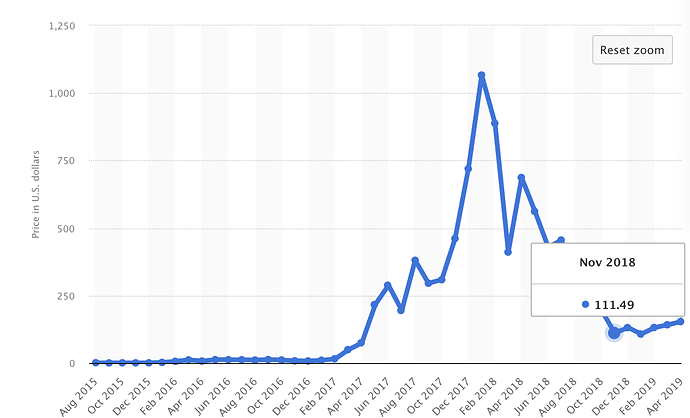

The market for ETH drew down 95% from 2017 → 2019. ETH went from $1400 to $80.

In november 2018, I became so concerned with the market downturn to the Finance team at Consensys:

Date: 11/21/2018

Subject: Guidance I expect from Finance in a downturn

Hey NAME,I wanted to send a quick email about the downturn because it’s on my mind, and I suspect that it’s on the mind of other spoke leads.

I’ve been around the block as a CTO of a VC backed company a few times before, and the cycle that I see is that we raise a round, hire a bunch of people, and then have to lay them off 14 months later because we mismanaged our burn and roadmap or theres a downturn or VC interest dried up.

i really dont want to go through that here with Gitcoin.

here’s how i see things:

we just got approved for $Xmm/year in burn in august. right now we’re right around $(Y)mm/year in burn.

there are two scenarios i can see here:

- we continue on course to increase our burn to $Xmm through the course of 2019.

- we batter down the hatches, implement a hiring freeze and stricter financial management policies, and wait until the market finds a bottom and focus on revenue in the meantime. We focus on performance and maybe even exit low performer or two. After that, we can continue to our “official process approved burn” of $Xmm.

right now we are on course for (1). please please please tell me that i need to change course to (2) if that is the case.

if i can avoid it, i really dont’ want to go down the course of (1) and have to fuck up morale and our momentum, by laying off half the team 6 months later.

i’m at PHONE_NUMBER if phone is easier.

thanks,

Kevin

As it turns out, Consensys then went on to several iterations of restructuring - aiming for what was then called Consensys 2.0, but later refactored into the creation of Consensys Software Inc + the seperation of that SoftwareCo from the more investment-oriented projects.

This 2 year period from Dec 2018 to Dec 2020) is what I began to call The Great Bear. Here is an excerpt from that post:

The Great Bear started in 2018 as the market hit its malaise, but it really hit its apex in December 2018 - ETH drew down from $1400 a year before to only $80. This is when the music stopped. Consensys began laying off it’s staff - and many of the projects that previously did not have to worry about revenue went to being guided to “get profitable this quarter”. We were assigned a “Spinout Shepherd” and instructed that we had 3 months of capital left.

From December 2018 to Summer 2020 was the Great Bear. Asset prices had gone done 95% in the case of the large caps like ETH/BTC. Some ICOs went down 99.9% or more.

These were not fun times. I’ve also called these years The Struggle years. Our team of 10 was funded by Consensys for these years, and we struggled to get revenue, to keep morale up, and we struggled as we saw many changes in the ecosystem at Consensys during these years. Consensys divided into Consensys Software Inc and Mesh Inc - we were slated for the later (and somehow, whether by luck or by skill, our 3 months of capital kept getting extended).

Morale was hit hard during these years. In retrospect, I think we all thought we were missionaries during the Bull Market, but when the Great Bear, we realized how many of us were mercenaries. We were unable to secure budget for compensation increases through these years - and we because of that, we didnt do performance reviews. Stuck between a HR department whose attitude was “youre still lucky to be here”, many questions about our business model and longevity, and a team who was burnt out, our progress ground to a halt on many important initiatives. Our culture suffered. Our communication suffered. Our trust suffered. I worked insane 13 hour days and just YOLO built features like Gitcoin Quests or the Gitcoin Avatar builder. During this time, we fell into a habit of hiring contractors to build new product initiatives like Grant Collections or the Quadratic Lands because the core team was unable to coordinate to push these things forward.

Gitcoin almost did not survive the Great Bear. But we did.

Suffice it to say, the Great Bear was long & hard. The struggle was real. A few excerpts from The Struggle that really resonate with me about this time:

The Struggle is when you are having a conversation with someone and you can’t hear a word that they are saying because all you can hear is The Struggle.

The Struggle is when you go on vacation to feel better and you feel worse.

The Struggle is the land of broken promises and crushed dreams. The Struggle is a cold sweat. The Struggle is where your guts boil so much that you feel like you are going to spit blood.

The Struggle is when you don’t believe you should be CEO of your company. The Struggle is when you know that you are in over your head and you know that you cannot be replaced. The Struggle is when everybody thinks you are an idiot, but nobody will fire you. The Struggle is where self-doubt becomes self-hatred.

The Struggle is where greatness comes from.

One extremely fucked up thing about the struggle is that even when the external constraints are gone, you still have internalized PTSD from it. Once you’ve internalized the struggle, it does not just go away when the market turns. It stays with you. You remember. You prepare for next time. But over time, you learn to release the struggle and make turns to create new opportunities.

Abundance (2020 - present)

As it turned out, Gitcoin survived the Great Bear, and then went on to the Great Reset and is now going through a Great Revival. We now have the lindey effect of having survived a market cycle, yay!

And we are again in abundance mode! Here is what I am seeing:

In January 2018 February 2022, we had a Consensys mesh GitcoinDAO retreat in PortugalBoulder. It was a place where we could meet all of our coworkers, and participate in various activities like hiking, cooking, or going to parties with prominent music performers and even fire dancers at magnificent historical castles going snow tubing or hanging out in the hot tub.

During this period of abundance, ConsensysGitcoinDAO was hiring. It was common for 2 or 3 people to join a team in a week, and then 2 or 3 more joining in the following week.

More & more projects were greenlit as capital rushed into the space. Investors were in landgrab mode. 100s of experiments blossomed.

Maybe you notice a pattern here. This period of abundance is a fractal of the period of abundance from 2017/2018. Of course, history doesnt repeat but it does rhyme. There are things that are different.

- DEFI, NFT, DAOs all exist now. The tech does now provide some useful use cases.

- GitcoinDAO did not exist in the last cycle. GitcoinDAO is now in charge of it’s own governance. No more asking Consensys Finance for favors, yay!

- The whole ecosystem is now just more mature & more established. Stablecoins exist, lots of great wallets exist. The Merge is coming.

Is the supercycle dead?

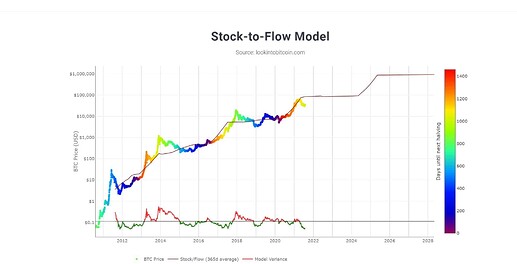

Here is what proponents of the BTC super cycle think will happen:

Of course, stock to flow is a flawed model insofar as it’s not necessarily predictive of the future. Prominent twitter accounts that promote stock 2 flow often change their targets, so the above should be taken with a grain of salt.

The space has been historically been very coupled to Bitcoin, which historically has operated on 3-6 year bull/bear cycles. Will it continue to do so?

The answer is anyones guess, but I tend to subscribe to the view that the one giant wave that was oscillating between bull/bear will start to de-couple into multiple smaller waves of smaller magnitudes, more coupled to the segments of society they disrupt. For example, I think that alt-L1s, L2s, privacy tech, DEFI Summer, NFTs, and DAOs are all waves. Its possible that Internet of Jobs and public goods and regen could be upcoming waves, and likely that we’ll see repeat waves for each of these subsectors. (these are my opinions, dont make any investment decisions based on these things - do your own research)

Zooming out

When I zoom out, I can’t help but see the cyclicality of the supercycle playing out.

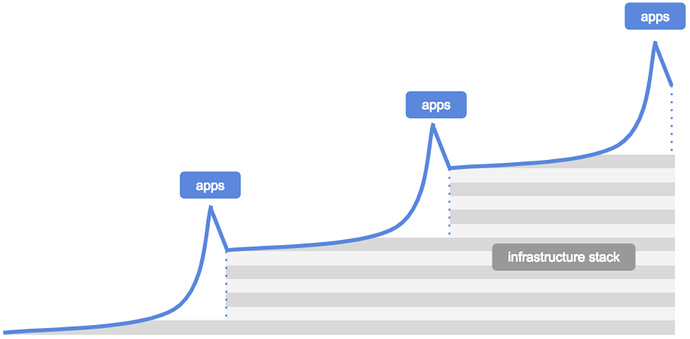

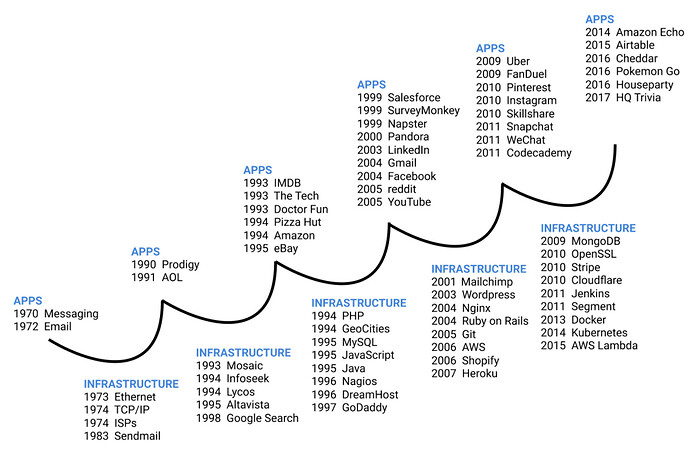

of course this is kind of an extension of an centurys-long cycle of financial markets between fear & greed, bull & bear, infrastructure & application:

and its affects on people:

Winter is coming

This all leads me to my final point:

Winter is coming.

I don’t know what will cause it. But I know the cyclicality of this space (and just markets in general). I know volatility. And I know that many of my new frens are summer children who do not have exposure to these things.

I hate to be a wet rag, I really do. But I just can’t help myself. Having gone through the struggle once, I really want to be prepared to win the next struggle.

So GitcoinDAO, here is my prompt to you

- how do we make the most of our current abundance?

- how do we set a floor on how bad things can get during the next bear?

- who all will be sticking it out (keeping the flame alive) during the next bear? in what capacity? under what terms?

- how do we maximize the utility & anti-fragility of the Gitcoin network?

I have my own ideas, but I want to make space for others to sensemake around this.