I trust that @deltajuliet and the financial team are making recommendations that they believe are best for the DAO and, therefore, I am in support of this proposal.

Very much support this idea. Thanks for bringing this forward.

Glad to see the diversification agenda rapidly evolving. However, I’d like to vote ‘Abstain’

In the beginning it is stated that:

but then this initial execution strategy does not align with these initial objectives.

We need to agree on if these will be onchain or offchain in general before moving forward. Diversification plans solely oriented on token sales can give the community an impression of ‘ceiling price’, and it’s important to manage that. In other DAOs, much of the OTC deals happen on the Foundation level (where they can keep it confidential) for that exact same reason.

Thanks, @jengajojo!

I appreciate you highlighting the need for clarity around our swapping mechanisms, especially concerning the potential ‘ceiling price’ impression from token sales. I acknowledge I could have been clearer in my wording.

On-chain swaps def ensure transparency and are trackable by the community, while off-chain methods like using Coinbase offer reduced costs and can handle large volumes securely.

It’s worth noting as well - we are not solely relying on this for our diversification strategy. I’m currently exploring solutions with over a number of partners and would love community input (including yours) on what would be an amenable solution.

Should we continue with an option like Coinbase for these swaps and update the proposal, or would another platform better align with the community? Now that you’ve outlined the considerations you have - What are some proposed solutions that would change your vote to a ‘yes’?

Thank you for the clarification. I’d suggest keeping all native token sales private, the swap venue is not a concern as long as the foundation does it’s due diligence. Any other token swaps or yield farming opportunities could be onchain. Infact, I do recommend the foundation to deploy some of the stables and ETH which is not needed immediately into yield farming.

Since these operations require quick response the best course is usually to gauge the risk appetite of the community and deploy according to those parameters as opposed to asking the community for each operation the foundation wants to make.

I’m in favor of this proposal and appreciate the forward-looking approach to keep us financially viable in the long term.

Excited to see this level-headed initiative to ensure Gitcoin’s continuity during an inevitable future bear market @deltajuliet!

I’m wondering whether it makes sense to use a mix of stablecoins instead of just USDC. It’d further diversify treasury and boosts Ethereum’s resilience (see page on Stablecoin Diversity).

As Glo Dollar’s CTO, I’d love to explore if all or part of the $5M could be swapped into Glo Dollars (USDGLO) instead of USDC. It ticks the boxes for treasury diversification and Ethereum resilience + after our upgrade to Glo Dollar 2.0 the holdings could generate up to $250K in funding for Web3 Public Goods each year, at no cost to Gitcoin ![]()

Getting Gitcoin’s endorsement has been pivotal for us; since the previous swap, we’ve doubled our market cap and welcomed other leading Web3 orgs like Polygon as holders of Glo Dollar.

In other news, we recently received our Bluechip stablecoin safety rating, with an initial B grade—positioning us as a top 10 fiat-backed stablecoin, deemed safer than the likes of USDT, FDUSD, and FRAX.

Hello Gitcoin fam! ![]()

I’m Spike from Avantgarde Finance and my role is to cover DAO governance.

GITCOIN is a cornerstone project and its importance for the ecosystem cannot be overstated. We believe the discussion around treasury management is an extremely valuable one and are happy to provide some insights which we hope the community will find useful.

As @deltajuliet put in her post

We certainly agree on the direction and would like to see discussion around the practical nuances of implementing this. What we particularly liked is that:

And this is one of the critical considerations throughout this discussion - to understand the “uses” and “sources” of funding. We would suggest that additional quantitative analysis should go into the amount of stables conversion (or if this has already been done, we feel it would be useful to share with the community from an auditability and accountability perspective how the figure of 5mUSD has been reached).

Additionally

Is also a certainly important point for analysis, and though we appreciate this might be under consideration in subsequent proposals, a more holistic approach that takes potential revenue from yield and the final composition of the treasury as a whole into account may better define the optimal size and choice of stablecoin(s).

We believe the final composition of the treasury and choice of strategies should be informed by the risk capacity and tolerance of the DAO, which is itself formed by its financial position and objectives. In our experience, establishing a comprehensive framework incorporating these elements and agreed upon by the community can lead to a more sustainable treasury management operation rather than ad hoc proposals for each individual decision around the treasury.

Another important consideration when implementing treasury diversification is managing price impact on the DAO’s native token - given the liquidity of GTC, we feel it is prudent that market depth should be factored into the sizing and timing of swaps.

There are many advantages to having a body oversee effective execution of treasury management (and many DAOs choose this approach) - this can be an internal committee / external treasury manager or a combination of both depending on the preferences of the community.The scope of work for a proposed committee is very large in terms of expertise required, which is why GITCOIN may engage external service providers and/or consultants (though each DAO is unique, and the nature of engagement differs based on their goals & objectives).

We fully commend the importance and intent of the initial post, though from our perspective we would caution against executing this 5mUSD transaction before a holistic treasury management framework is considered, which is in line with the intent in the extremely well-written SGTM 000 temp check.

We appreciate that a lot of thought has undoubtedly gone into this initiative and that the breadth of talent across the GITCOIN community can lead to successful execution on this. From Avantgarde’s perspective, we would be happy to provide any insights, analysis, or assistance with implementation where the community might find it beneficial.

Thanks so much @SpikeWatanabe.eth - I’m already in direct contact w/ the Avantgarde team. Will keep you and the community updated as conversation(s) continue. ![]()

As per input received from our Gov Gurus @CoachJonathan and @jengajojo I have amendments to make to this proposal before moving to Snapshot.

@mars @OPdelegate41 @yosemitesam @CoachJonathan @PaigeDAO @Viriya @M0nkeyFl0wer @Sov - tagging you for visibility as you initially participated on this post and would like you to have context on edits.

TL:DR - we won’t move funds to Coinbase or leverage a council (just now) if not agreed on by vote. Instead we propose to set up a diversification multi-sig (3/5) to execute the swaps at the appropriate time. I’m open to who those signers would be, and would request that one of our finance team @Sor03 or @darwinmvr be included for reporting. I can give an update once this proposal is ready to be executed on (again).

Updates

Change in Execution Method

- We are moving away from using Coinbase for direct execution. Instead, proposing establishment of a new 3/5 multisig wallet.

Revised Community Voting

- Reflecting the change in execution strategy, the updated voting option will be:

“Yes, fund the $5M and transfer it to the newly established diversification wallet.”

Given the current state of the market, we’ve missed the current window but will be ready to execute when favorable market conditions arise - once the funds are in the MS. I still intend to engage partners in a Phase 1/2 of the diversification, however want to make sure we’re not losing steam in the interim.

I appreciate everyone’s feedback on this post! There are some great learnings, and I’ll endeavour to breakdown more context (like platforms we can/can’t work with as a Cayman entity) and partners/strategies we’re evaluating. I’ll also use the initial post to track these proposals and partners in the future.

Me too.

Maybe possible to make such a voting structure:

- No: do not diversity

- Yes, diversify: all in stables

- Yes, diversify: 50% stables 50% BTC

- Yes, diversify: 50% stables, 25% BTC, 25% ETH

- Yes, diversity: 50% stables, 16.66% BTC, 16.66% ETH, 16.66% SOL (0.02% rounding error towards gas fees)

My logic is that either BTC / ETH / SOL offer access to instant liquidity without affecting prices and it is “in the spirit” of the original proposal of diversfication and thriving throug multiple market cycles.

How to reconcile multiple voting options?

Step ![]() : is option 1 more than 50%? If yes: it is the winning option.

: is option 1 more than 50%? If yes: it is the winning option.

Step ![]() : assuming option 1 is less than 50%, then check if option 2 (all stables) is more than 3 + 4 + 5 combined.

: assuming option 1 is less than 50%, then check if option 2 (all stables) is more than 3 + 4 + 5 combined.

Step ![]() : assuming option 2 is less than 3 + 4 + 5 combined, then pick the strategy among 3 or 4 or 5 that received the most vote.

: assuming option 2 is less than 3 + 4 + 5 combined, then pick the strategy among 3 or 4 or 5 that received the most vote.

Game theory, strategic voting, 2nd 3rd 4th order effects

I do not anticipate any strategic voting, I think the proposal is simple to explain and simple to understand. I’ve seen similar mechanics (combining multiple options) already in the wild. Not sure how easy / how hard to describe using Snapshot syntax. My personal market condition assessment is that with 10x ETF and halving, inflation, interest rates, global geopolitical instability, multipolar world, reducing dependency on USD and petrodollar I think that over long time horizon the number will go up while “just stables” will lose the purchasing power.

EDIT / UPDATE: decision fatigue. I don’t know which diversification option to choose, too complicated, I’ll just pick “no”. Unlikely, the options are not that complicated.

The multi-sig seems like a plausible solution and one that can fit into an ‘all things being equal’ vein.

For your initial concern @deltajuliet Option B: Form a council for executing these swaps and managing updates, using a 3/5 multisig.

- This ensures strategic and democratic use of these funds

- Cons: Slows down the process by chasing a group of people to propose, review and execute swaps

Perhaps whomever is tapped, or steps up, for the multi-sig be required to sign a formal agreement with Gitcoin/DAO that they be responsive to all action items within a 36 hour window, for example? Your concern about having to ‘chase people’ is valid and should not have to be a concern when dealing with responsible and conscientious members of a professional organization.

I do, still, find that @mars suggestions resonate. Stables are great but also BTC, SOL and ETH. As well as some hard asset holdings such as prime real estate (my suggestion).

In any case, this seems acceptable: Yes, fund the $5M and transfer it to the newly established diversification wallet.” w/ the caveat of your note ‘when favorable market conditions arise.’

Thank you for all the reflection and thoughtful considerations that have gone into, and is going into, this.

Longevity for Gitcoin is certainly the desired goal and outcome.

I have to vote against this proposal. I don’t believe it is in the best interest of the DAO in it’s current form.

Of course I support measures of treasury diversification, but I would personally rather see more efforts towards creating utility and demand for GTC, and then promoting those efforts to strategic partners and sell them GTC OTC, than see us, as a DAO, publicly signal to the market, that we intend to dump GTC.

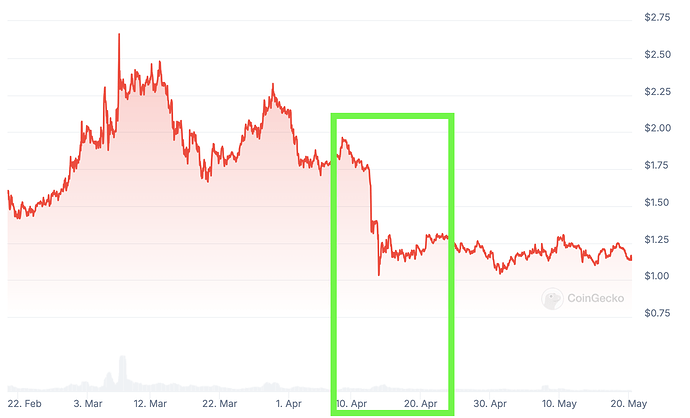

Before this post, the price of GTC was $1.76.

Less than 2 days after this post, the price dipped to $1.13

Imagine if the post said:

We have big plans for the GTC token, and want to move 5M GTC to the foundation to make OTC deals with strategic investors for stablecoins.

How different would things have been… hard to say of course, lots of confounding variables.

THAT SAID:

I don’t have much voting power and it looks like the coinbase approach will probably win… If so PLEASE do not hold funds on Coinbase or any other centralized exchange.

A wise man once said, “Centralized exchanges are like public bathrooms, go in, do your business and get out. Don’t linger!”

Only send what you want to sell to the exchange and then withdraw. You never know when Coinbase’s compliance crew decides that DAOs selling their own currency is a sketchy thing and then freezes it, not to mention all the other obvious issues that can arise.

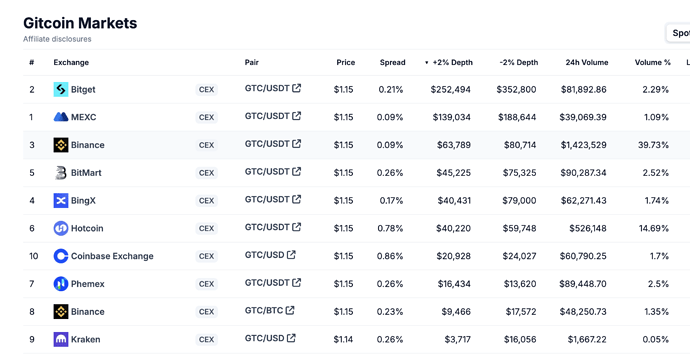

Also, there is 2x-10x more liquidity 6 other exchanges (at the time of posting this), so it would be wise to not commit to one exchange but to play the market and use several exchanges to avoid slippage.

Any specific reason for choosing Coinbase, it can be any reputed establishment !

EDIT / UPDATE:

See this:

I think that @griff post already triggered some action, so well done you ser!

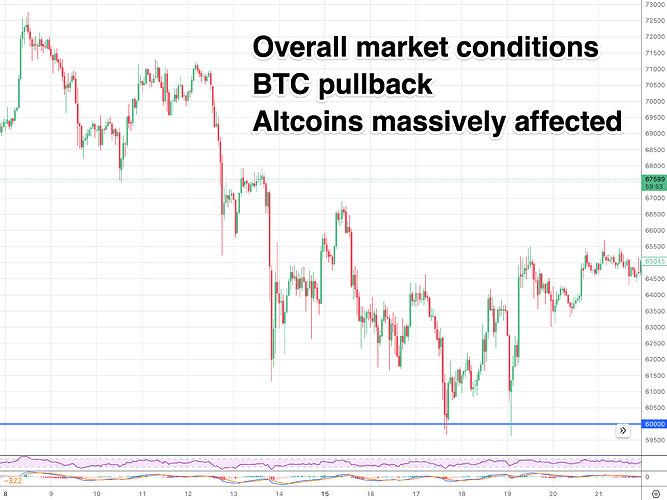

Good point Mars. It did coincide with some major market downward movements (BTC down ~15%), which make it hard to solely attribute the GTC dip (of ~35%) to this post. So I will concede that point.

I hope that the other points don’t get lost in my comment tho:

-

We should put more effort into creating utility for GTC so OTC deals can be easier to close.

-

Hopefully we don’t store funds on CEXs longer than it takes to execute the trades.

-

Coinbase is is not the most liquid CEX, we should use multiple CEXs.

This snapshot has closed and option to “Yes via diversification wallet” has won.

Metrics:

1740 unique wallets voted

~2.7M GTC tokens cast.

Thank you to the author for the proposal and to all the GTC token delegates who cast their vote.