Hello Kyle, appreciate your response to this post about predictably promoting value accumulation/accrual or, alternatively, minimizing value loss to output a stablecoin like asset by splitting, stacking, and churning GTC & Hypercerts into short-term bonds.

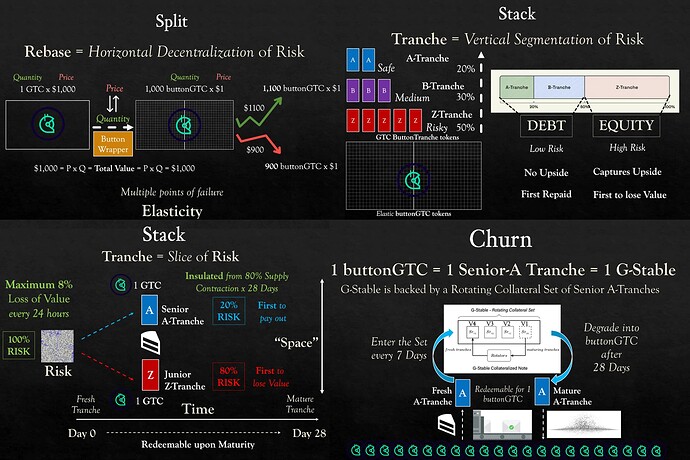

Below is a rough schematic of such a mechanism design that can drive Utility towards the GTC token.

More details can be found here: Split, Stack & Churn: Stabilizing Value with Rebase, Tranche, & Rotations in Decentralized Finance

GTC can be converted into a rebasing “buttonGTC” which can be similarly parametrized to not lose more 8% of its Supply per 24 hours. The entire set of configurations can be modified. E.g., A/Z ratio can be 25/75 or 15/85 or 30/70; Maximum loss of A-Tranche can be n% depending on favored risk profile; bond length can be 90 Days to match the length of staked GTC - in which case, the G-Stable asset can be even more robust, as market participants are guaranteed to have their G-Stable backed by GTC after 90 days (there is no “bank run” type scenario). There are roughly 400k GTC tokens in the staking contract at this time.

Zooming out, if certain assurances are made to be clear, then Hypercert NFTs can be integrated into such bond-like instruments so that the Positive Impact they represent can be converted into Digital Value on Ethereum’s Distributed Ledger. E.g., by lumping Hypercerts with GTC into a Tranche that backs a G-Stable like asset. This is basically how MBS and CDO like instruments are created in TradFi. But things are safer when everything is transparent and capable of being audited in real time on-chain.

Numbers in, Numbers out. If the inputs are “legit,” then the output(s) (G-Stable) will be as well.