Hello Gitcoin fam!

I’m Spike from Avantgarde Finance and my role is to cover DAO governance.

GITCOIN is a cornerstone project and its importance for the ecosystem cannot be overstated. We believe the discussion around treasury management is an extremely valuable one and are happy to provide some insights which we hope the community will find useful.

As @deltajuliet put in her post

We certainly agree on the direction and would like to see discussion around the practical nuances of implementing this. What we particularly liked is that:

And this is one of the critical considerations throughout this discussion - to understand the “uses” and “sources” of funding. We would suggest that additional quantitative analysis should go into the amount of stables conversion (or if this has already been done, we feel it would be useful to share with the community from an auditability and accountability perspective how the figure of 5mUSD has been reached).

Additionally

Is also a certainly important point for analysis, and though we appreciate this might be under consideration in subsequent proposals, a more holistic approach that takes potential revenue from yield and the final composition of the treasury as a whole into account may better define the optimal size and choice of stablecoin(s).

We believe the final composition of the treasury and choice of strategies should be informed by the risk capacity and tolerance of the DAO, which is itself formed by its financial position and objectives. In our experience, establishing a comprehensive framework incorporating these elements and agreed upon by the community can lead to a more sustainable treasury management operation rather than ad hoc proposals for each individual decision around the treasury.

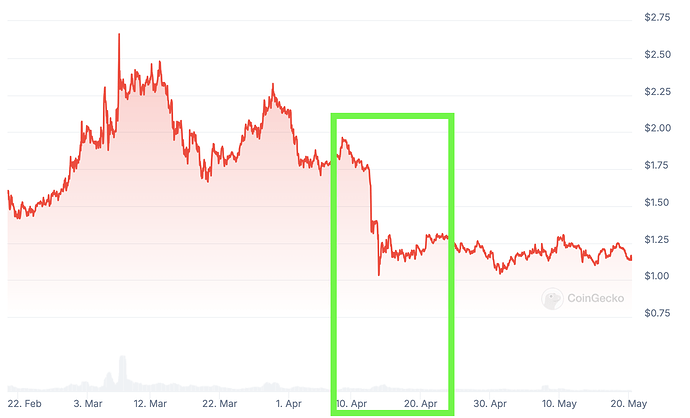

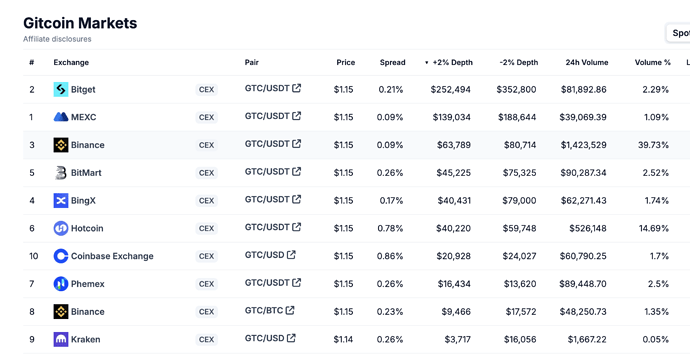

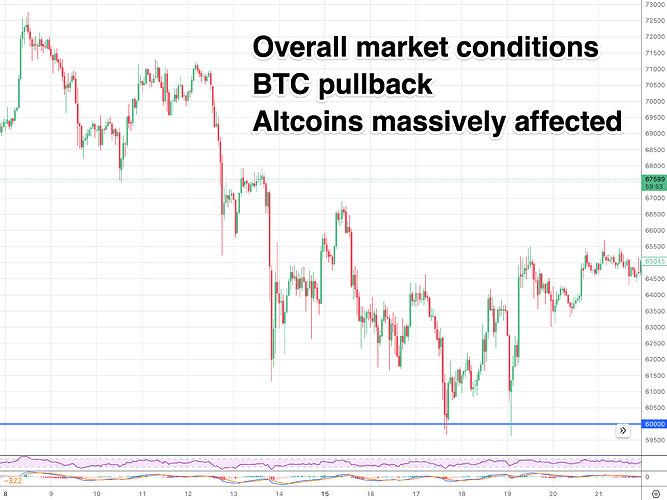

Another important consideration when implementing treasury diversification is managing price impact on the DAO’s native token - given the liquidity of GTC, we feel it is prudent that market depth should be factored into the sizing and timing of swaps.

There are many advantages to having a body oversee effective execution of treasury management (and many DAOs choose this approach) - this can be an internal committee / external treasury manager or a combination of both depending on the preferences of the community.The scope of work for a proposed committee is very large in terms of expertise required, which is why GITCOIN may engage external service providers and/or consultants (though each DAO is unique, and the nature of engagement differs based on their goals & objectives).

We fully commend the importance and intent of the initial post, though from our perspective we would caution against executing this 5mUSD transaction before a holistic treasury management framework is considered, which is in line with the intent in the extremely well-written SGTM 000 temp check.

We appreciate that a lot of thought has undoubtedly gone into this initiative and that the breadth of talent across the GITCOIN community can lead to successful execution on this. From Avantgarde’s perspective, we would be happy to provide any insights, analysis, or assistance with implementation where the community might find it beneficial.